ARTICLE AD

Ki Young Ju, the founder of CryptoQuant, a crypto analytics platform, predicts a severe Bitcoin “sell-side liquidity crisis” in the next six months. In this event, the founder thinks that not only will prices erupt to new levels, surpassing expectations, but the crisis will likely lead to a market disruption.

Bitcoin Records New All-Time Highs

Bitcoin is trading at around new all-time highs following sharp price gains on March 11. The coin roared to print new all-time highs of $72,800 before cooling off to spot levels.

Even though the upside momentum has waned as prices move horizontally when writing, the uptrend remains. Accordingly, more traders expect BTC to ease above yesterday’s highs as bulls target seven digits at $100,000. If bulls break above this psychological number, technical and fundamental analysts say it will be a crucial inflection point for Bitcoin.

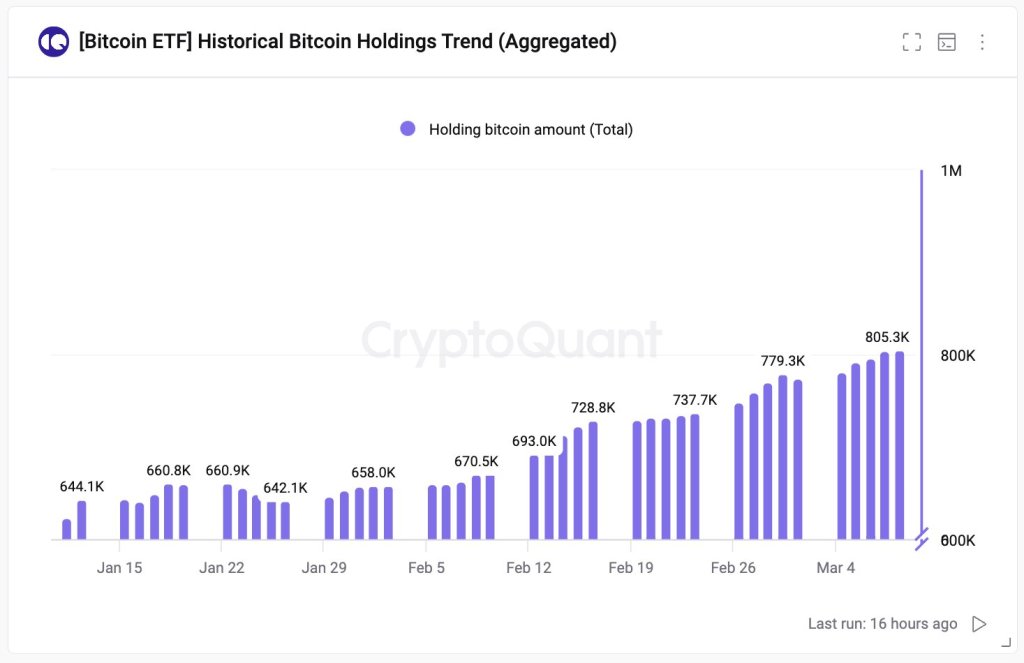

The founder expects Bitcoin prices to explode in the next six months primarily because of two factors. The first, Ju notes, is the massive influx of demand from institutions via spot Bitcoin exchange-traded funds (ETFs). So far, analysts have linked the current upswing in Bitcoin to institutional demand.

BTC held by entities | Source: Ki Young Ju on X

BTC held by entities | Source: Ki Young Ju on X

Last week, Ju observed a net inflow of over 30,000 BTC. This means that institutions are taking away more coins from circulation at an unprecedented level, contributing to scarcity. Institutions and wealthy individuals can gain exposure to BTC through spot ETFs without necessarily owning it directly.

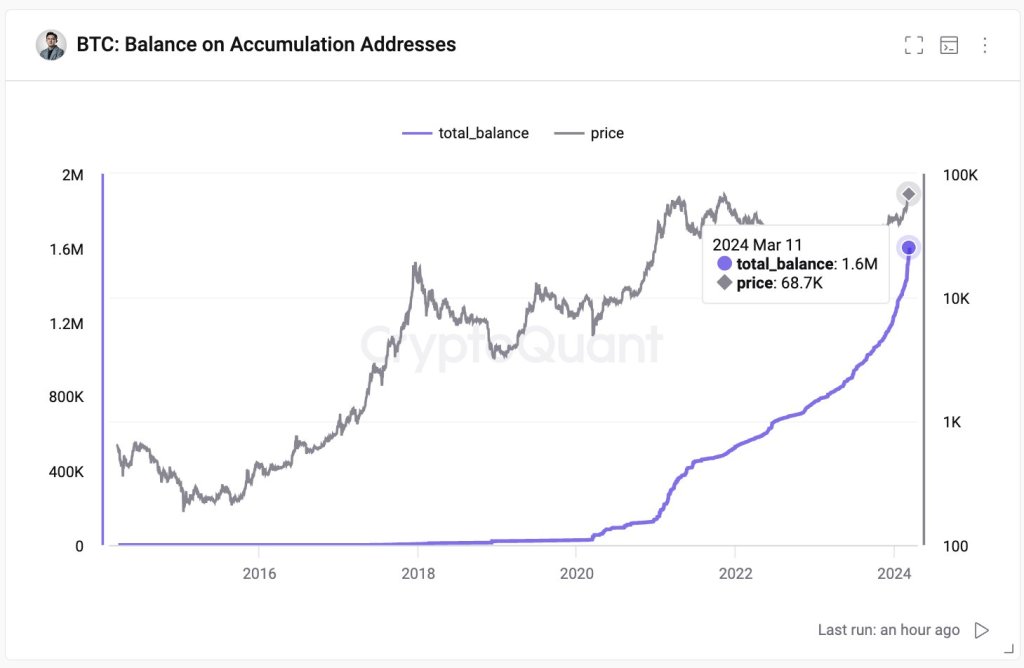

Beyond this, the concern lies in the limited number of coins held across centralized exchanges and known entities, especially miners. The founder estimates that exchanges and miners own roughly 3 million BTC. Ju explains in the post that entities in the United States hold 1.5 million BTC.

BTC accumulation addresses | Source: Kin Young Ju on X

BTC accumulation addresses | Source: Kin Young Ju on X

BTC Scarcity Crisis Expected

The founder notes that rising demand from spot ETFs and a constrained supply will create a “sell-side liquidity crisis” within six months. This scenario could lead to a situation where there aren’t enough sellers to meet the high buyer demand, further lifting prices to fresh levels.

The Bitcoin network will slash miner rewards by half in April from the current 6.125 BTC. Because of this, BTC’s emissions will drop, meaning only small amounts of coins will be released into circulation, further worsening the situation.

As such, if the current level of demand remains and institutions continue to double down, the expected scarcity crisis may likely cause a major disruption in the market, benefiting coin holders.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

8 months ago

50

8 months ago

50