ARTICLE AD

Ethereum and Polygon maintain their lead over newer Ethereum Virtual Machine (EVM) chains in drawing new users and increasing trading volumes, as revealed by Flipside’s “New EVM Users: Q1 Snapshot” report.

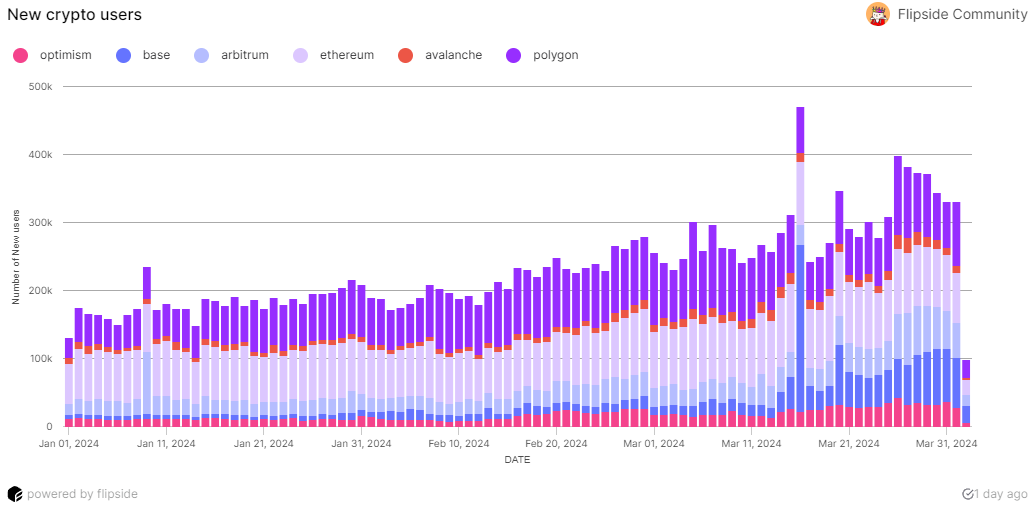

As of March 27, Ethereum had 13.4 million new users, while Polygon had 12.3 million, accounting for roughly 70% of the total number of new EVM users this year. In contrast, Arbitrum has added 4.7 million users since the beginning of 2024.

New crypto users report Q1 2024 | Source: Flipside

New crypto users report Q1 2024 | Source: Flipside

While Ethereum’s mainnet maintains its historical dominance, Layer-2 protocols are processing more data. Decentralized finance (defi) remains the key attraction for new users, with Ethereum leading in trading volume at $12 billion in Q1.

Furthermore, the upward trend of defi activity contrasted with the previous year’s intermittent, volatile swings, indicating a growing interest and participation in DeFi among novices in the blockchain space.

Arbitrum ranked second on the list, with a $9.5 billion gain since the beginning of 2024. The Flipside report attributes this milestone to increased new user activity in Arbitrum’s defi space. In contrast, Polygon’s high new user numbers are ascribed to an increase in non-fungible token (NFT) activity.

With a record 243,000 new users as of March 16, Base has nearly octupled its new user base since January, owing to Coinbase’s efforts to simplify cryptocurrency for novices.

“While this still puts Base far behind the leading EVM chains in terms of overall new user volume, it nonetheless represents impressive growth, particularly since the chain’s activity waned during the final months of 2023,” the report stated.

The report notes that the surge coincides with Bitcoin reaching a new all-time high and represents the highest single-day new user count among EVM chains this year.

Demonstrating diversity, a significant portion of newly registered users interact with an assortment of decentralized applications (dApps) on Ethereum. However, the analysis found that Ethereum did not have the most evenly distributed app adoption among the six analyzed chains.

“This distinction goes to Base, where the difference in new user volume between the chain’s 1 and 2 apps was only 16.9%, compared to Ethereum’s ~300%.”

“The fact that Base is relatively new likely reduced early protocols’ first mover advantage and consequent network effects, preventing user consolidation around a single app.”

Token swaps and bridging apps are the most typical entrance points for new users on EVM chains, with Uniswap and Orbiter Finance leading the way on Ethereum and Base, respectively.

As revealed by additional insights in the Flipside report, NFT trading activity across EVM chains painted a muddled picture.

New user NFT trading on Ethereum and Base increased steadily, whereas it declined significantly on Polygon from its early peaks; this variation highlights the erratic nature of interest in NFTs and suggests that they may not continue to dominate the market narrative in the upcoming cycle as they had in the past.

Moreover, the report also emphasized the role of specific applications in directing user activity on various chains. For instance, many new Optimism users were lured to Worldcoin (WLD), indicating a long-term community interest in certain projects:

“This remarkable statistic, along with Optimism’s low DeFi and NFT trading volume relative to other observed chains, may reflect a potential divergence between Optimism’s ecosystem evolution relative to other EVM chains.”

7 months ago

45

7 months ago

45