ARTICLE AD

Ethereum has witnessed a drop towards the $2,350 level as on-chain data reveals the whales have been making large exchange inflows recently.

Ethereum Exchange Netflows Have Been Positive Recently

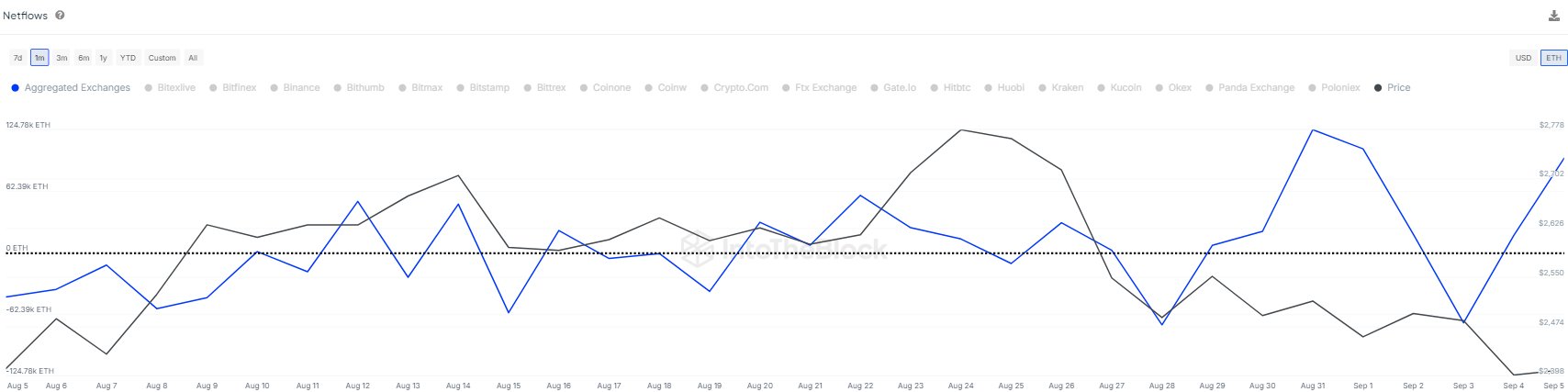

According to data from the market intelligence platform IntoTheBlock, the ETH Exchange Netflow has been positive recently. The “Exchange Netflow” here refers to an on-chain indicator that keeps track of the net amount of Ethereum that’s flowing into or out of the wallets connected to centralized exchanges.

When the value of this metric is positive, it means the investors are depositing a net number of tokens into these platforms. As one of the main reasons holders may transfer their coins to the exchanges is for selling-related purposes, this trend can be bearish for the asset’s price.

On the other hand, the negative indicator implies that a net amount of BTC is being transferred from exchange-related addresses. Such a trend implies the investors may be planning to hold into the long-term, which can naturally be bullish for the cryptocurrency.

Now, here is a chart that shows the trend in the Ethereum Exchange Netflow over the past month:

As displayed in the above graph, the Ethereum Exchange Netflow has observed a couple of spikes into the positive territory recently, suggesting some large net deposits into the exchanges have occurred.

The investors have transferred 312,183 ETH to these platforms during the past week, worth around $745 million at the current exchange rate. Given the massive scale involved here, it’s likely that whale entities were behind these inflows.

These humongous investors may have sold as the motive behind these large transactions. Something that could add credibility to this is that the Ethereum price has gone downhill in this period, now slipping under the $2,400 level.

Even before these latest deposits, the exchanges had received net inflows throughout the past month, although their scale was not quite as big. Thus, the Ethereum market has been under pressure for a while now.

The Exchange Netflow could be to keep an eye on in the coming days, as any further inflow spikes could suggest more bearish price action for Ethereum, considering the trend that has followed recently.

ETH Price

Much like Bitcoin and other assets, Ethereum has been going through a bad time recently, with its price gradually heading in a bearish trajectory. After registering another decline of more than 6% over the past week, ETH has dropped to around $2,350.

The chart below shows what cryptocurrency’s performance has looked like over the last few months.

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com

2 months ago

26

2 months ago

26