ARTICLE AD

Zeta Markets’ founder explains that market corrections generally affect the trading volume in exchanges.

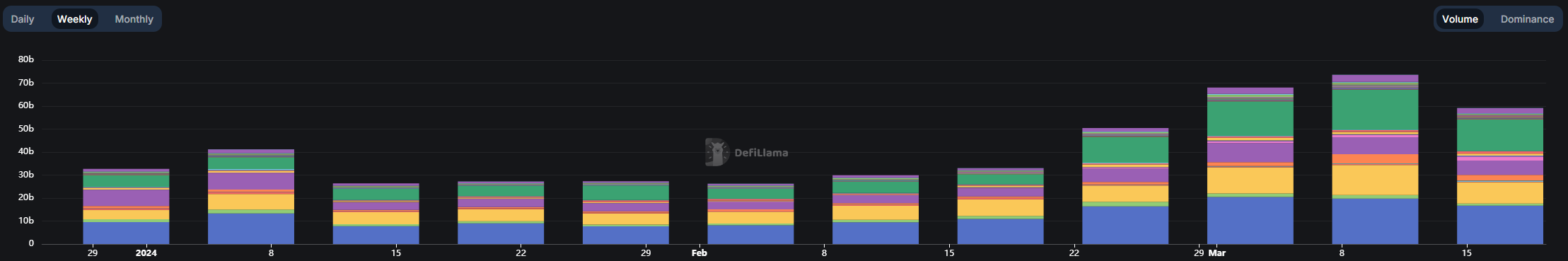

Decentralized exchanges (DEX) weekly trading volume fell by 24,5% in the past seven days, according to DefiLlama’s data. Within the top 10 blockchains by traded volume, Polygon’s 40% slump was the worst, followed closely by Avalanche’s 39,5% fall.

Not even meme coin’s favorite chain Solana escaped the fall in weekly trading volumes, with a considerable slide of 20%. Base, on the other hand, rose over 64% in the same period driven by its own ‘meme coin mania.’ Starknet also saw positive weekly variation, with 28% more activity in its DEXes.

DEXes’ weekly trading volume divided by chain. Image: DefiLlama

DEXes’ weekly trading volume divided by chain. Image: DefiLlamaTristan Frizza, founder of the decentralized platform Zeta Markets, pointed out that this negative movement in trading volumes could be tied to the pullback in prices seen last week.

“Typically, such retractions in the market disproportionately affect memecoins and altcoins which ultimately leads to a significant reduction in trading activities for these types of cryptos. This phenomenon could be seen as common market behavior, where investors start retreating from more speculative assets, resulting in diminished trading volumes for these coins,” Frizza explains.

Moreover, this movement could be a healthy adjustment to market euphoria, since the $73,6 billion in weekly trading volume seen from Mar. 9 to 15 was the highest weekly volume ever registered on-chain.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

8 months ago

48

8 months ago

48