ARTICLE AD

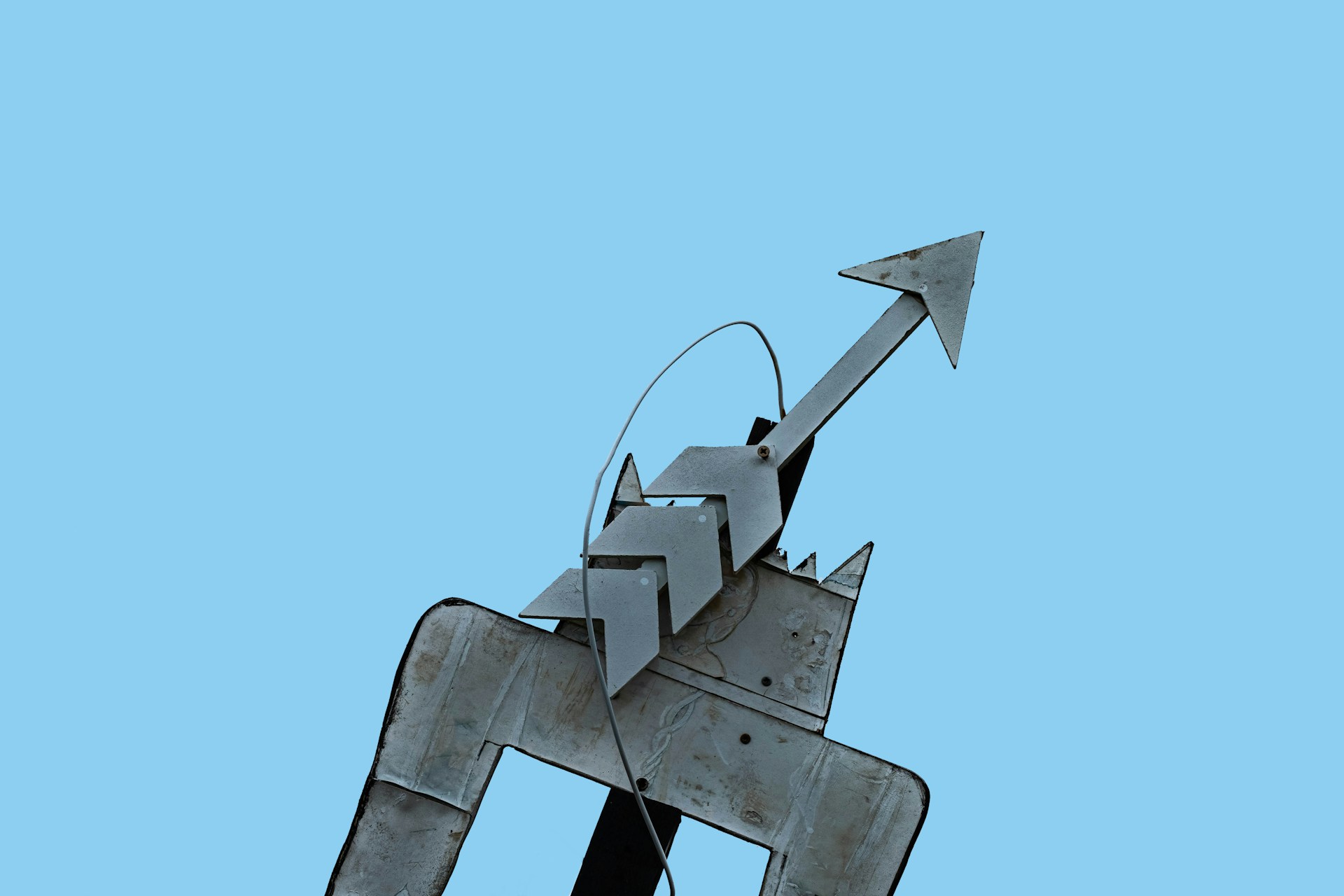

DePIN offers a new revenue stream for Bitcoin miners post-halving.

Bitcoin (BTC) miners might turn to the DePIN ecosystem to turn mining facilities profitable after the latest halving cut block rewards to 3.125 BTC, shared Livepeer CEO Doug Petkanics with Crypto Briefing. DePIN is short for decentralized physical infrastructure network, a blockchain industry sector that brings transparency and decentralization to the real world.

Petkanics highlights that this movement to DePIN, where the business model is usually providing computing power through GPUs to artificial intelligence-focused companies, is met with good and bad news for Bitcoin miners.

“The hardware that they’ve bought and deployed and paid for Bitcoin mining are really specific to Bitcoin. Their ASICs, they can only mine Bitcoin. They can only do that specific cash function. They really can’t be redeployed into other networks. I think that’s the bad news. But that’s not surprising. That’s what they knew their investment was and they knew they were optimizing for.”

On the opposite side, the expertise and surrounding infrastructure that the facilities built up around mining crypto are really efficient when it comes to energy usage, bandwidth, and operational management, Petkanics points out. This characteristics can be proven useful when managing a

The expectation after the April 20 halving is that electricity and overall production costs will nearly double, according to a report by asset management firm CoinShares. The report also sheds light on that mining companies like BitDigital, Hive, and Hut 8 are already generating income from artificial intelligence (AI).

“All that expertise and resources absolutely can be repurposed into one of the sort of biggest opportunities of this point in time that we’re in right now, due to the just massive amount of computing resources that are going to be required when it comes to this paradigm shift of artificial intelligence models being this new technology that’s changing everything about how people interact with technology.”

Fostering development

According to Livepeer CEO, decentralized computing power networks offer benefits in different layers. The first is related to how the GPU market is organized, where tech firms must buy large batches of graphic chips to achieve a cheaper acquisition price.

However, these companies usually don’t have immediate usage for all the GPU acquired, and that’s where DePIN shows its potential by letting computing power be lent.

“I think that actually fits really neatly into this notion that decentralized networks can let anyone who’s paid for that capacity, but has it sitting idle, make it available to developers that want to use it temporarily via open marketplaces.”

Moreover, the necessity to buy large batches of GPU is also a threshold to companies such as data centers and infrastructure providers. This is also another issue that can be solved by DePIN, as these smaller companies can tap into the dormant capacities of these idle graphic chips via an open marketplace, Petkanics underscored.

“You don’t have the overhead or the bureaucracy of needing contracts and customer relationships and sales and the stuff that adds a lot of cost on top of just sort of connecting directly to the computing power.”

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

8 months ago

42

8 months ago

42