ARTICLE AD

Rising leverage in crypto markets prompts early warning.

The crypto market’s temperature is rising, with the top 20 crypto-assets, excluding stablecoins, boasting an average 90-day return of 103% according to IntoTheBlock data. Even the group’s laggard has surged 28%. Meme tokens are not the only assets experiencing a surge, with large-cap crypto also seeing a rapid increase in leverage usage, as the cost to borrow for long positions has hit a peak not seen since 2021.

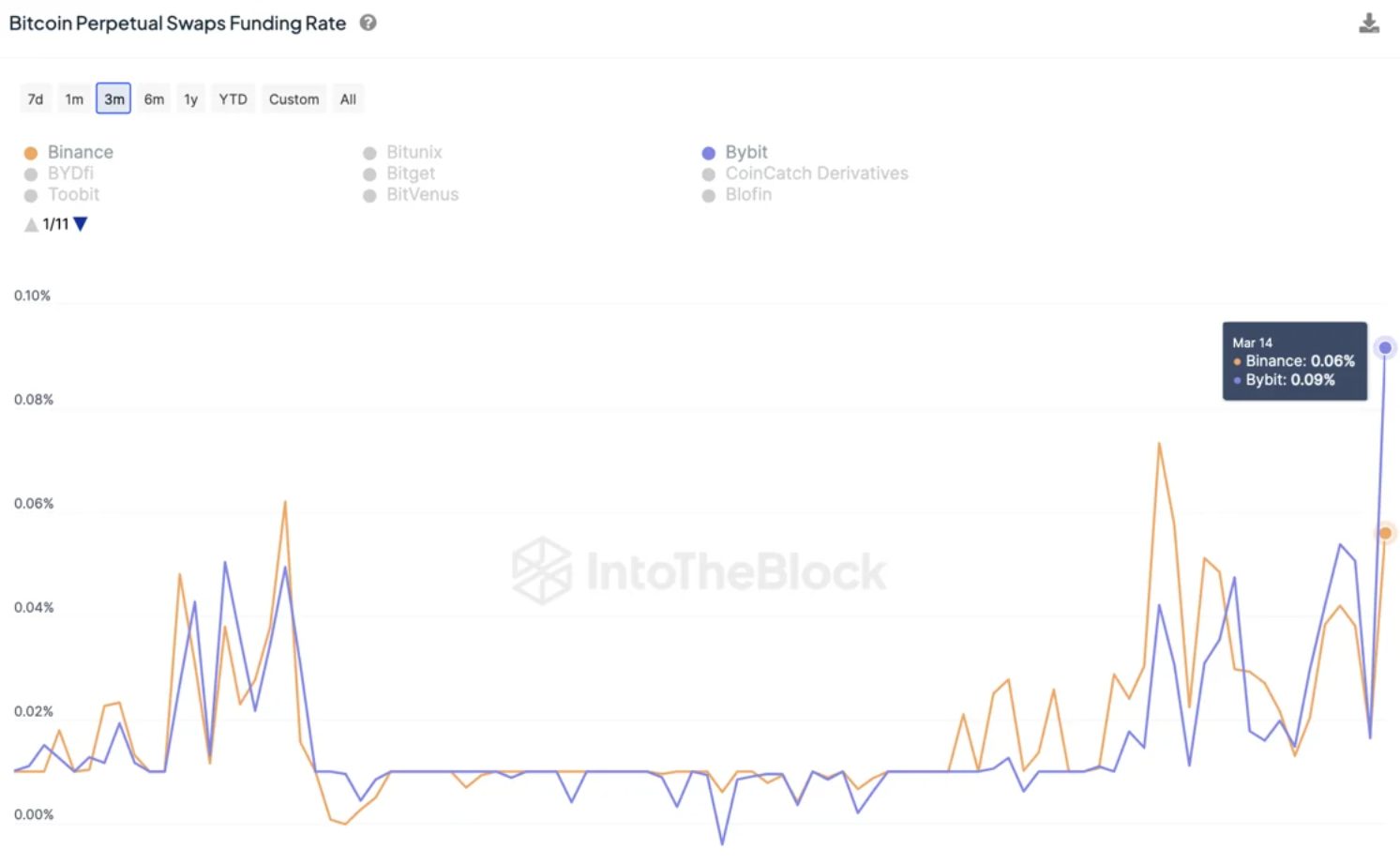

Funding rates for Bitcoin perpetual swaps have reached their highest levels since October 2021. On platforms like Binance and Bybit, these rates have escalated to 0.06% and 0.09% respectively, calculated every eight hours. These rates translate to an annualized cost of 93% and 168% for those looking to go long on Bitcoin. Such elevated funding rates suggest a market heavily skewed towards bullish bets.

Despite the potential for exchange-traded fund (ETF) flows to buoy spot prices temporarily, the current bullish stance in derivatives is a harbinger of potential market instability. The trend of high leverage is not confined to centralized exchanges, as the decentralized finance (DeFi) sector is also experiencing a rapid increase in borrowing. In 2024, the total debt issued through Aave v3 on Ethereum has more than doubled.

As Bitcoin carves out new all-time highs, investors are increasingly leveraging their holdings. The amount of wrapped Bitcoin (WBTC) supplied to Aave has swelled by over 10,000 BTC, valued at approximately $700 million. With this surge in demand for leverage, interest rates in the DeFi space have also climbed, signaling a market that may be over-leveraged and at risk of a correction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by HAL, our proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

8 months ago

32

8 months ago

32