ARTICLE AD

Record trading volumes as Bitcoin and Ethereum lead the charge.

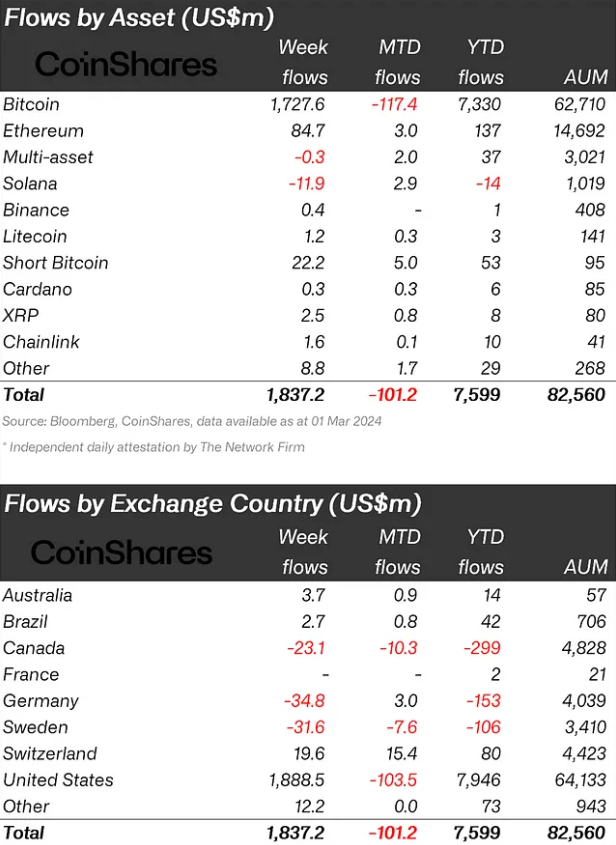

Crypto investment products experienced a monumental week with inflows surpassing $1.8 billion, marking the second-highest on record, a Mar. 4 report by asset manager CoinShares shows. Bitcoin was the standout, attracting 94% of these inflows, which amounted to $1.73 billion. This surge comes despite recent market volatility, which saw short investors inject an additional $22 million into short Bitcoin products.

Ethereum also witnessed significant activity, with inflows almost reaching $85 million last week, the largest since mid-July of 2023. However, its assets under management (AUM) stand at $14.6 billion, still below the peak of $23.7 billion. Meanwhile, total AUM across all digital assets is nearing an all-time high at $82.6 billion, approaching the previous record of $86 billion set in early November 2021.

Image: CoinShares

Image: CoinSharesThe US market remains the epicenter of these inflows, contributing a net of close to $1.9 billion. This was despite Grayscale’s Bitcoin ETF experiencing outflows of $1.46 billion. New issuers more than compensated for this with a combined inflow of $3.2 billion. Other regions presented a mixed picture, with Switzerland seeing inflows of $20 million, while Sweden, Germany, and Canada faced outflows totaling $32 million, $35 million, and $23 million, respectively.

Polygon also made significant moves with inflows of $7.6 million, representing 22% of its AUM. In contrast, Solana faced outflows of $12 million. As the week concluded, trading volumes in investment products shattered previous records, exceeding $30 billion and at times accounting for half of the global Bitcoin trading volume on trusted exchanges.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by HAL, our proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

8 months ago

55

8 months ago

55