ARTICLE AD

Franklin Templeton, the global investment giant, has positioned Bitcoin Ordinals at the forefront of a burgeoning renaissance within the Bitcoin ecosystem.

The introduction of Ordinals, a system that allows for the creation of NFTs directly on the Bitcoin blockchain, has catalyzed a revival of activity, propelling Bitcoin to unprecedented levels of engagement and creativity.

Through a series of analyses and investor notes, Franklin Templeton has emphasized the pivotal role of Bitcoin Ordinals, alongside other innovations such as BRC-20 tokens, Runes, and Bitcoin Layer-2 networks, in revitalizing activity and fostering innovation across the Bitcoin network.

Unleashing the Potential of Bitcoin NFTs

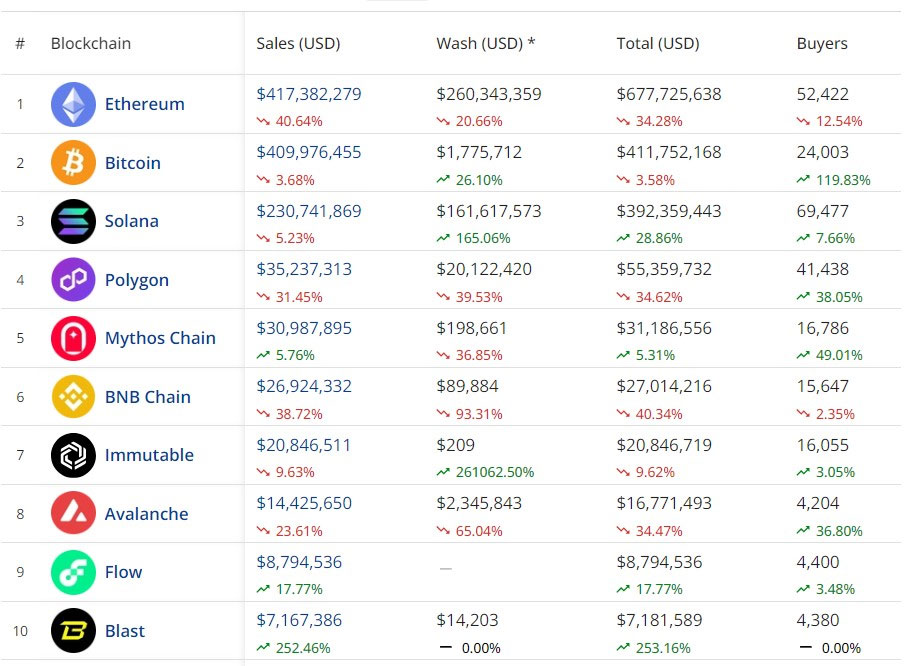

Photo: CryptoSlam

Bitcoin Ordinals have not only introduced a novel concept to the Bitcoin network but have also led to a dramatic increase in trading volumes and market capitalization within the NFT ecosystem. Esteemed collections such as NodeMonkes, Runestone, Bitcoin Puppets, Ordinal Maxi Biz, and Bitmap have begun to dominate the NFT space, signifying a shift in market dynamics and a newfound appreciation for Bitcoin’s potential beyond its traditional role as a digital currency.

A Catalyst for Broad-Based Innovation

The surge in activity around Bitcoin NFTs is part of a larger trend of innovation encompassing new fungible token standards like BRC-20 and Runes, as well as the development of Bitcoin-based layer-2 networks and DeFi primitives.

Last week, Z Yin, co-founder and Chief Operating Officer of Magic Eden, expressed enthusiasm for the Rune protocol, a new standard for fungible tokens set to be introduced by Casey Rodarmor during the Bitcoin halving later this month. Yin believes that this innovation will significantly energize the Bitcoin ecosystem. These advancements are contributing to a more vibrant, diverse, and innovative Bitcoin ecosystem, expanding the utility and appeal of Bitcoin beyond its foundational use cases.

Franklin Templeton’s Progressive Stance

The Rise of Bitcoin Ordinals pic.twitter.com/nKLwwlMM4d

— Franklin Templeton Digital Assets (@FTI_DA) April 3, 2024

Franklin Templeton’s proactive approach to digital assets, exemplified by its early adoption of a Bitcoin ETF and exploration of an Ethereum ETF, underlines its commitment to embracing and shaping the future of finance. The firm’s recognition of Bitcoin Ordinals and its contributions to the Bitcoin ecosystem highlights a broader trend of traditional financial institutions exploring and investing in the possibilities presented by blockchain technology and digital assets.

The Value Between Meme Coins and Their Native Networks pic.twitter.com/LYjQ5HvXHp

— Franklin Templeton Digital Assets (@FTI_DA) March 13, 2024

Franklin Templeton has been expanding its investors’ exposure to various segments of the cryptocurrency market. On March 14, the company fully embraced the speculative aspect of the crypto world by releasing an investor note focused on memecoins. On this note, the company acknowledged the rapid profit-making potential of memecoins while also pointing out their lack of intrinsic value.

Acknowledging the Risks and the Road Ahead

While Franklin Templeton’s outlook on Bitcoin Ordinals and related innovations is overwhelmingly positive, the firm also cautions investors about the inherent risks associated with digital assets. The volatility, uncertain regulatory landscape, and technological challenges pose significant risks that investors must consider. However, the firm’s engagement and investment in the infrastructure supporting Bitcoin Ordinals and other digital assets innovations reflect a belief in the long-term potential of these technologies.

7 months ago

44

7 months ago

44