ARTICLE AD

The rally aligned with unfounded rumors that FTX would begin reimbursing its defrauded creditors by September 30.

Key Notes

FTX Token (FTT) surged 60% despite overall market decline, surprising traders given FTX's 2022 bankruptcy due to fraud.Rumors of creditor reimbursement by September 30 fueled the rally, but court hearing actually scheduled for October 2024.Skepticism remains high as FTX faces legal challenges and creditors express dissatisfaction with proposed 10-25% compensation of losses.FTX Token (FTT) jumped by 60% on Sunday, making it one of the most significant moves in the cryptocurrency market lately, according to CoinMarketCap. Meanwhile, the overall market faced a 1.80% drop in total value. Such a sharp increase in FTT’s value surprised traders, given the FTX exchange‘s bankruptcy in late 2022 due to fraudulent practices.

FTT’s trading volume skyrocketed by more than 3700%, a remarkable change, especially since the token has had no practical use since FTX’s collapse. This sudden increase in activity raised concerns, as investors still recall the token’s 90% crash after FTX’s downfall.

Creditors Displeased with Compensation

The rally aligned with unfounded rumors that FTX would begin reimbursing its defrauded creditors by September 30. However, Sunil Kavuri, an FTX creditor activist, confirmed that the court hearing on the restructuring plan would not occur until October 7, 2024. Despite the debunking of these rumors, confidence in eventual compensation persisted as announcements were made to distribute $16 billion to creditors by the end of 2024.

FTX Distribution

False: Large accts. spreading false info, FTX distribution has started and/or start on 1st Oct etc and $16bn inflow

7th October: Plan hearing

Approx No.

Est. $5.5bn claims bought (50%) – not crypto investors – won't reinvest in crypto

Claims <$50k:…

Amid the optimism, Sunil Kavuri voiced dissatisfaction with the settlement terms, which promise only 10% to 25% of the original losses. The unexpected rise in FTT’s value ignited discussions within the crypto community. A crypto analyst predicted that FTT’s price could range from $10 to $30, contingent upon a successful restructuring plan and subsequent venture capital infusions.

FTX is transferring 18% of DOJ forfeiture funds up to $230m to FTX equity holders (Plan supplement)

FTX crypto holders are getting 10% to 25% of their crypto back pic.twitter.com/3f6BePpoNU

Despite these discussions, skepticism remains high. FTX continues to face legal challenges, and the repercussions of its restructuring on FTT’s future value remain unclear. Creditors have publicly expressed their displeasure with the compensation plan, which they argue does not adequately reflect their substantial losses.

What’s Next for FTX?

As FTX inches toward a resolution of its bankruptcy proceedings, all eyes are on how the token’s value will respond to future developments. While FTT’s 60% rally provided a rare moment of optimism, the road ahead remains fraught with challenges. A successful restructuring could stabilize FTT, but until more solid outcomes emerge, the FTX market remains speculative.

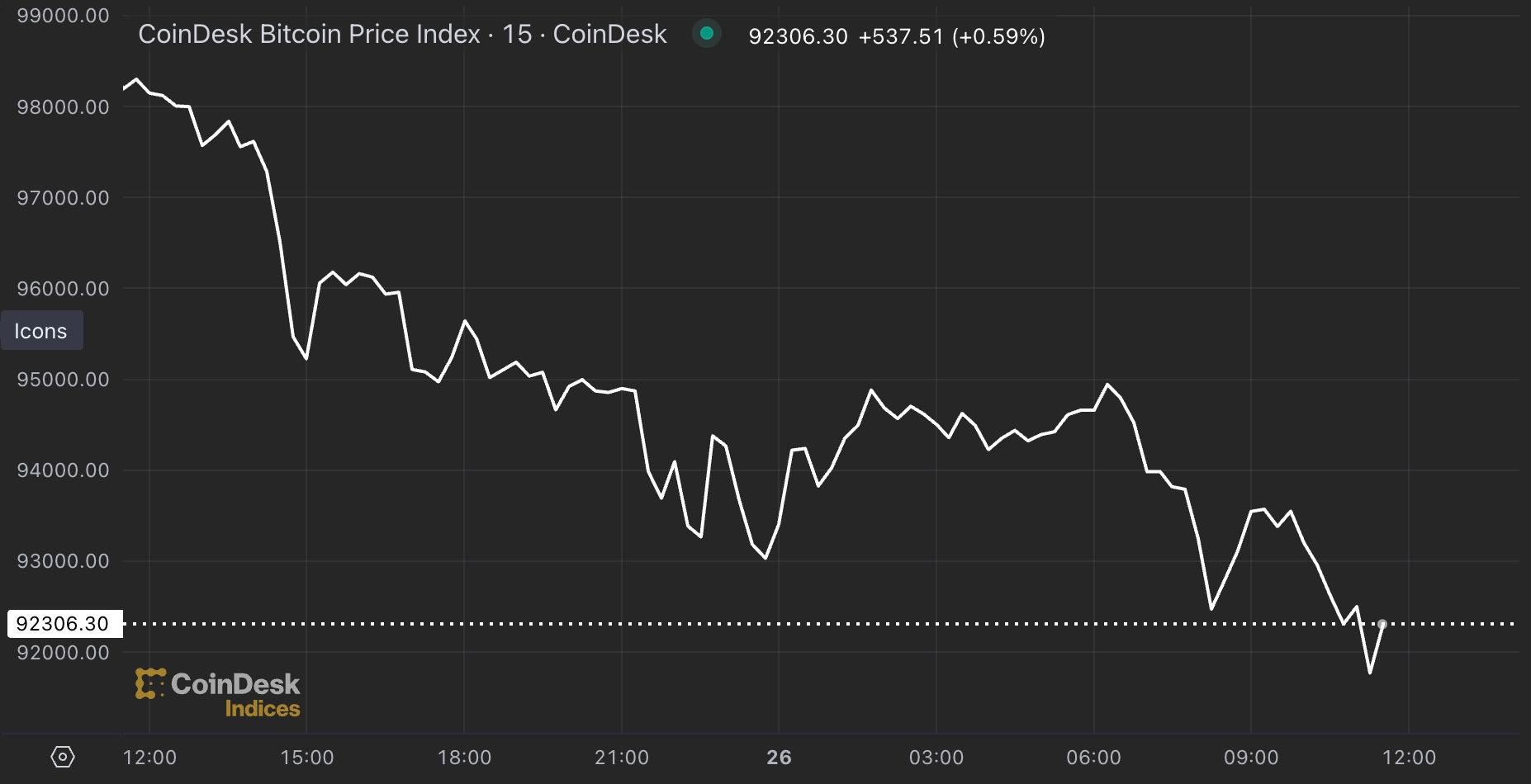

With Bitcoin currently trading near $64,140, gaining 2.20% in the last 24 hours but up slightly over the past week, the broader market remains relatively steady amid the FTX turbulence. Whether FTT can sustain its upward momentum or whether this was a short-lived burst remains to be seen.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

FTX (FTT) News, Altcoin News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

1 month ago

15

1 month ago

15