ARTICLE AD

Crypto investment products saw $862 million in weekly inflows in March last week, according to asset management firm CoinShares’ head of research James Butterfill. The movement comes one week after a record of almost $1 billion in outflows was registered by the same products.

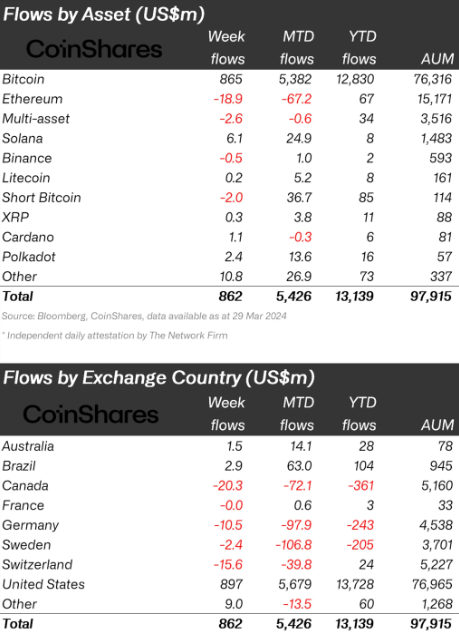

Funds with exposure to Bitcoin (BTC), mostly spot exchange-traded funds (ETF) traded in the US, registered $865 million in inflows and dominated the period. Meanwhile, crypto products going short on BTC price showed a $2 million outflow.

Investors showed less appetite for Ethereum (ETH) exposure through funds, with $19 million in outflows seen from these products. ETH funds suffered the largest outflows in March, with over $67 million being moved out by investors.

Solana-related funds saw $6 million in inflows last week, and $25 million last month, with SOL being the altcoin with the most attention in March. Polkadot (DOT) also captured weekly interest, as its $2.4 million in inflows show.

Image: CoinShares

Image: CoinSharesRegionally, the US registered $897 million in inflows last week, and over $5.6 billion in March. Brazil and Australia registered $2.9 million and $1.5 million in weekly inflows, respectively, while the rest of the countries tracked by CoinShares went the opposite way.

Crypto products traded in Canada registered $20 million in weekly outflows, while Switzerland funds shrunk by $15.6 million in assets under management in the same period.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

9 months ago

51

9 months ago

51