ARTICLE AD

Despite growth from layer-2 blockchains, Ethereum still leads the EVM ecosystem.

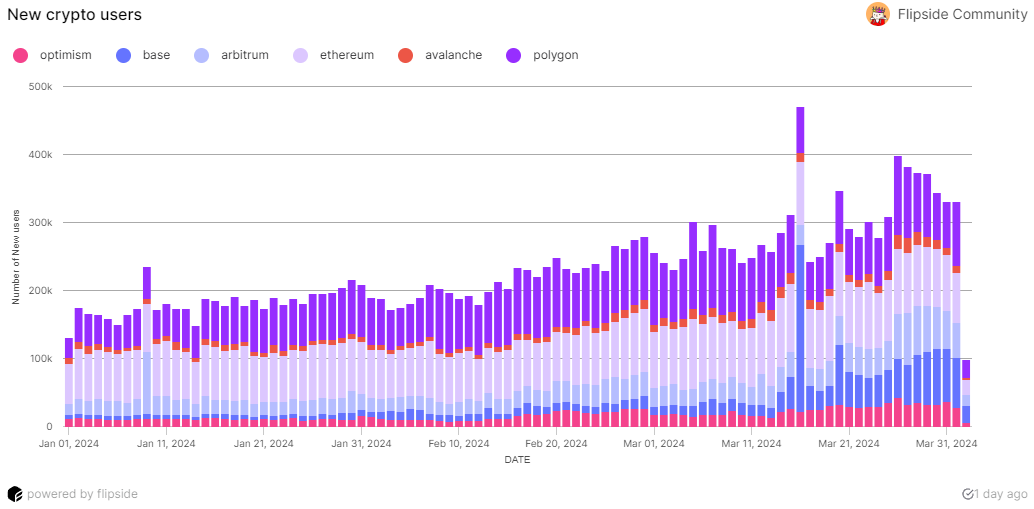

Ethereum and Polygon continue to outpace newer Ethereum Virtual Machine (EVM) chains in attracting new users and trading volume, Flipside’s “New EVM Users: Q1 Snapshot” report shows. As of March 27, Ethereum has garnered 13.4 million new users, while Polygon has attracted 12.3 million, accounting for approximately 70% of the new user base across all EVM chains this year. In contrast, Arbitrum has seen 4.7 million new users since the start of 2024.

While Ethereum’s mainnet maintains its historical dominance, Layer-2 protocols are cumulatively processing more volume. Decentralized finance (DeFi) remains the primary draw for new users, with Ethereum leading in trading volume at $12 billion in Q1. Notably, Arbitrum’s new users have contributed a significant $9.5 billion in DeFi trading volume, indicating a strong engagement despite lower user acquisition numbers.

Base, benefiting from Coinbase’s efforts to simplify crypto for novices, has nearly octupled its new user base since January, with a record 243,000 new users on March 16. This surge coincides with Bitcoin’s new all-time high and marks the highest single-day new user count across EVM chains this year, the report points out.

The decentralized applications (dApps) ecosystem on Ethereum showcases diversity, with a large proportion of new users engaging with a variety of applications. However, Base exhibits the most evenly distributed dApp usage among new users, likely due to its nascent stage and lack of established market leaders.

Token swaps and bridging apps are the most common entry points for new users across EVM chains, with Uniswap and Orbiter Finance being the leading platforms on Ethereum and Base, respectively. Meanwhile, Optimism’s new user activity is notably concentrated on Worldcoin, reflecting sustained interest in the project.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

9 months ago

57

9 months ago

57