ARTICLE AD

Investment crypto products’ outflows amounted to $21 million last week.

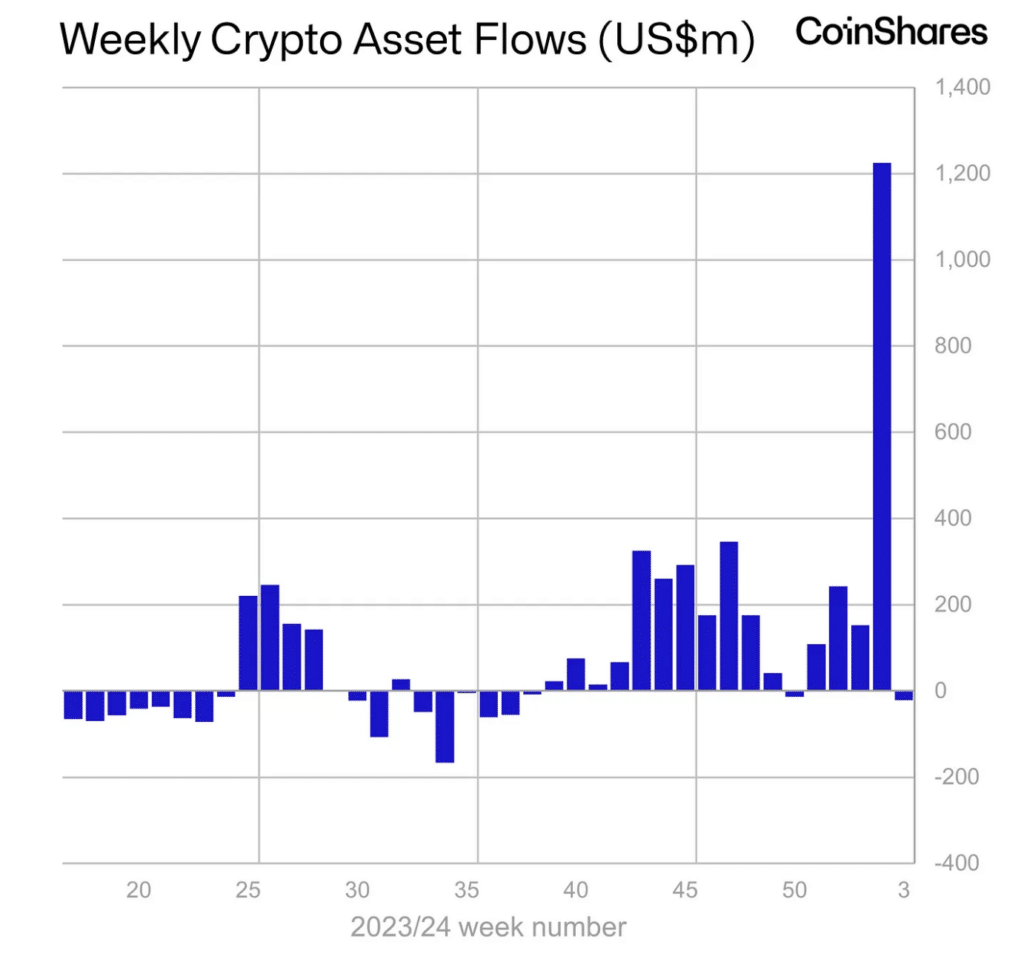

According to a CoinShares report, outflows from investment products into digital assets were modest at $21 million last week. However, this figure masks very high Bitcoin (BTC) trading volumes last week, totaling $11.8 billion, seven times the average weekly trading volume in 2023.

Source: CoinShares

Source: CoinShares

Geographically, capital inflows into the United States totaled $263 million, while Canada and Europe saw outflows of $297 million. Analysts suggest that such trends are explained by the migration of assets to the United States.

Bitcoin product outflows were minor, totaling $25 million, although trading volumes of $11.8 billion represented 63% of all BTC volumes on trusted exchanges. Ethereum (ETH) and Solana (SOL)-based products saw outflows of $14 million and $8.5 million, respectively.

Analysts note that ETP activity is currently dominating overall trading activity. Incumbent issuers with higher costs have been hit in the U.S., with capital outflows totaling $2.9 billion since the launch of spot Bitcoin ETFs.

Since launch, these newly issued ETFs have gained $4.13 billion, outpacing losses from more expensive existing ETPs. Investors saw the recent price decline as an opportunity to add to short Bitcoin investment products, receiving an influx of $13 million. Net inflows into U.S. ETFs have been $1.2 billion since launch.

Senior IT architect at BTCData Chris Jay Terry predicted an outflow of another $25 billion from the largest spot Bitcoin ETF GBTC.

After six days of trading, the net outflow from GBTC amounted to $2.8 billion. JPMorgan Chase bank experts expect that the fund will lose about $13 billion, of which $10 billion will be transferred by investors to other products from the same sector.

LATEST: Despite $GBTC seeing a -$590m outflow gash friday, The Nine overwhelmed it w/ +$623m (3rd best day), $IBIT & $FBTC both >$200m while $BTCO & $HODL had their best hauls to date. TOT NET FLOWS stand at +$1.2b as Nine's aum hit $4b vs GBTC's -$2.8b, upping aum share to 14%. pic.twitter.com/nB57H8Ro8s

— Eric Balchunas (@EricBalchunas) January 20, 2024

1 year ago

73

1 year ago

73