ARTICLE AD

L2 networks' surge reshapes Ethereum's economic landscape.

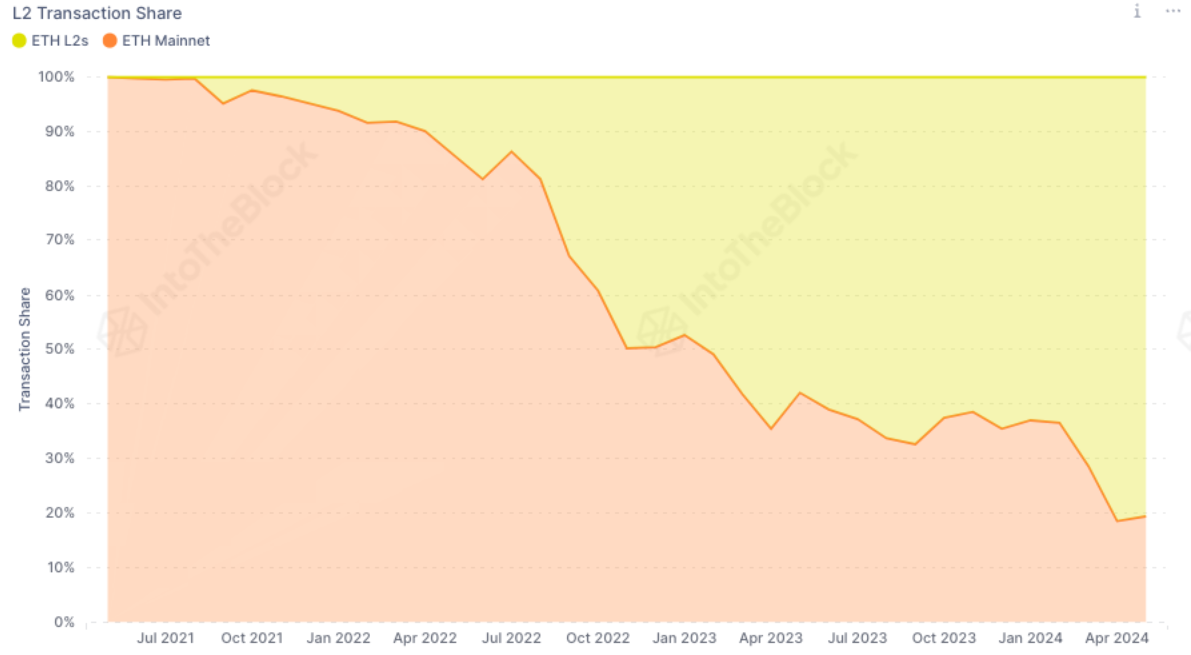

Ethereum’s transaction fees have reached a six-month low, caused by the shift of transactions to layer-2 (L2) blockchains, according to the latest edition of IntoTheBlock’s “On-chain Insights” newsletter.

This migration has contributed to a decrease in the total fees accrued by Ethereum. In April, transactions on the largest three L2s, Arbitrum, Optimism, and Base, accounted for an unprecedented 82% of all Ethereum transactions.

With the inclusion of additional L2s, this percentage is likely even higher. The launch of EIP-4844 on March 13 played a crucial role in this transition by slashing L2 fees by more than tenfold, leading to a 10% drop in mainnet transactions and a shift in Ethereum’s token economics.

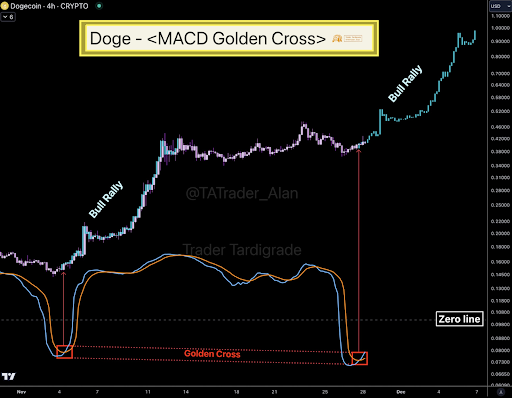

Image: IntoTheBlock

Image: IntoTheBlockIn the competitive landscape of L2s, different platforms are carving out their niches. Institutions have shown a preference for Arbitrum, which dominated 73% of Ethereum’s transaction volume among the top L2s. Conversely, Arbitrum accounted for only 39% of the number of transactions, while Base captured a 50% share. Notably, Blackrock and Securitize have recently applied to introduce the BUIDL real-world assets fund on Arbitrum.

On the retail side, Optimism’s OP Stack has been gaining traction through “SocialFi” applications. Coinbase’s Base L2 experienced a surge in transactions following FriendTech’s airdrop, and the social media-based card game Fantasy.top generated $6 million in fees this week on the Blast L2. This diversification of applications has intensified the competition among L2s, particularly in terms of market capitalization.

Optimism’s OP token has seen a 48% increase from its April lows, outperforming ARB’s 22% gain. The OP token now surpasses ARB in both circulating market cap and fully diluted valuation. Additionally, venture capital firm a16z’s $90 million investment in OP has bolstered the project’s resources and credibility.

The ongoing competition among L2s is leading to lower fees for Ethereum in the short term. However, it is simultaneously fostering a rich ecosystem of applications that promise to stimulate economic activity and offer long-term benefits, concludes IntoTheBlock.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

6 months ago

38

6 months ago

38