ARTICLE AD

Crypto security startup Fireblocks has rolled out public access to its dApp Protection and Transactions Simulation tool to bolster on-chain safety when moving assets.

Following the introduction of spot Bitcoin (BTC) ETFs in U.S. markets and rising cryptocurrency prices leading into this year, decentralized finance has witnessed a fresh spate of institutional investment and detail adoption.

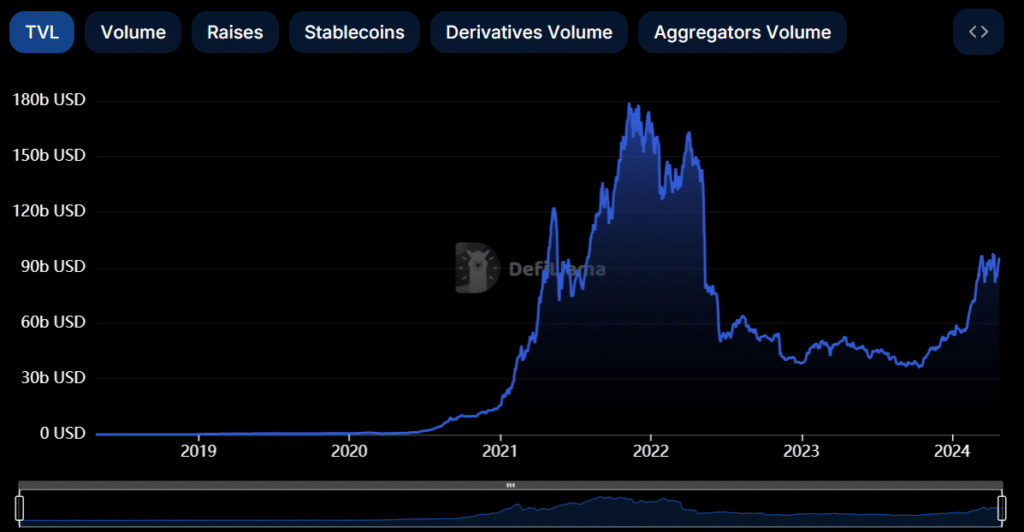

According to DefiLlama, used have stashed over $100 billion in decentralized protocols for the first time since May 2022, signaling an appetite for crypto solutions and on-chain participation.

Defi TVL around $100 billion | Source: DefiLlama

Defi TVL around $100 billion | Source: DefiLlama

Fireblocks has also noticed a 75% uptick in institutional defi volume on its platform, valued at nearly $4.5 billion month-over-month. While this represents positive sentiment for the overall crypto market, it also incentivizes bad actors and paints a target on the digital asset industry.

The crypto safety provider cited a CertiK study that points to over $500 million in stolen crypto wealth during this year’s opening months. A report shared with crypto.news argued that traders face obstacles when identifying potential risks due to complexities associated with defi transactions.

Fireblocks’ solution

To combat this issue, Fireblocks expanded a suite of on-chain security guardrails to protect users engaging in blockchain operations.

“A new proactive security approach for DeFi is required — one where traders and operations teams can automatically monitor malicious activity, identify high-risk threats across common attack vectors, and gain context into the impact of a contract call, all before approving a transaction or connecting with a dApp.”

Shahar Madar, Fireblocks’ VP for Security and Trust ProductsClients can access the dApp Protection and Transactions Simulation panel via Fireblocks’ browser extension, MetaMask Institutional, and WalletConnect. The aim is to give institutional customers real-time threat-detection tools capable of analyzing smart contract calls and initiating preventive measures.

A company spokesperson said the security firm already scanned transactions worth over $10 billion during its beta phase to finetune its systems geared against malicious contract interaction.

7 months ago

39

7 months ago

39