ARTICLE AD

Key Notes

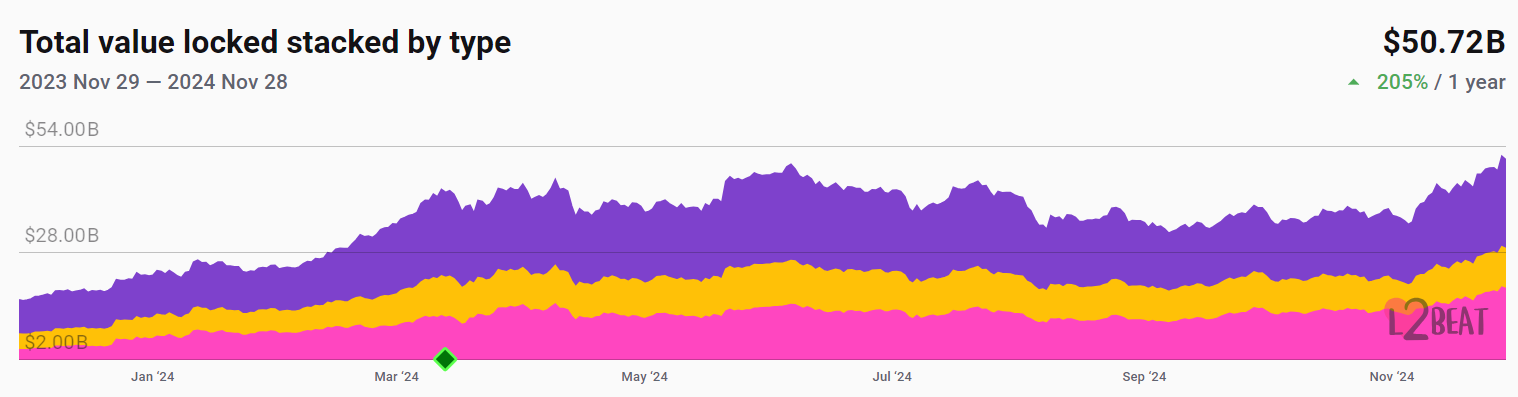

Arbitrum dominates the Ethereum Layer 2 landscape with $18.3 billion in TVL, contributing 35% of the total TVL.Base follows as the second-largest L2 with $11.4 billion, representing 22% of cumulative TVL.The Ethereum Dencun upgrade introduced fee stabilization leading to a 99% median transaction fee reduction across Layer 2 platforms.The Ethereum ecosystem has managed to deliver stellar performance despite criticism. Thanks to the Layer 2 platforms whose cumulative total value locked (TVL) has surged a staggering 205% year-to-date while hitting a record high of $51 billion. This shows a strong value growth and rising investor interest in the Ethereum-native assets.

From just $16.6 billion in November 2023, the Ethereum Layer-2 TVL has surged by a staggering 205% crossing $51 billion now, as per the current data from L2BEATS.

Courtesy: L2BEAT

The Ethereum Layer 2 solutions have played a crucial role in enhancing the network’s scalability by offloading transactions on secondary chains. This reduces the burden and chances of network congestion on the Ethereum mainnet. It also reduces wait times while lowering transaction costs simultaneously.

However, some industry experts have raised concerns that L2s could be “cannibalistic,” potentially reducing revenue for the Ethereum mainnet and limiting Ether’s price growth.

Top Two Ethereum Layer Networks: Arbitrum and Base

The two major contributors to Ethereum Layer 2 TVL above the record levels of $51 billion are Arbitrum and Base. Being the leading Layer 2, Arbitrum alone holds more than $18.3 billion in total value locked (TVL) thereby catering to a massive 35% of the total TVL.

Besides, Coinbase L2 network Base is the second-largest network holding a total of $11.4 billion in TVL. thus, it represents 22% of the cumulative total L2 TVL. Arbitrum’s total value locked (TVL) climbed by over 12%, while Base saw an 11.4% increase in the week leading up to November 28.

On November 26, Base hit a record 106 transactions per second (TPS) as its TVL exceeded the $10 billion mark for the first time. Additionally, Base recently surpassed 1 billion total transactions, fueled largely by the ongoing memecoin frenzy during this bull cycle.

How Dencun Upgrade Contributed to L2 Fee Stabilization

Following the Ethereym Merge event back in 2022, when the Ethereum blockchain transitioned into a PoS network, it underwent a major upgrade dubbed Dencun earlier this year in March 2024.

Nick Dodson, co-founder and CEO of Fuel Labs, noted that it played a crucial role in stabilizing fees across Layer 2 networks. He wrote:

“On the point of EIP-4844, a lot of people talk about the fee reduction, but it’s more about fee stabilization. It’s actually more about expanding capacity and scale and not so much lowering fees.”

Several Ethereum Layer 2 networks, including Starknet, Optimism, Base, and Zora OP Mainnet, experienced a 99% reduction in median transaction fees following the upgrade’s implementation.

The open interest in CME's ether futures has nearly doubled since the election.

All-time highs by a wide margin, with futures premiums trailing above BTC for the past few days. pic.twitter.com/sV0Myo6VWE

— Vetle Lunde (@VetleLunde) November 25, 2024

The Ethereum price ETH $3 552 24h volatility: 0.4% Market cap: $427.66 B Vol. 24h: $45.09 B is once again showing strength recovering over 15% from the lows of $3,000 last week. The Ethereum futures open interest on CME exchange has also touched a new all-time high showing bullish sentiment among investors. The next major milestone for ETH would be $4,000 before it sets the path for a new all-time high.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Cryptocurrency News, Ethereum News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

1 hour ago

2

1 hour ago

2