ARTICLE AD

Despite the 7% pullback, Bitcoin, Base, and Blast managed to capture more interest from DeFi users.

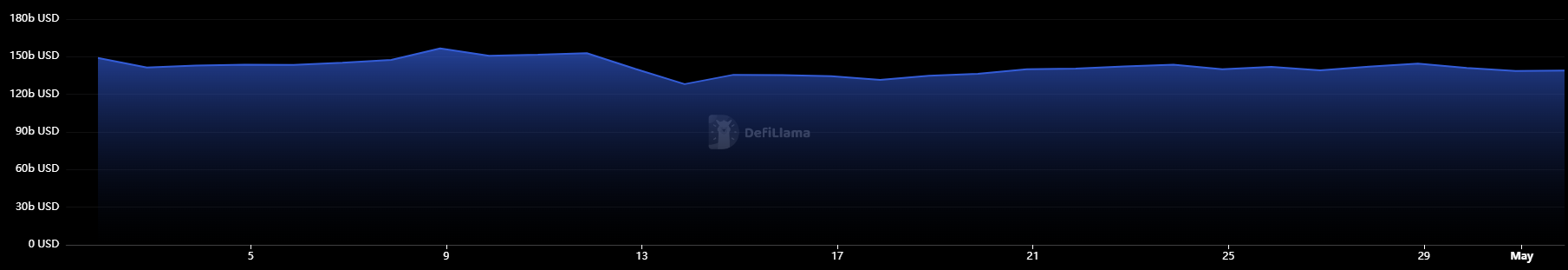

The total value locked (TVL) on decentralized applications fell $10 billion in April, according to data aggregator DefiLlama. That’s a 7% drop in 30 days, as the decentralized finance (DeFi) ecosystem closed last month with $138.6 billion, including liquid staked amounts.

DeFi’s TVL variation in April. Image: DefiLlama

DeFi’s TVL variation in April. Image: DefiLlamaConsidering the 10 largest blockchains by TVL, Avalanche registered the most significant monthly drop, with 31.5% of the funds leaving the chain. Solana also saw a considerable amount of crypto leaving its ecosystem as its TVL slump was almost 30%.

Nevertheless, the over $6 billion locked in its applications makes Solana the third-largest blockchain in total value locked. Meanwhile, despite the 14.2% drop, Ethereum still dominates almost 69% of DeFi’s TVL.

Despite the outflow of locked funds seen in the decentralized ecosystem, Base and Bitcoin managed to attract more capital and surpass the $1 billion threshold. The Layer-2 blockchain created by crypto exchange Coinbase presented an 18.4% growth, led by Moonwell, Seamless Protocol, and Tarot applications.

Bitcoin was propelled by new L2 infrastructure, which boosted its TVL by almost 39% in a month. Moreover, the Bitcoin DeFi narrative is hyped by industry players, such as services provider Trust Machines. Mark Hendrickson, a member of Trust Machines’ team, shared with Crypto Briefing that Bitcoin has as many functionalities as other blockchains, and events such as Stacks’ Nakamoto upgrade will boost the DeFi narrative.

Blast, another layer-2 blockchain built on Ethereum, showed a slight growth of 4.4% in April and closed the group of winners for the past 30 days.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

6 months ago

15

6 months ago

15