ARTICLE AD

Stakeholders in the financial technology and banking sectors have called for increased collaboration to ensure the availability and accessibility of financial services, especially in underserved areas.

The call was made at the recently organised Nigeria Fintech Forum held in Lagos.

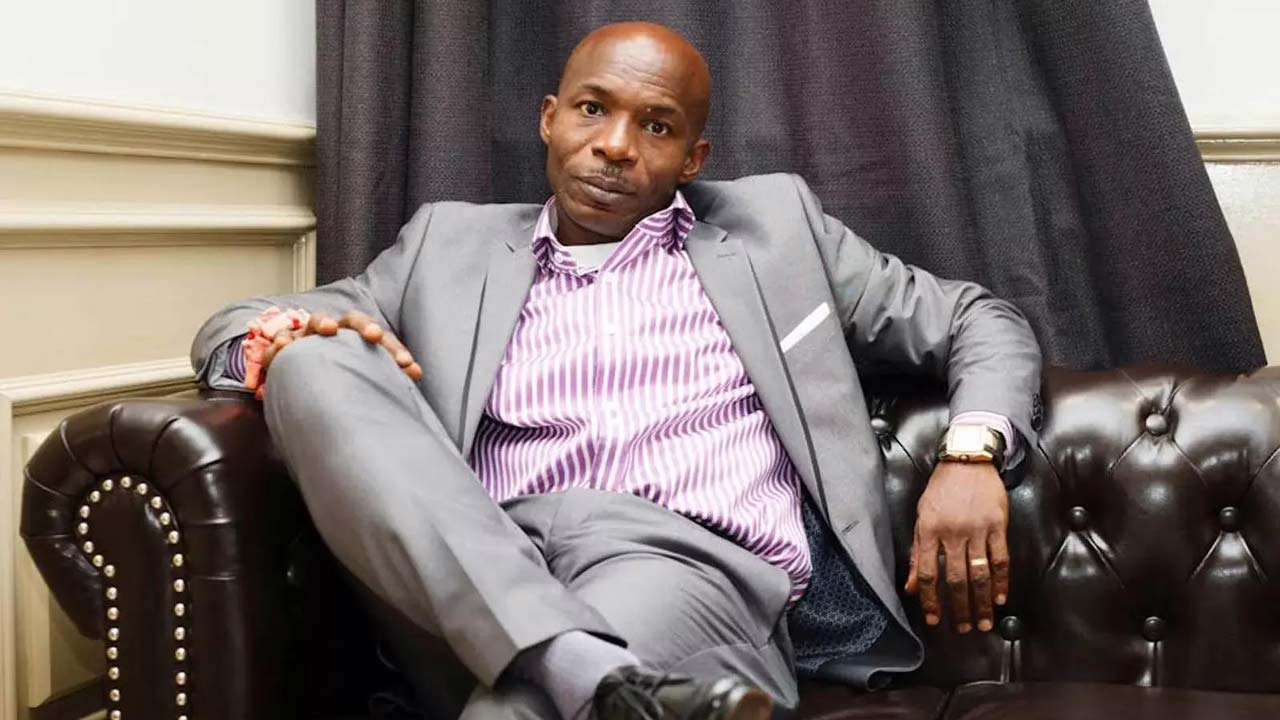

The organiser of the event and the CEO of Eventhive.ng, Jamiu Ijaodola, remarked that the forum convened stakeholders and digital financial experts in Nigeria’s payment industry to deliberate on issues and opportunities shaping the future of the industry.

The Head of Retail Banking at 9 Payment Service Bank, Oladimeji Saka, told Sunday PUNCH that driving digital and financial inclusion was not a solo effort but required collaboration and partnerships.

Nigerian fintechs and traditional banks are increasingly competing, particularly in digital lending.

Traditional banks are launching standalone digital lending apps to attract customers with lower interest rates, challenging established fintechs.

Saka said fintechs could help bridge this gap, as banks cannot do it alone due to the resources required to set up branches in many areas.

“However, with fintechs on board, we can serve these areas and provide innovative products that enable access for underserved populations,” he stated.

The 9PSB official expressed optimism about the potential for growth through partnerships, stating, “There will be growth opportunities as we tap into new markets. Everyone benefits as long as we deliver value.”

All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express written permission from PUNCH.

Contact: [email protected]

1 month ago

4

1 month ago

4