ARTICLE AD

The market is dominated by Ethereum futures ETFs, with Canada and Europe shining, followed by Brazil and the US.

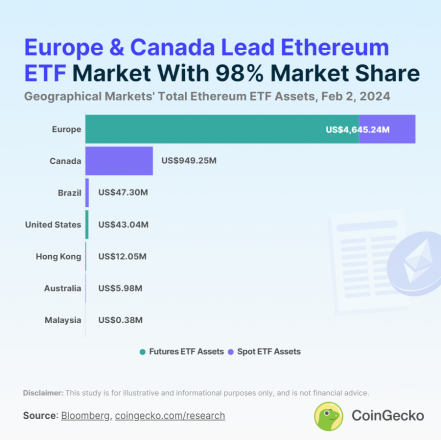

The Ethereum (ETH) exchange-traded fund (ETF) landscape is currently valued at $5.7 billion in total assets, with Europe holding an 81% majority share, according to a Feb. 2 report by CoinGecko. Leading the pack is XBT Ethereum Tracker One (COINETH) with assets amounting to almost $3.5 billion, making it the largest Ethereum ETF globally.

Its counterpart, XBT Ethereum Tracker Euro (COINETHE), follows as the second largest, boasting $511 million in assets. Both ETFs, which are based on ETH futures, have been traded in Europe since their inception in October 2017, marking the world’s introduction to ETH ETFs.

In Canada, the CI Galaxy Ethereum ETF (ETHX) stands out with over $478 million in assets, while Europe’s 21Shares Ethereum Staking ETP (AETH) holds the title for the second largest spot ETH ETF, with $329 million. Launched in 2019, AETH was the first of its kind worldwide.

Thus, the global ETH ETF market is largely concentrated in Canada and Europe, with the top 10 ETFs traded exclusively within these regions. The United States trails behind, with its highest-ranking ETH ETFs occupying 14th position or lower.

This gap is attributed to the US Securities and Exchange Commission’s hesitancy in approving spot ETH ETF applications, leaving room for speculation on whether the U.S. will be able to bridge this divide.

Overall, Ethereum ETFs are present in 13 countries and traded across seven markets. Brazil emerges as the third-largest market, followed by the US, with smaller contributions from Hong Kong, Australia, and Malaysia. The distribution of ETF types varies by region, with Europe offering both futures and spot Ethereum ETFs, while other markets specialize in one or the other.

Globally, there are 27 active Ethereum ETFs, encompassing both spot and futures contracts. Despite the diversity of offerings, the market is dominated by a few key players, with the top 10 ETFs holding 96.4% of total assets. The landscape is skewed towards Ethereum futures ETFs, which account for 68.5% of the total assets, double that of spot Ethereum ETFs.

The proliferation of Ethereum ETFs saw significant growth during the crypto bull market of 2021, with 12 new launches across various regions. The trend continued, albeit at a slower pace, through 2022 and into 2023, with new ETFs emerging in markets including Malaysia, which introduced the Halogen Shariah Ethereum Fund (HALSETH) in 2024.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

87

1 year ago

87