ARTICLE AD

Web3 gaming's active addresses soar by 155% as DeFi protocols double TVL in Q1.

Decentralized finance (DeFi) has emerged as a dominant force in the blockchain space, surpassing stablecoins in daily transactions and concluding the first quarter with approximately 7 million daily transactions, reveals the “OnChain Report Q1 2024” by QuickNode and Artemis. All major DeFi protocol categories, including Liquid Staking, Lending, Bridges, Yield, and Derivatives, have seen their total value locked (TVL) increase two to threefold during Q1 2024.

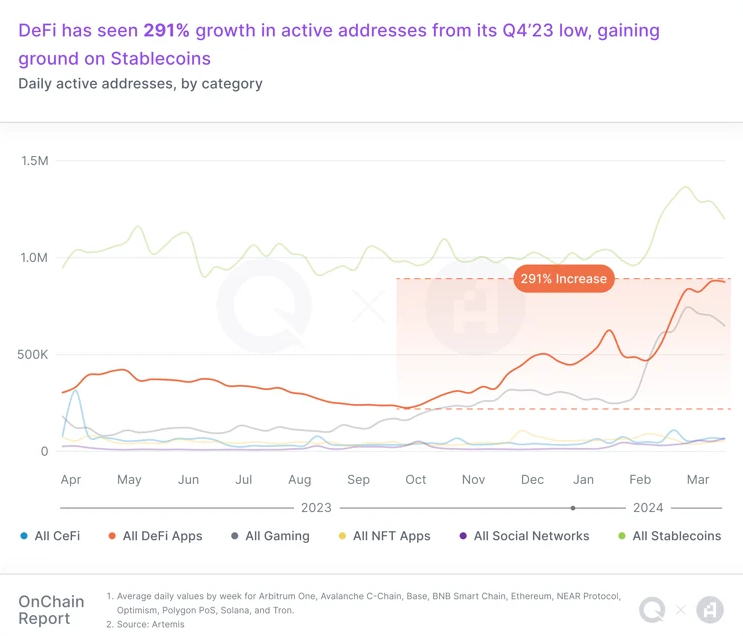

The first quarter marked the beginning of what the report calls ‘DeFi Summer part 2,’ with a staggering 291% quarter-over-quarter (QoQ) increase in user activity. This resurgence has sparked optimism and a strategic shift in the DeFi landscape, despite regulatory challenges from the SEC.

Image: Artemis/QuickNode

Image: Artemis/QuickNodeIn parallel, Web3 gaming has not only surpassed stablecoins in transaction volume but has also become the fastest-growing category year-over-year. The sector has experienced a 155% QoQ jump in active addresses, indicating a significant rise in player engagement and a testament to Web3’s capacity to attract and retain players.

However, stablecoins are still the most active sector in blockchain for the fifth consecutive quarter, with over 41% of the activity related to addresses interacting with those assets and a 42% QoQ increase in this metric. Factors contributing to this surge include the approval and listing of spot Bitcoin exchange-traded funds (ETFs), the upcoming Bitcoin halving in April, an exodus from hyperinflated fiat currencies, and the revival of DeFi.

Image: Artemis/QuickNode

Image: Artemis/QuickNodeLayer-2 blockchains have also seen remarkable growth, with platforms like Arbitrum and Base doubling their TVL, signaling a continued interest in expanding on-chain liquidity.

Decentralized social platforms, while smaller in scale, have experienced a 425% QoQ growth in daily active addresses, offering users more control over their data and a stake in the platforms’ success.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

63

7 months ago

63