ARTICLE AD

Digital asset investment products witnessed $500 million of outflows last week, according to a report by asset manager CoinShares published today. Bitcoin-indexed exchange-traded products (ETPs) represented almost 96% of the total outflows.

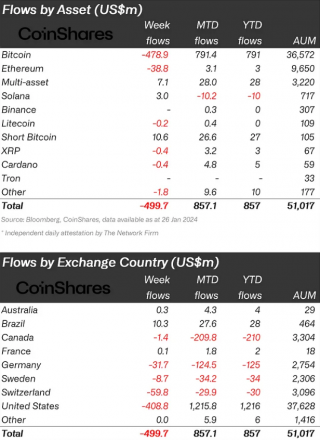

Focusing on individual assets, Bitcoin has been at the forefront of investors’ minds, experiencing outflows of $479 million. Conversely, short-bitcoin positions have seen a relevant increase in interest, with total inflows getting close to $11 million.

Altcoins have not been spared from the cautious stance of investors, with Ethereum, Polkadot, and Chainlink witnessing outflows of $39 million, $0.7 million, and $0.6 million, respectively. Despite the negative flow of $10 million in 2024, investment products indexed to Solana escaped last week’s trend, growing $3 million in assets under management.

Moreover, a closer look at regional dynamics reveals that the bulk of these outflows were concentrated in the United States, Switzerland, and Germany, with respective totals of $409 million, $60 million, and $32 million.

Netflows by asset and country. Imagem: CoinShares

Netflows by asset and country. Imagem: CoinSharesThe United States, in particular, has been at the epicenter of these shifts, with Grayscale, a leading incumbent ETF issuer, experiencing a staggering $5 billion in outflows since Jan. 11. Last week, the firm reported outflows of $2.2 billion.

However, there’s a silver lining, as the pace of these outflows appears to be decelerating, suggesting a potential stabilization in the near term. In contrast, newly launched spot Bitcoin ETFs in the US have been receiving investors’ attention. Over the past week alone, these products have attracted $1.8 billion in inflows, reaching almost $6 billion since they began trading on Jan. 11.

Furthermore, when considering the net inflows, including those into Grayscale since its launch, the total accumulation of BTC through ETFs in the US stands at $807 million.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

71

1 year ago

71