ARTICLE AD

Ethereum's price has already increased by 5% this week in anticipation of the SEC's final approval.

Key Takeaways

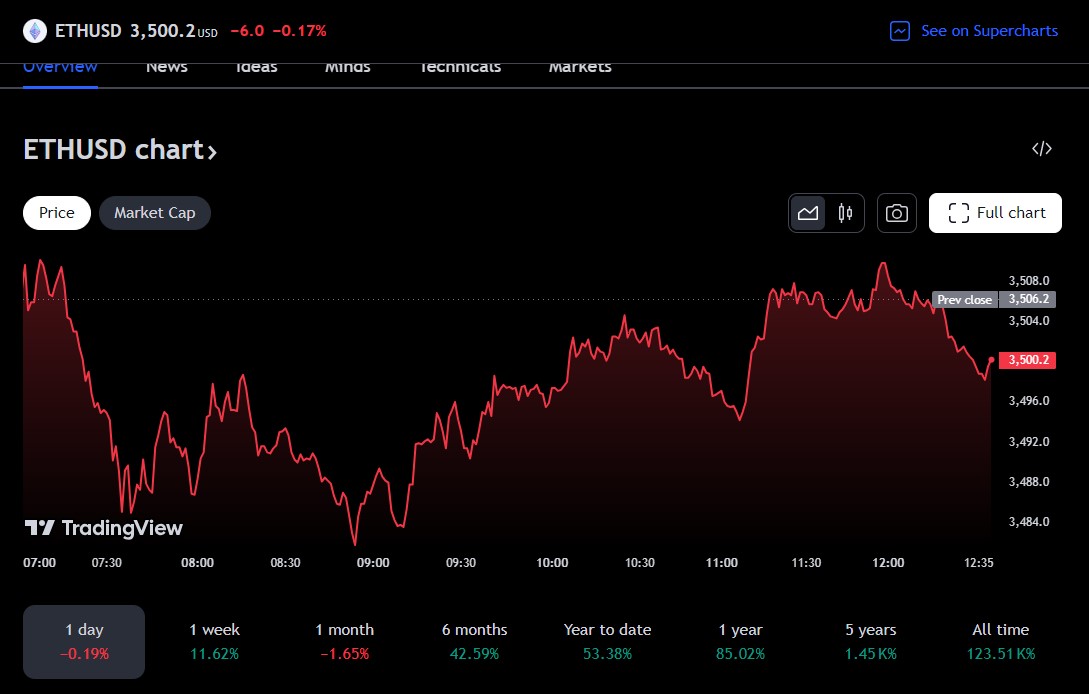

Ethereum's price has surged 11% in a week, driven by anticipation of spot Ethereum ETFs. Ethereum ETF issuers have released fee structures, with a competitive range between 0.19% and 0.25%, excluding Grayscale's higher fee. <?xml encoding="UTF-8"?>The price of Ethereum (ETH) has surged past $3,500, marking an 11% increase over the past week, TradingView’s data shows. The rally follows CBOE’s announcement that five spot Ethereum exchange-traded funds (ETFs) will start trading on the exchange on July 23.

Source: TradingView

Source: TradingViewWith ETF submitting their final S-1 forms, Bloomberg ETF analyst Eric Balchunas suggested several spot Ethereum ETFs could debut on July 23, exactly two months after the SEC greenlit the first batch of spot Ethereum ETFs.

The coming launches on CBOE include Fidelity Ethereum Fund (FETH), Franklin Templeton Ethereum ETF (EZET), Invesco Galaxy Ethereum ETF (QETH), VanEck Ethereum ETF (ETHV), and 21Shares Core Ethereum ETF (CETH).

These funds, alongside BlackRock’s and Grayscale’s Ethereum Trust, received initial approval from the US Securities and Exchange Commission (SEC) in May. BlackRock’s iShares Ethereum Trust is expected to launch on Nasdaq while Grayscale Ethereum Trust is set to debut on NYSE, though neither exchange has yet to make official announcements.

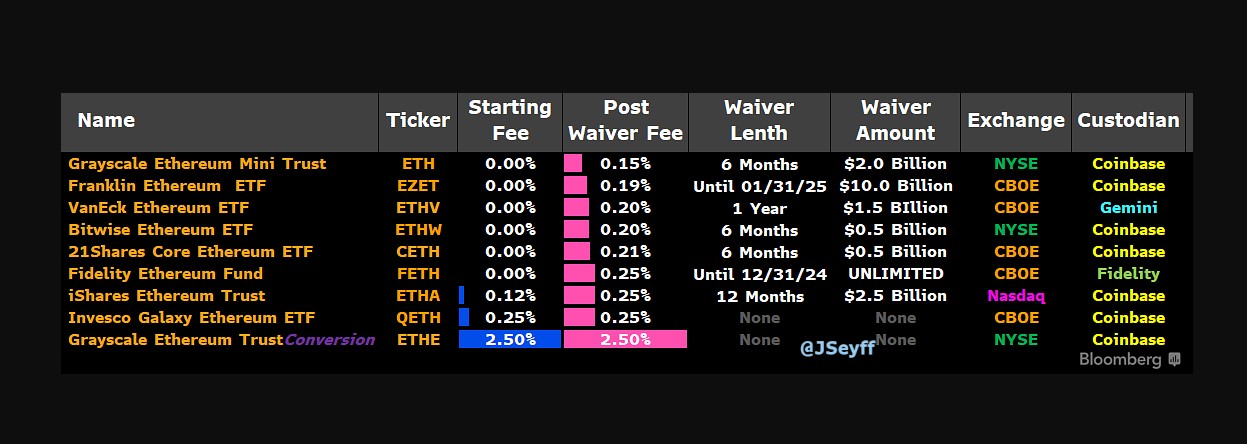

Most Ethereum ETF issuers have disclosed their fee structures ahead of the upcoming launch. Despite initial fee waivers offered by some issuers to attract assets, post-waiver fees among most asset managers are relatively similar without significant price competition.

Franklin Templeton offers the lowest post-waiver fee at 0.19%, while Grayscale’s ETF management fee is considerably higher at 2.5%. The fee range for other issuers, excluding Grayscale Ethereum Mini Trust, is between 0.20% and 0.25%, according to data from Bloomberg ETF analyst James Seyffart.

Source: @JSeyff

Source: @JSeyffEthereum kicked off the week strongly with the price rallying 5% to over $3,300 as the market awaits the SEC’s trading approval of spot Ethereum funds. Ethereum is currently trading at $3,500 and is still down around 28% from its all-time peak of $4,800, per TradingView’s data.

The final approval is expected to have a positive impact on the Ethereum market and the broader crypto industry. It could attract significant inflows of institutional and retail capital into Ethereum, potentially mirroring the success of spot Bitcoin ETFs.

According to TradingView’s data, the price of Bitcoin has surged over 40% following the launch of US spot Bitcoin funds in January, despite experiencing an initial correction. The flagship crypto reached a new record high of $73,000 in mid-March.

Disclaimer

4 months ago

27

4 months ago

27