ARTICLE AD

Recent comments made by Polygon Labs CEO Marc Boiron have ignited a debate on the necessity and potential consequences of Layer 3 (L3) networks, arguing that they may divert value and security away from the Ethereum mainnet.

The growth of adoption and development for L3 networks like Orbs, Xai, zkSync Hyperchains, and Degen Chain, have attracted significant activity across a number platforms, prompting key figures in the crypto space such as Boiron to voice their opinion on the matter of Layer 3 networks.

“L3s exist only to take value away from Ethereum and onto the L2s on which the L3s are built,” Boiron said.

Boiron argues further argued that if all L3s settled to one L2, Ethereum would capture little value, putting its security at risk.

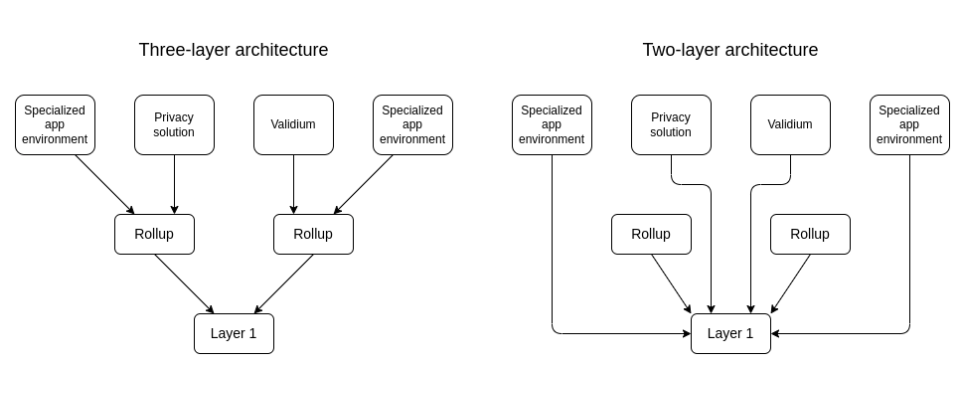

The L3 debate has been brewing for some time now. In 2022, Ethereum co-founder Vitalik Buterin began the argument that the purpose of L3s were to provide a “customizable functionality” towards L2s, although not necessarily operating as extensible layers of the core functionality designed for L2s. To Buterin, a third layer on the blockchain ecosystem would only be practical if its function fundamentally differs to what L2s already serve.

L2 vs L3 architecture. Source: “Fractal Scaling: From L2 to L3” by StarkWare

L2 vs L3 architecture. Source: “Fractal Scaling: From L2 to L3” by StarkWareHowever, not everyone agrees with Boiron’s assessment. Some respondents argued that L2 value is inherently tied to Ethereum’s value, while others pointed out the potential benefits of L3s, such as lower bridging costs and specialized functionality.

Peter Haymond, senior partnership manager at Offchain Labs, countered Boiron’s claims. According to Haymond, advantages such as low-cost native bridging from L2, custom gas tokens, and specialized state transition are functions that don’t necessarily “take value” away from Ethereum.

Arbitrum Foundation researcher Patrick McCorry expressed surprise at Boiron’s take, suggesting that L3s could allow L2s to become settlement layers and ultimately rely on Ethereum as a “global ordering service [and] final judge of settlement.

Degen Chain, a recently launched L3 running on top of the Base L2 network, is one of the L3 networks that have gained a significant traction (and volume), with one anonymous trader reportedly making as much as a $2 million profit over a $7,000 investment.

Degen Chain, notably, was built using Arbitrum Orbit, a new offering from the Arbitrum ecosystem that enables developers to create “modular” or customizable Layer 2 and Layer 3 chains. In this context, Orbit chains operate by connecting to the core ecosystem of Arbitrum, with the ability to settle transactions over Ethereum L2 solutions.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

41

7 months ago

41