ARTICLE AD

Dogecoin shows bullish potential with increased addresses and whale activity, despite a recent price dip.

Key Notes

Surge in new Dogecoin addresses created, up 72% in a week, suggesting growing interest.Technical analysis points to a potential bullish MACD crossover, a historically bullish trigger.Dogecoin, however, faces resistance at key levels that it needs to overcome for a decisive rally.Dogecoin DOGE $0.11 24h volatility: -8.4% Market cap: $15.85 B Vol. 24h: $1.38 B has been a center of attraction lately as on-chain metrics are becoming favorable, indicating signs of an impending bullish run. On Tuesday, October 1, a top crypto analyst, who goes by the name Ali on X, revealed some interesting metrics about Dogecoin. Based on his tweet, the Dogecoin network has been seeing notable growth over the past week, with a 72% increase in new DOGE addresses.

He went further to say that on Monday alone, 19,630 new DOGE addresses were created. This surge in the number of new addresses suggests that more people are getting involved with Dogecoin. The rising interest in this meme coin could have been motivated by the growing positive sentiment in the general crypto market. There have been various thoughts about an upcoming bull rally, with many top analysts suggesting that October could actually be an “Uptober” for cryptos.

The #Dogecoin network is experiencing significant growth! Over the past week, there's been a 72% increase in new $DOGE addresses, and just yesterday alone, 19,630 new #DOGE addresses were created! pic.twitter.com/5Tj8ZvcxUu

— Ali (@ali_charts) October 1, 2024

With Dogecoin’s record of doing well during market rallies, investors may be positioning themselves to ride the upcoming wave in case the prediction comes true.

Dogecoin surged by close to 50% between September 7th to 28th. Such rallies attract many more wallets into the network as investors begin to FOMO into the ecosystem. However, the price has retraced by close to 20% at the time of writing.

Santiment, an on-chain analytic firm, explained that this price correction may not be indicative of the general sentiment within the DOGE community as whale activities remain very high. The retracement was triggered by some profit-taking activities from the whales, but the rising metrics still show that the party may not be over yet.

🐶 Dogecoin has retraced -18% from its top back on Saturday. But on-chain activity indicates that whales may not be done with all the bullish momentum of crypto's top meme coin. Though they took profit just before the top, their activity remains very high on DOGE's network. pic.twitter.com/FsmWJGkSE6

— Santiment (@santimentfeed) October 2, 2024

Technical Analysis Supports Impending Rally

Ali made another post on Dogecoin as he went back in history to study patterns that could point to a possible rally for DOGE. The top analyst used the Moving Average Convergence Divergence (MACD) indicator in his analysis. He noted that the last two times DOGE had an MACD bullish crossover on the weekly chart, there was a 90% and 180% price surge, respectively. The chart he posted shows that the MACD line is getting closer to the Signal Line, and in this case, a crossover could trigger a big move.

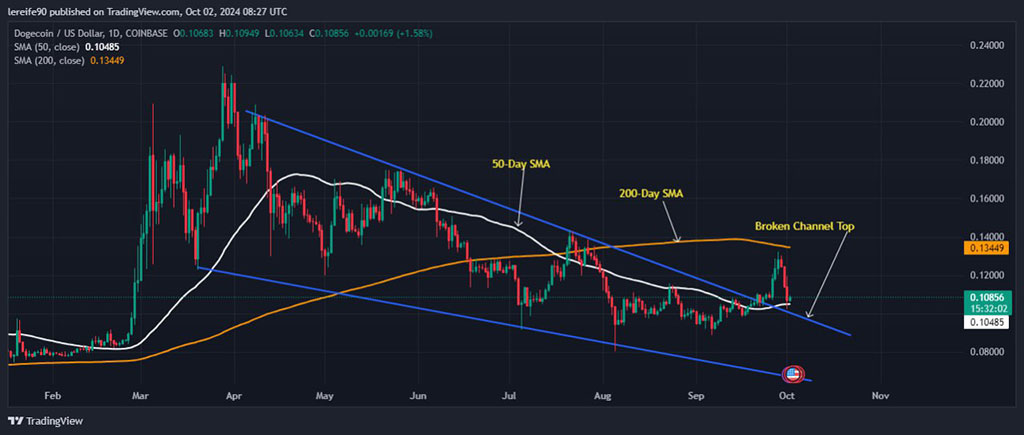

A broader analysis of Dogecoin shows it was trading within a descending channel between March and mid-September when it finally broke out. Following a bullish breakout, the price had little or no retest and began to spike upward, but as investors began to take profit, it started to see some decline, which is still fulfilling the test requirement. A successful retest would mean that the former resistance would have to hold as support. If this happens, we could see a major rally from that point.

Photo: TradingView

The Relative Strength Indicator on the daily chart is at 58 at the time of writing, which shows that the price would have room to run before it becomes overbought in case the bullish move continues.

Looking at the Simple Moving Averages, the short-term 50-day SMA is currently serving as support for the price, which is indicative of a possible rally; however, the more long-term 200-day SMA is above the price and could serve as resistance in the medium term.

The rising on-chain metric is a bullish sign, but technical analysis is showing a bit of a mixed picture. These point to one thing: the price still has to overcome some strong resistance (just like the 200-day SMA) and maintain key support (the top of the broken descending channel) for a decisive rally.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Altcoin News, Cryptocurrency News, News

Temitope is a writer with more than four years of experience writing across various niches. He has a special interest in the fintech and blockchain spaces and enjoy writing articles in those areas. He holds bachelor's and master's degrees in linguistics. When not writing, he trades forex and plays video games.

1 month ago

11

1 month ago

11