ARTICLE AD

Nate Geraci, president of ETF Store, said ETFs are simply a bridge for the mainstream to access crypto. Once that bridge is fully built, no going back.

Key Notes

US spot Ether ETFs turn positive with $135.9M net inflows on Nov 12, led by BlackRock’s iShares Ethereum Trust ($131.4M).Ethereum ETFs reach a $3.1B milestone in net inflows, while BlackRock’s fund totals $1.67B since launch.Ethereum price surges 22% to $3,150, market cap exceeds $400B, driven by Trump’s election win and increased derivatives interest.

Investment in spot Ether exchange-traded funds (ETFs) based in the United States recently turned positive, marking a crucial shift since the funds’ launch in July. Driving this reversal, a major inflow surged into BlackRock’s iShares Ethereum Trust, which logged its second-largest net gain, reaching $131.4 million.

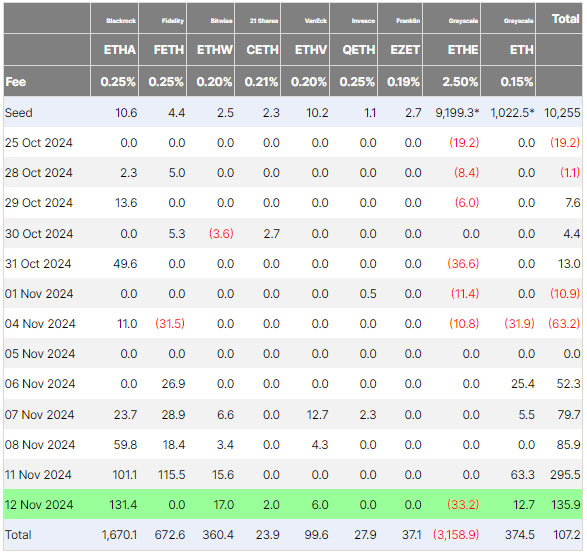

Source: Farside Investors

On November 12, the nine spot Ether ETFs collectively draw $135.9 million in net inflows, according to Farside Investors. The positive trend followed a record-breaking inflow of $295 million on November 11, as reported by Farside Investors. The consecutive gains pushed the total net flows for these nine funds to a positive $107.2 million — a first since their initial launch.

Ethereum ETFs Inflows Reach $3.1 Billion Milestone

Net inflows in the Ethereum ETF market have now reached $3.1 billion, significantly outpacing the ongoing $33.2 million decline in Grayscale’s Ethereum Trust (ETHE). BlackRock’s iShares Ethereum Trust (ETHA) stands out, amassing $1.67 billion in total inflows since its launch and consistently avoiding any net outflow days. This solid performance positions BlackRock as a dominant force in the Ethereum ETF space.

Nate Geraci, president of ETF Store, pointed out on X that BlackRock’s fund ranks among the top six ETF launches of 2024. Such high performance underscores BlackRock’s growing influence over the Ethereum ETF market.

Meanwhile, Bitwise’s Ethereum ETF (ETHW) recorded an inflow of $17 million, while Grayscale’s Ethereum Mini Trust (ETH) saw $12.7 million in new funds. Additionally, though smaller, inflows were reported for Ark 21Shares and VanEck’s funds. Over five consecutive trading days, Ether ETFs have attracted nearly $650 million in inflows.

On November 13, Geraci highlighted the expanding connection between cryptocurrency and ETFs in asset management. He remarked:

“Remember, ETFs are simply a bridge for the mainstream to access crypto. Once that bridge is fully built, no going back.”

He further explained that ETFs act as a gateway for mainstream access to cryptocurrency markets, suggesting that once this bridge is built, the trend will be irreversible. The positive trajectory extended to Bitcoin ETFs as well. Spot Bitcoin ETFs witnessed aggregate inflows of $817.5 million on November 12, according to Farside Investors.

Ethereum Price Surges, Market Cap Hits $400 Billion

Ethereum ETH $3 182 24h volatility: 3.7% Market cap: $383.80 B Vol. 24h: $49.57 B recorded a 22% price surge over the past week, reaching just above $3,150 on November 13, according to CoinMarketCap. The recent rally pushed Ethereum’s market capitalization beyond $400 billion, adding the full market cap equivalent of Solana within just five days.

A crypto-friendly outlook in the United States, driven by Donald Trump’s presidential election win, fueled optimism, lifting Ether’s value by over 37% in the last week. Data from CryptoQuant revealed that Ethereum’s total open interest in the derivatives market expanded from 9.8 million ETH on November 5 to an unprecedented 13 million ETH by November 13.

A trader named Alan noted on X that Ethereum has now achieved an all-time high in futures open interest, emphasizing that renewed interest has returned to what he termed the “boss of altcoins”. Alan underscored Ethereum’s continued importance in the crypto landscape.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

1 week ago

2

1 week ago

2