ARTICLE AD

Crypto assets surge with record-breaking weekly investment.

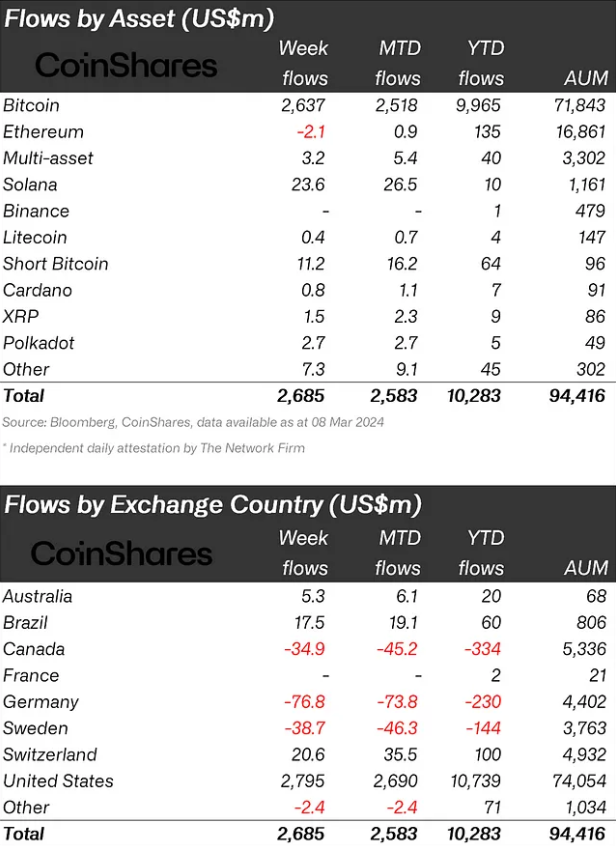

Crypto investment products registered $2.7 billion in inflows over the last week, a new weekly record, according to a report from asset management firm CoinShares. This capital injection has propelled the year-to-date total flow to $10.3 billion, nearing the all-time high of $10.6 billion recorded for the entirety of 2021. Bitcoin has been the primary beneficiary, attracting $2.6 billion and accounting for 14% of the total Assets under Management (AUM).

The trading turnover for digital assets has also seen a substantial increase, reaching a new high of $43 billion this week, a considerable jump from the previous record of $30 billion. This uptick in trading activity coincides with a 14% increase in AUM over the last week, pushing the total to over $94 billion, marking an 88% rise since the beginning of the year.

Image: CoinShares

Image: CoinSharesDespite a recent uptick in short positions, Bitcoin continues to attract investment, with an additional $11 million flowing into short Bitcoin products last week. On the other hand, Solana has rebounded from negative market sentiment, securing $24 million in inflows. Ethereum, despite a strong performance year-to-date, faced minor outflows of $2.1 million. Other altcoins such as Polkadot, Fantom, Chainlink, and Uniswap also saw inflows, with amounts ranging from $1.6 million to $2.7 million.

In terms of regional distribution, the US led the inflow with $2.8 billion, followed by Switzerland and Brazil with $21 million and $18 million, respectively. However, some countries like Canada, Germany, and Switzerland have realized profits, resulting in outflows of $35 million, $77 million, and $39 million, respectively.

Blockchain equities did not share the same bullish sentiment, experiencing minor outflows totaling $2.5 million.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by HAL, our proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

10 months ago

60

10 months ago

60