ARTICLE AD

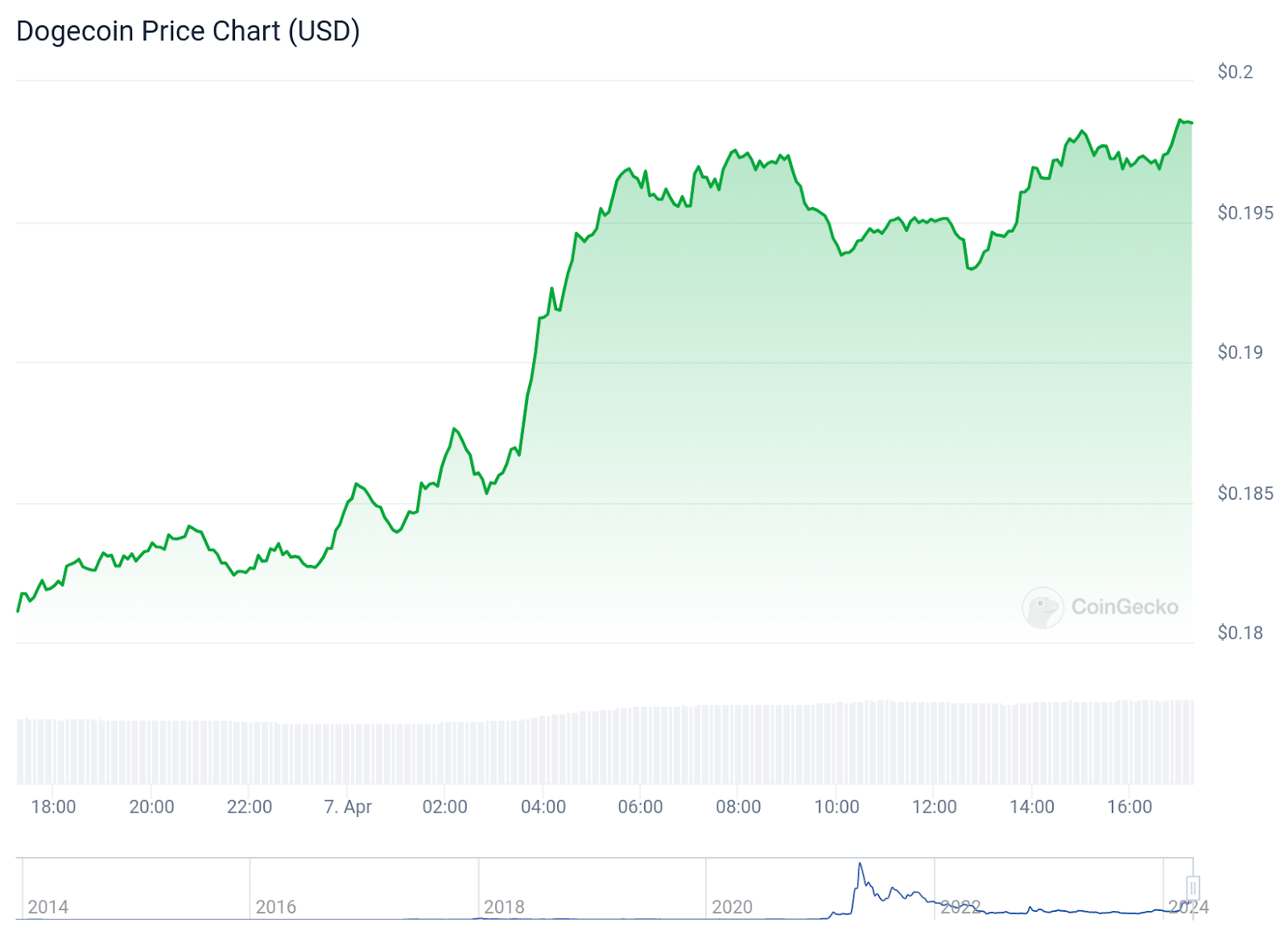

The price of dog-themed meme coin Dogecoin (DOGE) shot up 10.1% to go above the $0.20 mark over the past 24 hours.

The meme coin has been on an upward trend in the last couple of days, gaining 7% on April 6 to surpass $0.18 after a period of stability earlier in the week.

Analysts attributed the surge to a substantial movement of 200 million Dogecoins from Robinhood to an undisclosed wallet. It sparked discussions in the crypto community about its potential to reach the coveted $1 milestone.

The movement of DOGE, totaling around $35.45 million, was detected by Whale Alert. It involved two transactions carried out within 24 hours.

Dogecoin resurgence

Initially, the mysterious wallet moved 100 million DOGE worth $17.77 million from Robinhood, followed by another transaction of 99.27 million meme coins valued at $17.68 million from the same platform. This activity pushed DOGE’s price up by more than 7% to reach $0.196.

Currently, DOGE is trading at $0.2003, reflecting a more than 10% increase in the past 24 hours and an 18.7% uptick over the last 30 days.

Dogecoin 24-hrs price chart | Source: CoinGecko

Dogecoin 24-hrs price chart | Source: CoinGecko

Its price over the last fortnight was also in the green, registering nearly 15% growth. However, over the previous seven days, the meme coin’s performance was a tad lackluster, losing 3.9% of its value, according to CoinGecko.

Alongside the whale transactions, several bullish metrics have also contributed to this price jump, including a 31.95% rise in trading volume over the previous day to $2.23 billion, indicating increased market activity and interest in DOGE.

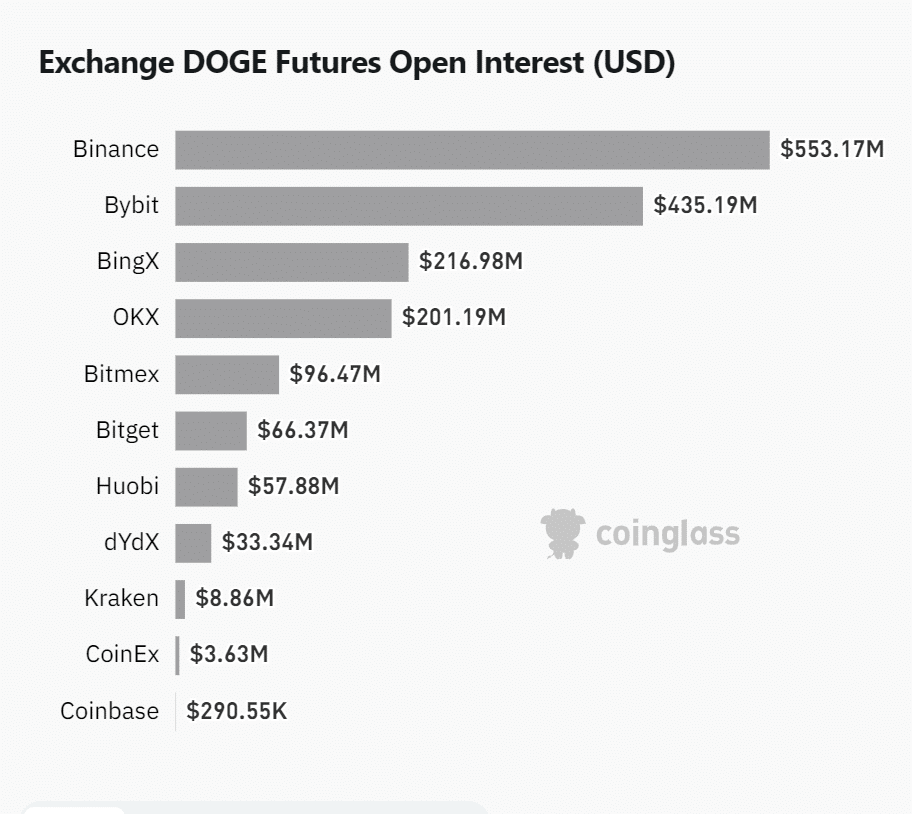

Additionally, data from CoinGlass indicates that open interest in Dogecoin has grown by 17.5% to $1.67 billion. Notably, a substantial portion of this interest, $553.17 million, is held on Binance, followed by Bybit with $435.19 million and BingX with $216.98 million.

Dogecoin futures open interest | Source: CoinGlass

Dogecoin futures open interest | Source: CoinGlass

This widespread participation across different platforms showcases widespread trader participation.

Overall, Dogecoin’s recent price movements and market metrics suggest a resurgence in investor confidence and interest, highlighting its continued relevance across the cryptocurrency landscape.

9 months ago

53

9 months ago

53