ARTICLE AD

Ethereum and Cardano see significant inflows as crypto market expands.

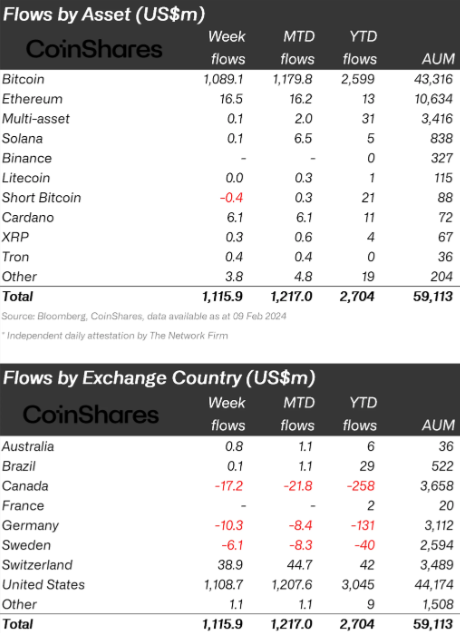

Crypto investment products have garnered over $1 billion in inflows, raising the total for the year to $2.7 billion, as reported by asset management firm CoinShares. This surge has propelled assets under management (AUM) to a peak not seen since early 2022, now standing at $59 billion.

In the US, newly launched spot Bitcoin exchange-traded funds (ETFs) have been a major draw, contributing significantly to the inflow with $1.1 billion last week alone. Since their inception on Jan. 11, these ETFs have amassed almost $3 billion in investments. This trend indicates a growing investor interest in crypto-based financial products.

Bitcoin has been the primary beneficiary of these inflows, capturing nearly 98% of the total. The rise in Bitcoin prices has also positively influenced the market sentiment towards other digital currencies like Ethereum and Cardano, which experienced inflows of $16 million and $6 million, respectively.

Image: CoinShares

Image: CoinSharesWhile the focus has been on the US, other regions have seen mixed movements. Canada and Germany experienced minor outflows amounting to $17 million and $10 million, respectively. Conversely, Switzerland reported positive inflows of $35 million last week.

Despite the overall positive trend, certain areas have seen withdrawals. Uniswap and funds short positions on Bitcoin-indexed investment products faced slight outflows of close to $1 million. Meanwhile, blockchain equities saw a net outflow, driven by a significant $67 million withdrawal from one issuer, though this was partially offset by $19 million in inflows to other issuers.

Although the market’s momentum appears robust, the potential sale of Genesis holdings of Grayscale Bitcoin Trust, valued at $1.6 billion, looms as a factor that could influence future outflows.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

64

1 year ago

64