ARTICLE AD

According to the latest report from Coinshares, global crypto investment products saw a significant rebound with $436 million in net inflows last week alone, driven largely by Bitcoin’s resurgence. CoinShares noted that this marks a return to positive flows after two consecutive weeks of net outflows.

Behind these positive flows are major asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares experiencing a turnaround, indicating a renewed interest in crypto investment products.

Detailing The Fund Flows

Bitcoin-based funds were at the forefront of this rebound, generating $436 million in net inflows after a 10-day streak of outflows totaling $1.2 billion.

This shift represents a strong reversal in investor sentiment toward Bitcoin, particularly in the US market. Spot Bitcoin exchange-traded funds (ETFs) based in the United States accounted for a substantial portion of the inflows, contributing $403.9 million in net weekly inflows.

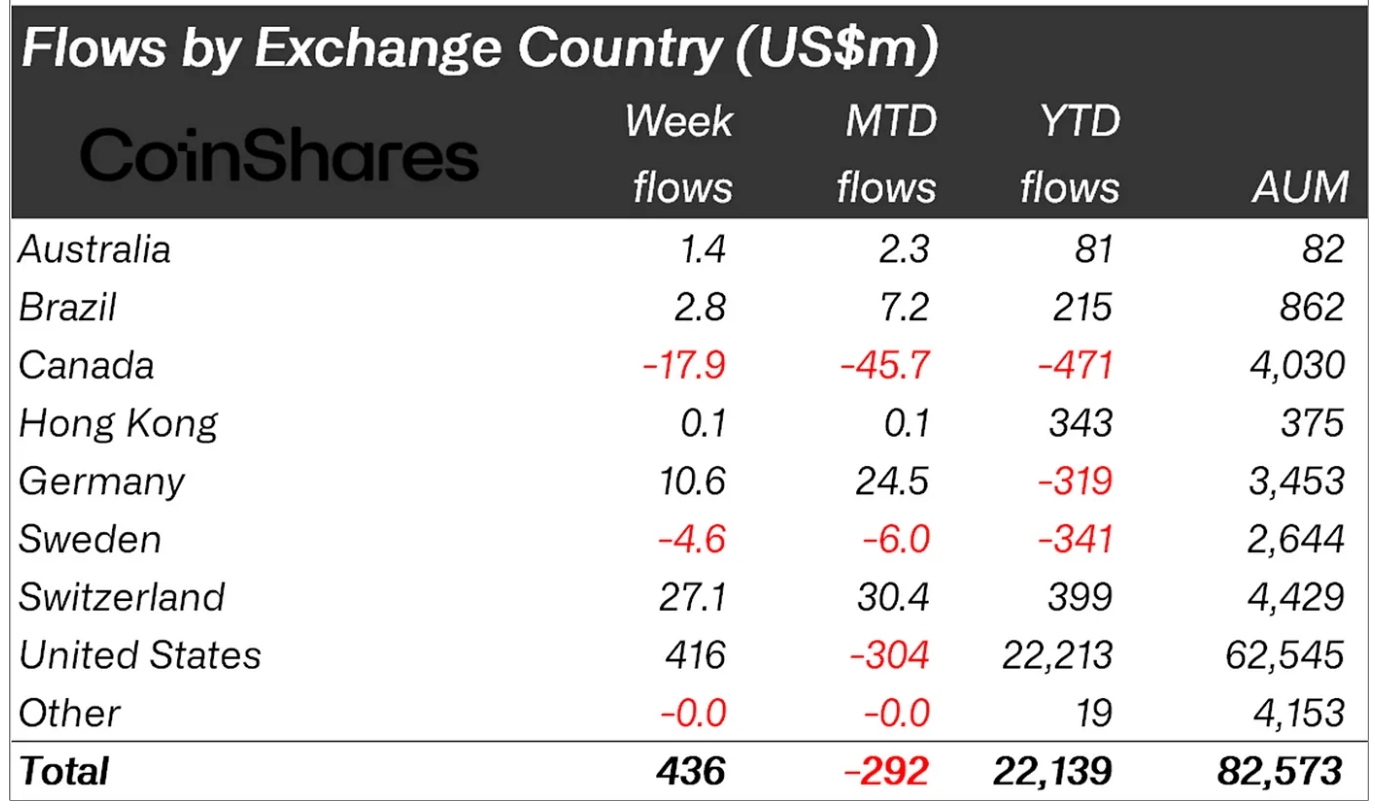

European markets also showed positive trends, with Switzerland and Germany-based funds recording net inflows of $27 million and $10.6 million, respectively. However, not all markets followed this trend, as Canada-based products experienced net outflows of $18 million.

Crypto asset fund flows by region. | Source: CoinShares

Crypto asset fund flows by region. | Source: CoinShares

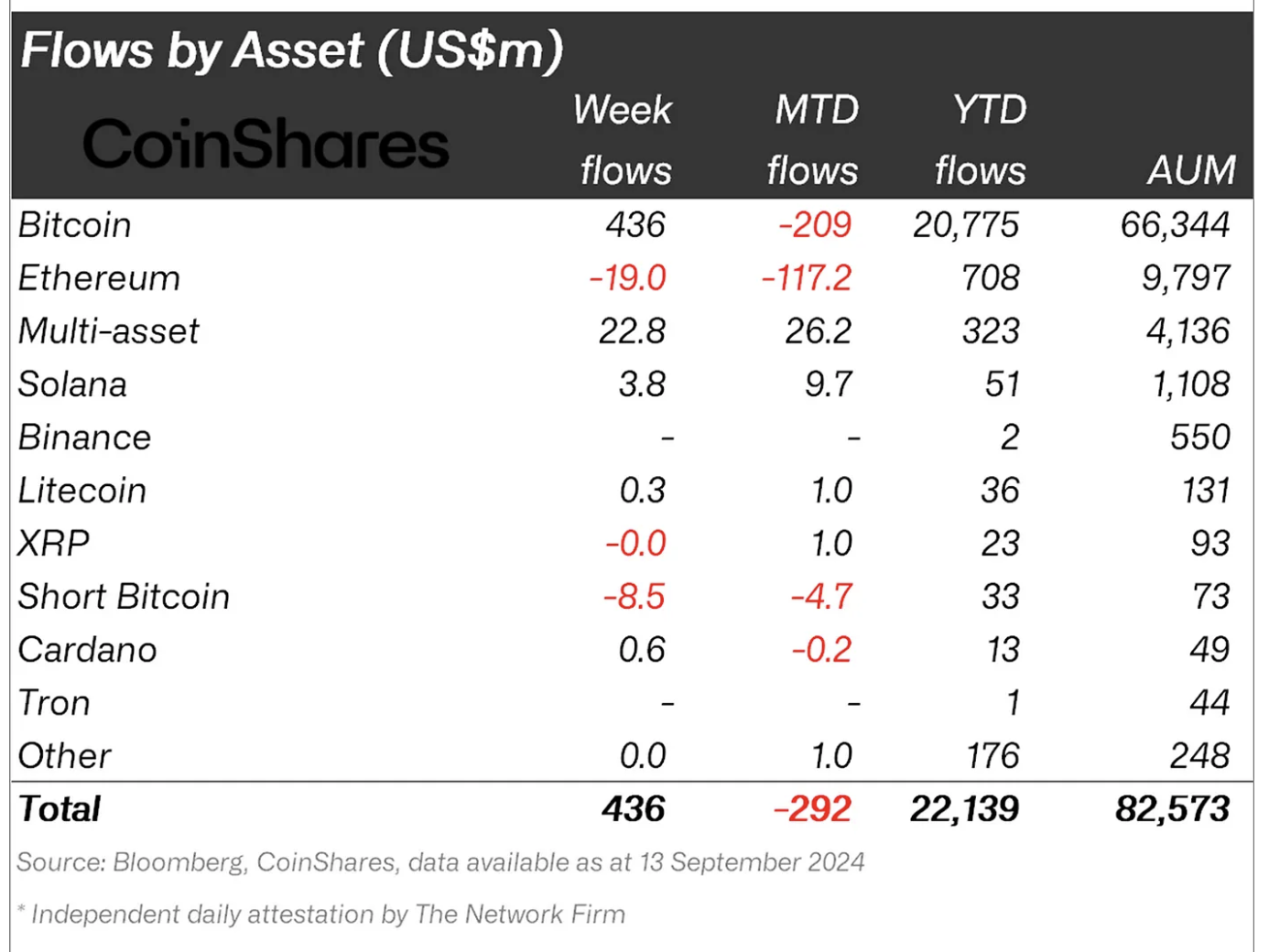

After three consecutive weeks of inflows, short Bitcoin investment products also reversed their previous trend, registering net outflows of $8.5 million. This shift could indicate a change in investor strategies, with more confidence returning to the market.

Additionally, Solana investment products witnessed net inflows of $3.8 million for the fourth consecutive week, indicating a growing interest in alternative cryptocurrencies besides Bitcoin.

Crypto asset fund flows, | Source: CoinShares

Crypto asset fund flows, | Source: CoinShares

Reason Behind The Rebound And The Catch

As CoinShares Head of Research James Butterfill highlighted, the shift in market sentiment was attributed to changes in market expectations regarding potential interest rate cuts.

Butterfill particularly noted:

We believe the surge in inflows towards the end of the week was driven by a significant shift in market expectations for a potential 50 basis point interest rate cut on September 18th, following comments from former NY FED President Bill Dudley.

Despite this recovery, trading volume across crypto investment products remained flat at $8 billion for the week, significantly lower than the 2024 average of $14.2 billion.

Additionally, while Bitcoin-based funds drove the rebound, Ethereum-based funds have continued to struggle, experiencing another week of net outflows, signaling differing investor sentiments within the crypto market.

CoinShares report shows that the past week saw net outflows of $19 million from Ethereum funds, adding to the $98 million in negative flows reported the previous week.

Featured image created with DALL-E, Chart from TradingView

2 months ago

18

2 months ago

18