ARTICLE AD

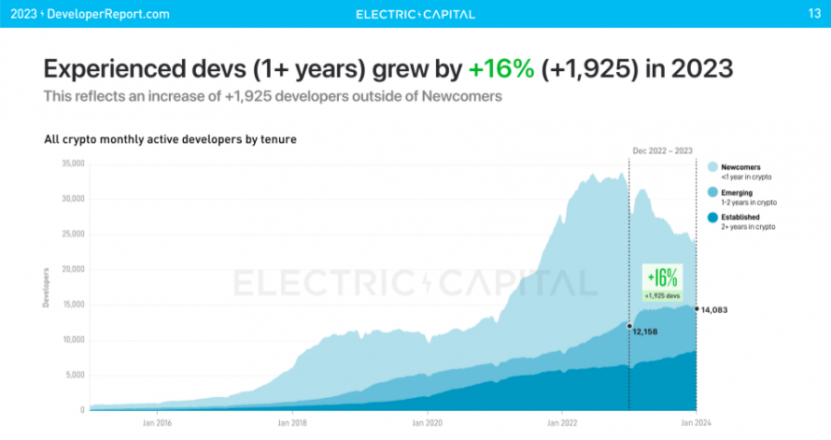

Almost 2,000 developers (devs) completed more than one year deploying blockchain smart contracts in 2023, with a yearly growth of 16%, according to the ‘2023 Crypto Developer Report’ published by Electric Capital on Jan. 17. The report highlights this group of developers as ‘experienced’, which is responsible for 75% of all the code created within the Web3.

This number eases last year’s 24% fall in monthly active devs, a drop representing 7,200 individuals in absolute numbers. Moreover, the number of ‘established’ devs, who have been developing blockchain-focused applications for more than two years, rose 52% per year from 2019 to 2023.

Image: Electric Capital

Image: Electric CapitalDevs drive crypto’s growth

When it comes to crypto’s expansion, what may come to mind are metrics tied to the market, such as stablecoins’ market cap, decentralized finance’s total value locked (TVL), and trading volume. However, developers are a fundamental part of this ecosystem’s growth, says Guilherme Neves, co-founder of the Brazilian ‘squad-as-a-service’ firm Blockful.

Neves says that blockchain and its ecosystem are still considered an innovative industry within the fintech sector. Yet, this industry is still in its early stages when compared to Java or Cobol.

“Only when we have clear standards, comprehensive and well-executed rules, it will be possible to access no-code tools capable of onboarding a great share of the ‘Web2 market’. That’s why developers from this vanguard industry are considered extremely valuable […] In a world where code optimization and scalability are like gold, developers become the best kind of miners,” assesses Neves.

Why do newcomers leave?

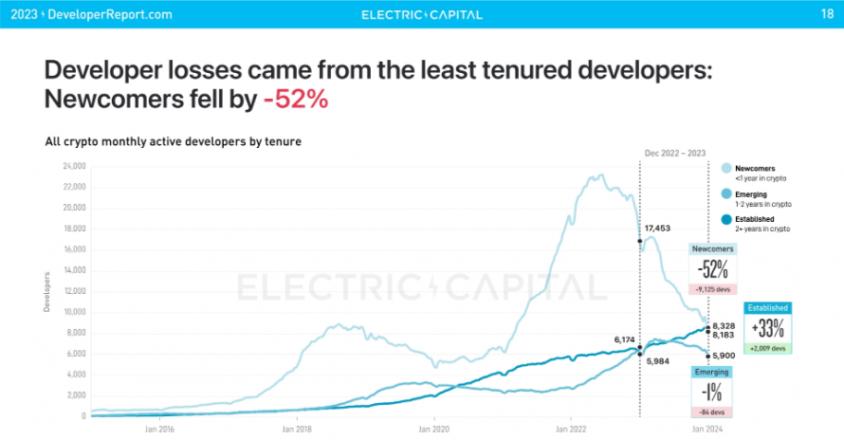

Electric Capital’s report shows that the blockchain industry tends to receive significant developer inflows when crypto assets’ prices are rising. More than 150,000 devs joined crypto between 2021 and 2022. That’s probably the reason behind the 52% shrink in the number of newcomer developers in 2023, which are developers with less than a year in the blockchain industry.

From a developer’s perspective, the pullbacks on crypto assets’ market caps and protocols collapsing might scare newcomers, weighs in Alex Netto, Blockful’s CEO. He says that those newcomers get side-tracked by crypto’s wild swings, and this disturbs their understanding process, ending up in a failing attempt to connect with blockchain’s vision and true impact.

Image: Electric Capital

Image: Electric Capital“Another factor is tied to the companies that survive bear markets, which prioritize high-standards delivery instead of investing in people. This reduces the number of available entry-level jobs. Blockchain is attracting a lot of PhD-level and genius developers with its disruptiveness, and this could take us to human relations with more trust, transparency, and freedom”, adds Netto.

Preparing for a massive influx of blockchain devs

If analysts’ expectations turn out to be concrete, a new bull run could start after the next Bitcoin halving, which happens in April this year. Considering Electric Capital’s data, the blockchain industry could see another significant inflow of developers.

Apart from the interest related to the rising prices during a bull run, Neves explains that the renewed inflow of developers could be tied to a movement within the companies.

“Newcomer devs are usually consumed by content and narratives of changing a technological paradigm, while more seasoned devs migrate to more complex technologies and better pay, opening job roles to new developers,” says Neves.

What does it take to be a blockchain developer?

Empathy and management capacity are two of the most important skills for developers wanting to navigate the blockchain industry, says Franco Aguzzi, full-stack developer and co-founder of Blockful. Paired with technical knowledge, those are the skills developers should have to succeed in this sector, as it is in the traditional technology market.

“What differentiates a Web2 dev from a Web3 dev are the ‘stacks’ [Web3 native programming languages] and the capacity of working with them, since a good part of Web3 projects don’t have the same structure as established Web2 initiatives,” concludes Aguzzi.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

86

1 year ago

86