ARTICLE AD

Bloomberg ETF analysts change their predictions as background noises from the SEC start.

Bloomberg ETF analysts Eric Balchunas and James Seyffart increased to 75% their odds of a spot Ethereum exchange-traded fund (ETF) being approved in the US. The previous odds were 25%. As a result, Ethereum (ETH) leaped 8.3% after the news.

Previously, both analysts explained that the low odds were related to the lack of background noise made by the SEC asking players about the ETF approval. However, due to political issues, Balchunas stated on X that the US regulator will “be doing a 180 on this.” Moreover, the odds at 75% are substantial, since Seyffart and Balchunas are still waiting on filing documents to boost it higher.

Seyffart joked on X about being criticized by Ethereum bulls since he and Balchunas were previously quenching their hopes up until now.

“Never gonna hear the end of this from the .eth people in my replies if this turns out to be true. But it’s what we’re hearing from multiple sources. Should see a bunch of filings over coming days if we’re correct,” he posted on X.

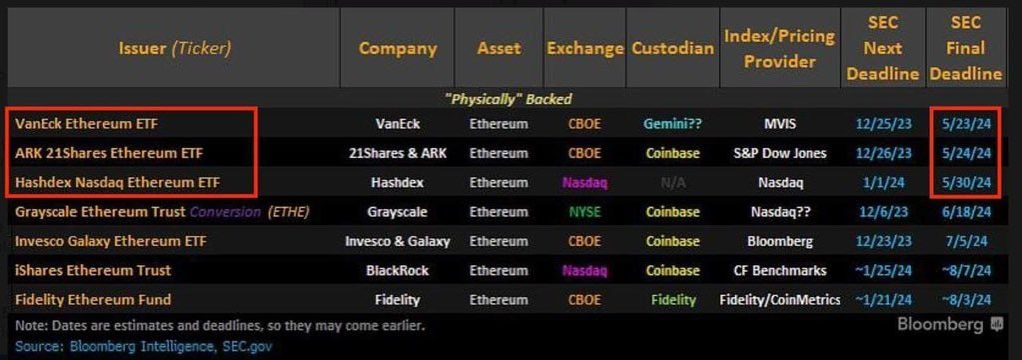

The first deadline for an ETF approval is on May 23, when the SEC must decide on VanEck’s Ethereum ETF filing. On the following day, the deadline for the ARK21 Shares Ethereum ETF also expires. The last deadline for this month is set for May 30, when the regulator must decide on Hashdex Nasdaq Ethereum ETF filing.

As reported by Crypto Briefing, not even notorious fund managers were expecting a spot Ethereum ETF approval in the US this week. Katherine Dowling, general counsel for ETF applicant Bitwise, said that “most people are universally expecting a disapproval order.” VanEck CEO Jan van Eck also predicted a likely denial during a CNBC interview.

In the last 24 hours, nearly $150 million in short positions were liquidated in crypto derivatives, according to data aggregator Coinglass. Of that total, $35.3 million were related to positions shorting ETH.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

30

7 months ago

30