ARTICLE AD

Ethereum’s fee revenue is significantly impacted by the rise of layer 2 solutions like Uniswap’s Unichain and updates such as EIP4844.

Key Notes

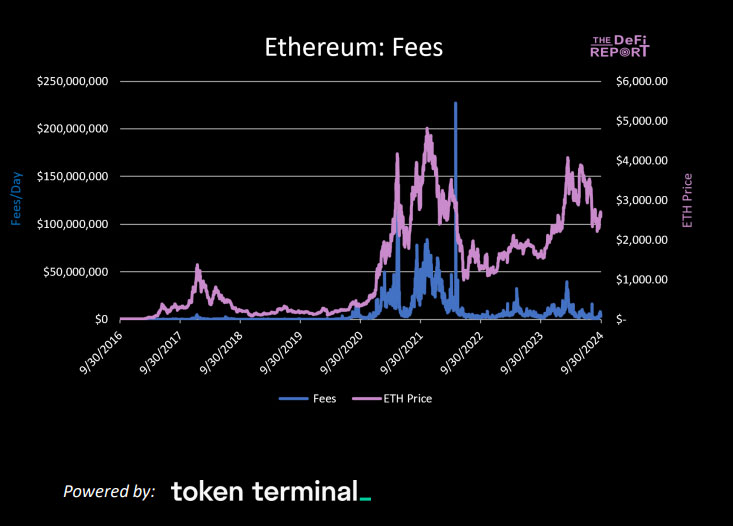

Ethereum network fees fell 47% in Q3 2024, earning $261 million, the lowest since 2020.Layer 2 networks, including Uniswap's Unichain, contributed to Ethereum’s fee decline and competitive challenges.Ethereum could lose $368M in fees to Uniswap, further pressuring ETH burning and token value.Ethereum ETH $2 605 24h volatility: 1.4% Market cap: $313.68 B Vol. 24h: $14.36 B experienced a sharp decline in the third quarter of 2024, earning $261 million in network fees. This represents a 47% drop from the previous quarter, the lowest since late 2020. The decline has triggered debates over what is driving Ethereum’s struggles.

Photo: The DeFi Report

A recent DeFi report “The ETH Report: Q3-24” published on October 16, points to the rapid rise of layer 2 networks as a key reason for the drop in fees. The adoption of Ethereum Improvement Proposal 4844 and fewer new cryptocurrency users during the quarter have also contributed. These factors have created a difficult situation for Ethereum’s main network.

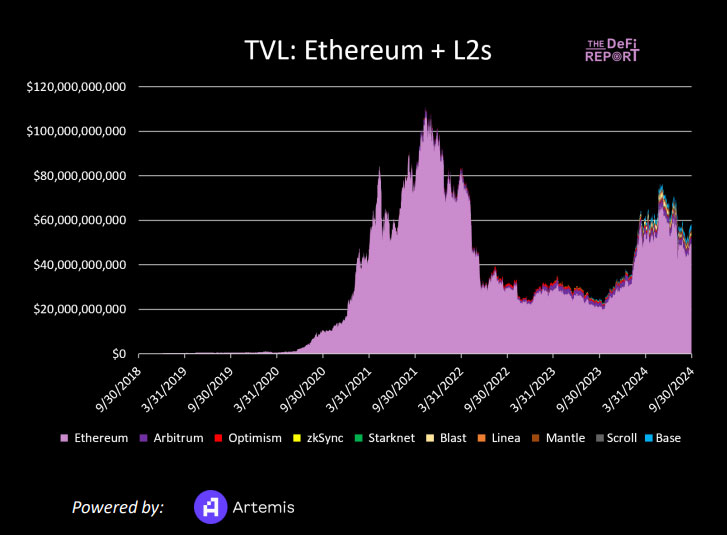

Besides lower fees, the report shows Ethereum’s Total Value Locked (TVL) fell by 14% this quarter. Yet, TVL has grown 133% over the past year, showing long-term progress despite short-term declines. Meanwhile, the ETH coin dropped 21% this quarter, partly due to more tokens being issued than burned, putting further pressure on its price.

Photo: The DeFi Report

Ethereum Fee Decline Linked to Multiple Factors

The DeFi Report attributes Ethereum’s fee decline to several factors. The EIP4844 update focuses on improving scalability and lowering costs, but it shifts some of the transaction load to layer 2 solutions. Furthermore, the rise of modular data availability networks, such as Celestia, along with cheaper alternatives, has also drawn activity away from Ethereum’s mainnet.

Uniswap Labs’ recent introduction of its layer 2 solution, Unichain, poses another challenge to Ethereum’s fee revenue. Controlling 20% of gas fees directed to Ethereum validators, Uniswap’s move to develop its own layer 2 could cause significant financial losses for the network. With fees falling, inflation rising, and Uniswap moving to layer 2, Ethereum’s ecosystem faces potential disruption.

Michael Nadeau, founder of the DeFi Report, believes Ethereum validators can address these hurdles. By boosting transactions and burning more tokens through reduced fees, they can drive token demand and improve profitability for the network. He sees this as beneficial for app developers, users, and ETH validators.

However, he warns that as layer 2 solutions expand, validator revenues might decline temporarily until new use cases emerge to fill the additional block space.

Ethereum Faces Potential $368M Loss to Uniswap

Earlier this week, Nadeau warned on X that Ethereum validators and token holders might lose around $368 million in settlement fees due to Uniswap launching Unichain. Instead of flowing to Ethereum, these funds could shift to Uniswap Labs and UNI token holders. As a result, ETH burning might decrease, and the redistribution could negatively affect ETH holders, undermining Ethereum’s value.

. @Uniswap generated nearly $1.3b of trading and settlement fees across 5 primary chains over the last year.

The protocol and token holders captured $0 of that value.

[100% went to Liquidity Providers, Ethereum Validators, MEV bots, and the L2 sequencers]

But with the launch… pic.twitter.com/vgpn7xjFky

This drop in fees, coupled with Uniswap’s strategic decisions, highlights shifts in blockchain. Layer 2 solutions, while offering better scalability and lower costs, create competition for Ethereum’s mainnet. Adapting to these challenges will be key for Ethereum to retain its lead in decentralized finance (DeFi).

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Uniswap (UNI) News, Altcoin News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

1 month ago

10

1 month ago

10