ARTICLE AD

Ethereum on-chain activity rises despite lagging returns

Ethereum’s (ETH) momentum might be set for a change, as on-chain fundamentals are strengthening, according to the “On-chain Insights” newsletter from on-chain analysis firm IntoTheBlock. The newsletter highlights the criticism towards ETH in recent months both within crypto over underperformance versus Bitcoin (BTC) and in the mainstream over speculation of it being deemed an unregistered security.

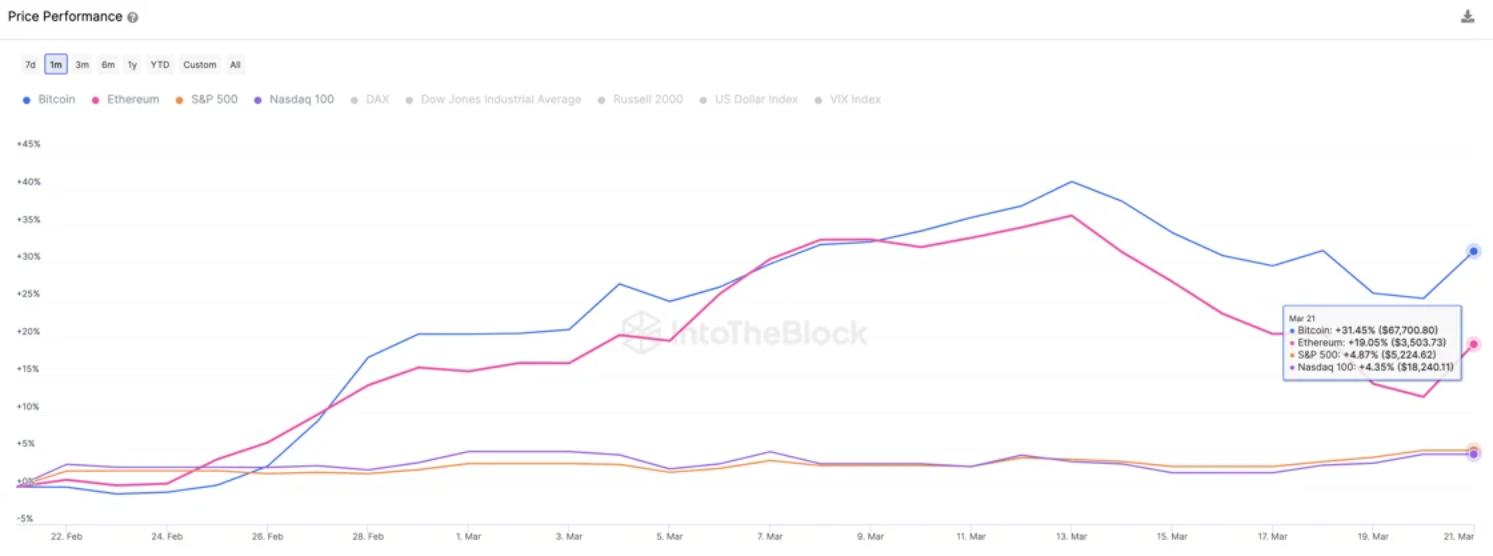

Lucas Outumuro, head of research at IntoTheBlock, says the underperformance is real. The ratio of ETH to BTC recently hit 0.05, near its lowest point since June 2022, and ETH has lagged both Bitcoin and the S&P 500 in risk-adjusted returns.

Price performance of BTC, ETH, S&P 500 and Nasdaq 100. Image: IntoTheBlock

Price performance of BTC, ETH, S&P 500 and Nasdaq 100. Image: IntoTheBlockYet Ethereum’s daily average transfer volume on mainnet reached its highest level since May 2022 this week. Moreover, layer-2 (L2) activity has boomed, with over 10 million ETH now deposited and transactions more than double mainnet’s.

Outumuro assesses that the lower fees post-Dencun should drive further L2 growth and that the bettering of the fundamentals didn’t go unnoticed by long-term ETH investors.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

9 months ago

54

9 months ago

54