ARTICLE AD

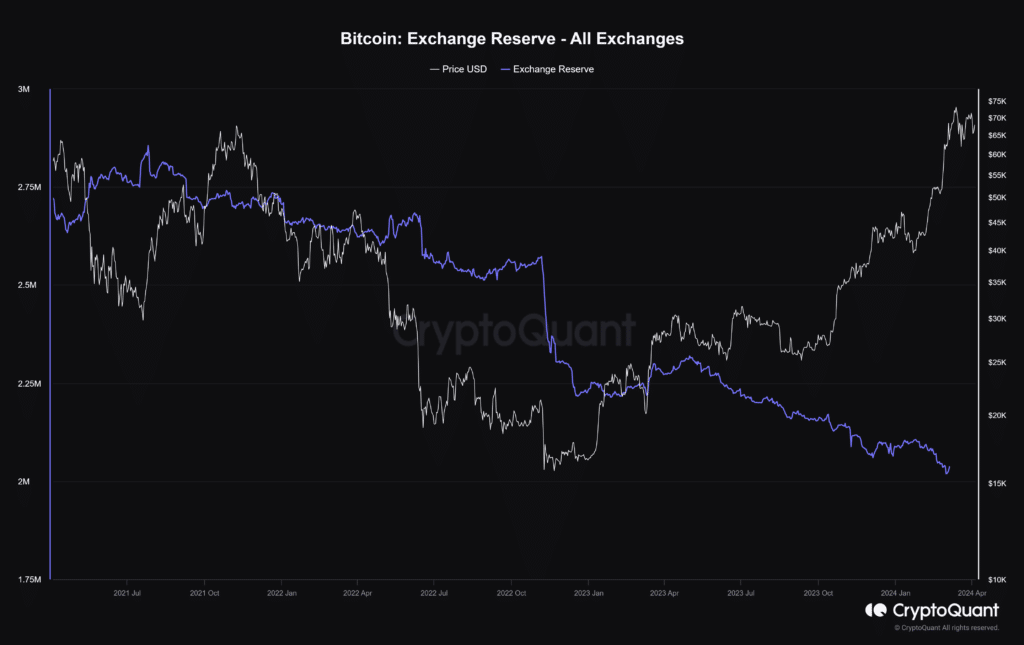

Bitcoin exchange reserves have plummeted to its lowest levels since early 2021, indicating that holders could store BTC another way.

More than 90,700 bitcoin have been withdrawn from major cryptocurrency exchanges over the past month, reveals CryptoQuant, stressing a reduction in Bitcoin’s liquid supply and hinting at a long-term holding strategy among investors.

According to data from CryptoQuant, the noteworthy outflow from exchanges to cold storage aligns with a multi-year trend, seemingly driven by the digital asset’s price increase, the approval of spot Bitcoin ETFs, and anticipation of the halving event.

In July 2021, Bitcoin exchange reserves hovered around the 2.8 million mark, CryptoQuant data shows, with a decline of approximately 900,000 coins since the firm began tracking this metric.

Despite the tightening of supply, Glassnode’s recent report indicates a notable shift from long-term to short-term holders.

“Following a historical tightness in supply, the divergence between long and short-term holder supply has started closing,” Glassnode notes, suggesting that rising prices and increasing unrealized profits are prompting long-term holders to liquidate their assets.

The report further states that the short-term holder supply has surged by around 1.12 million bitcoins, absorbing the distribution pressure from long-term holders.

On the macroeconomic front, Bitcoin’s (BTC) price has seen a modest uptick of approximately 3.2% in the past 24 hours, trading at $68,265 as of 1:46 p.m. ET. However, it still trails about 10% behind its all-time high of $73,000 from mid-March.

Kurt Wuckert Jr., the Chief Bitcoin Historian at CoinGeek, likens Bitcoin to gold and cash, noting its resistance to regulator suppression.

Ordinals Wallet CEO Joshua Petty remains optimistic about Bitcoin’s future, suggesting it could evolve or serve as a base for digital cash even under regulatory challenges.

9 months ago

52

9 months ago

52