ARTICLE AD

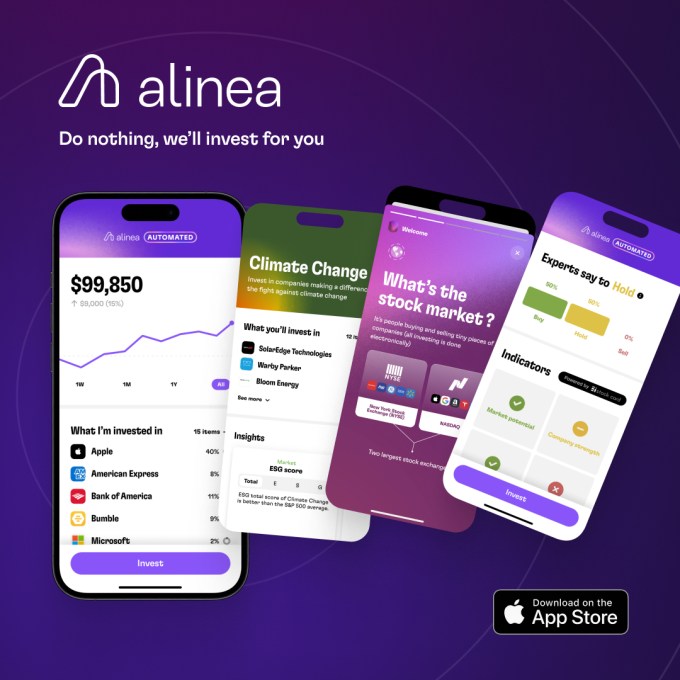

Alinea Invest, a fintech app offering AI-powered wealth management aimed at Gen Z women, has $3.4 million in seed funding ahead of the launch of a virtual AI assistant that will help users with their investing needs. The fundraising comes on the heels of 225,000 downloads of Alinea’s app, leading to a revenue run-rate of $1.8 million, allowing the New York area startup’s six-person team to operate profitably.

Founded amid the Covid-19 pandemic, Alinea was created by co-founders Anam Lakhani and Eve Halimi, as well as CTO Daniel Nissenbaum who met at Barnard College and Columbia University. Lakhani and Halimi, now co-CEOs, had interned on Wall Street but faced a similar pain point when it came to money: they didn’t know how to best invest. This idea led to the creation of a business plan for an app while taking an entrepreneurship class at school. Later, the founders headed into full-time jobs in investment banking and at a growth stage startup when Covid hit.

The pandemic ultimately freed up more time for the team to work on their app, so they applied to startup accelerator Y Combinator in 2021 and got in.

“The pain point we saw is that people like us who are young women, Gen Zs, children of immigrants, they have no idea where to start. Financial literacy is a massive pain point across the United States,” notes Lakhani. “We wanted to build an alternate platform that was really personalized, taught you how to build your wealth, and did it for you.”

Alinea Hallima Eve in orange and Lakhani Anam/credit: Alinea Invest

The app, which is described as a “Wealthfront meets Robinhood,” is built with a Gen Z audience in mind. That includes a heavy focus on an approachable design to make investing seem less intimidating. The goal is to attract users as they’re just leaving college and entering the workforce or getting their first paychecks, then helping them to automate their portfolio. This differentiates Alinea from other female-focused fintechs, like Ellevest.

Many users start with Alinea’s automated investing model, but later take advantage of the option to buy and sell stocks as they become more sophisticated investors.

However, unlike Robinhood and some others, Alinea operates on a subscription business model that costs a flat $120 per year.

Another differentiator for Alinea are its “playlists.” These let users build their own direct indexes — in a way that’s somewhat akin to curating music on Spotify. Today, Alinea investors have customized their own ETFs around themes like climate change, female leadership, AI, fashion, and even abortion rights. Daily, users create thousands of playlists, and these can also be shared with others.

Image Credits: Alinea Invest

The company so far has been successful at acquiring users through content marketing, particularly on TikTok, where the founders talk about investing and their startup journey. To date, their following has led to over 100 million views across their hashtags on the short video platform, the founders told TechCrunch.

With the seed round of $3.4 million, Alinea wants to move further into the AI market with the launch of an AI financial advisor. While the app is already leveraging a combination of AI and expert advisors to make stock recommendations, the new feature, due out later this year, will offer an interactive way to ask for investing help.

The AI helper will be tacked onto a new subscription.

“There will be an additional upscale tier, essentially, where it will be like a sort of AI copilot — an AI financial advisor that will answer all your questions…that are very personalized to you,” notes Halimi.

The AI will consider a variety of factors when answering questions, including the user’s age, risk tolerance, past track record, and more. The team expects to launch the feature around Q2 or Q3 this year, they said.

Though competition is rife in the fintech space, Alinea believes they can capture a particular demographic — the younger, Gen Z investor, and largely women. (80% of the app’s users are women). The average Alinea investor makes $80,000 per year and is around 22 to 24 years old.

The new funding was led by F7 Ventures and GFR and included Worklife Ventures (Bri Kimmel), FoundersX Fund, Gaingels, and Dropbox co-founder Arash Ferdowsi. Alinea had previously raised a $2.3 million pre-seed round from Goodwater, Kima Ventures, Harvard, Diaspora, and ex-Robinhood employees. The founders have not added to the board with the new capital, but rather plan to invest in further product development, including the AI copilot, personalization, and other educational initiatives.

“Financial literacy and investing is a crucial path to wealth and financial stability for women and Gen Z,” said Kelly Graziadei, F7 General Partner. “We are proud to invest in Eve & Anam as they build AI-powered investing with Alinea — making it easier and more accessible than ever for people to invest according to their interests and values. We can’t think of a better team to open up the path to a new generation of wealth creation,” she added.

1 year ago

83

1 year ago

83