ARTICLE AD

Trump’s lead over Harris influences investor behavior in crypto markets.

Key Notes

Trump leads Harris by 12% in prediction markets, influencing crypto sentiment.Ether's risk reversal rate for October 11 is -7.3%, indicating bearish sentiment.Ethereum call options sold at a 2.5:1 ratio compared to buys in September.As the US presidential election on November 5 approaches, the crypto market shows a marked divergence in sentiment toward two major cryptocurrencies: Ether ETH $2 414 24h volatility: 0.6% Market cap: $290.59 B Vol. 24h: $14.54 B and Bitcoin BTC $61 102 24h volatility: 0.0% Market cap: $1.21 T Vol. 24h: $31.35 B . With Republican Donald Trump widening his lead over Democrat Kamala Harris in prediction markets, this political shift appears to be influencing investor behavior differently for these digital assets.

At the moment, Ether is experiencing notably more bearish sentiment compared to Bitcoin, as evidenced by the latest options market data. According to Amberdata and Deribit, Ether’s 25-delta risk reversals, which measure the premium of put options over call options, are deeper into negative territory than those for Bitcoin.

ETH Risk Reversals Hit -7.3% amid Election Volatility

Options traders typically use risk reversals to gauge the market sentiment and hedge their positions in the spot and futures markets. The more negative the risk reversal, the higher the premium that traders are willing to pay for downside protection versus upside potential. Currently, Ether options set for expiration on October 11 show a risk reversal rate of -7.3%, with Bitcoin trading at -5.8%.

Photo: CoinMarketCap

However, at the time of writing Ether is trading at $2,415, marking a 1.30% increase in the last 24 hours. The community sentiment indicator on CoinMarketCap shows 33% favoring the bullish sentiments while 67% vote for bearish sentiments for the cryptocurrency.

Interestingly, as we look beyond the election with options expiring after November 8, Bitcoin’s risk reversals turn positive, signaling an expected volatility shift to the upside. Conversely, Ether’s sentiment does not improve until late December, suggesting that traders are bracing for more immediate volatility in Bitcoin following the election results.

In September, trading activities on Derive, a leading decentralized exchange, revealed that Ethereum call options were being sold at a ratio of 2.5 to 1 compared to buys. This activity indicates a lack of confidence in Ether’s short-term price increase, as traders are more inclined to hedge against further price drops.

Nick Forster, founder of Derive, highlighted this cautious stance in his exclusive report, noting:

“The skew in ETH open interest, with nearly 2.5 times more calls sold than bought, suggests that traders see the upside as limited for now. This divergence between the two assets will be key to watch as we get closer to election day.”

Political Influence on Crypto Market

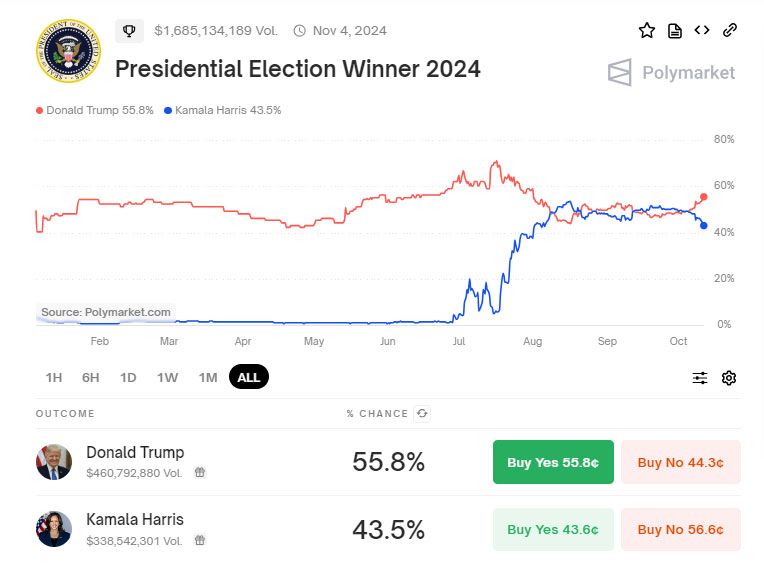

The intersection of politics and market sentiment is particularly pronounced in this election cycle. Trump’s odds of securing a victory have reached a two-month peak of 55.8% on Polymarket, significantly ahead of Harris at 43.8%. His campaign has intertwined with financial markets, notably through the September launch of the DeFi protocol World Liberty Financial.

Photo: Polymarket

While some financial analysts, like those from Standard Chartered, speculate that a Trump administration might favor Ethereum competitors like Solana, the broader sentiment is mixed. A Trump win is seen as potentially beneficial for cryptocurrencies in general, given his administration’s openness to integrating blockchain innovations into the financial ecosystem.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Cryptocurrency News, Ethereum News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

1 month ago

17

1 month ago

17