ARTICLE AD

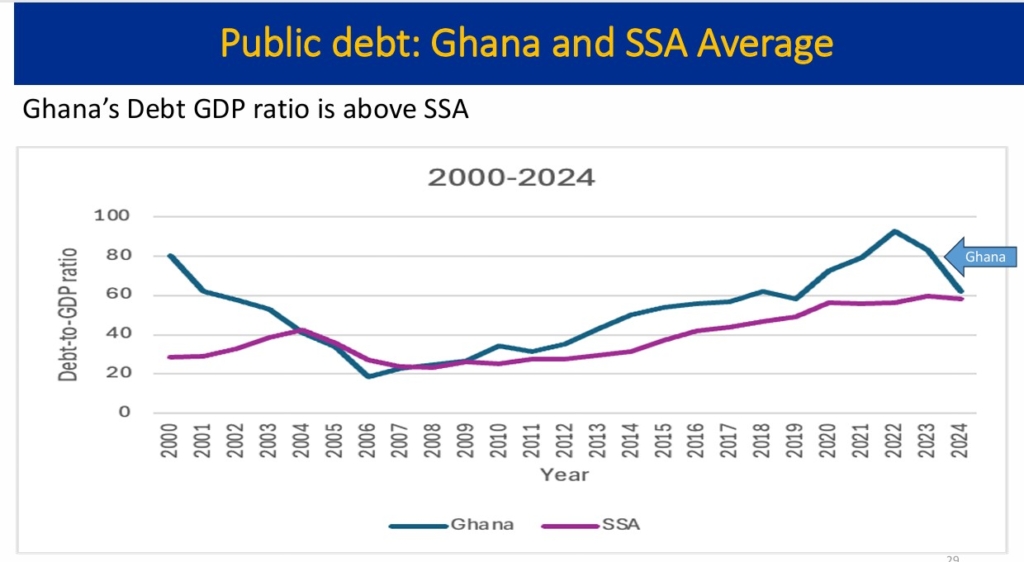

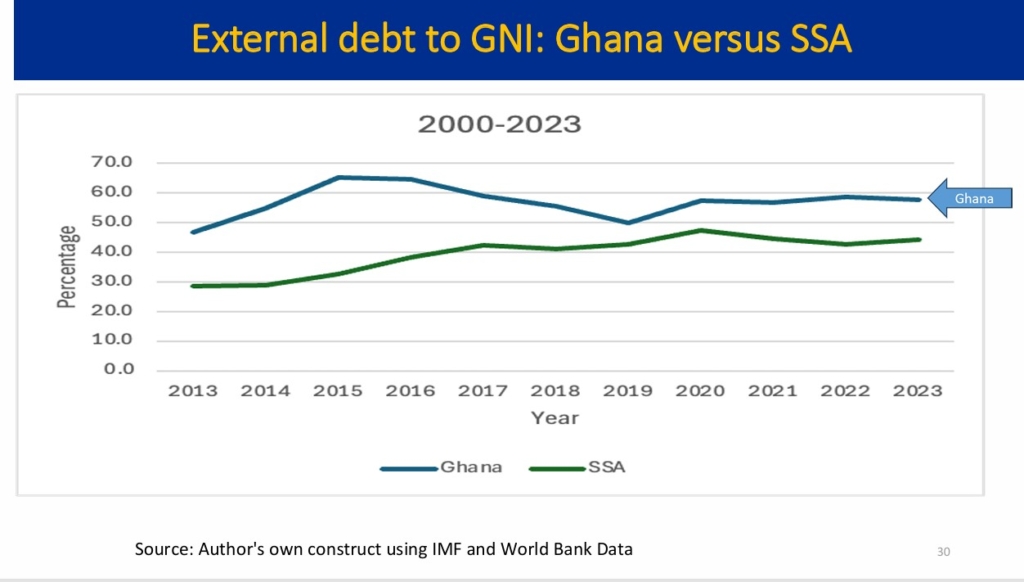

Ghana’s debt burden has risen significantly over the past decade, reaching 82.9% of GDP in 2023 before declining to 61.8% by the end of 2024.

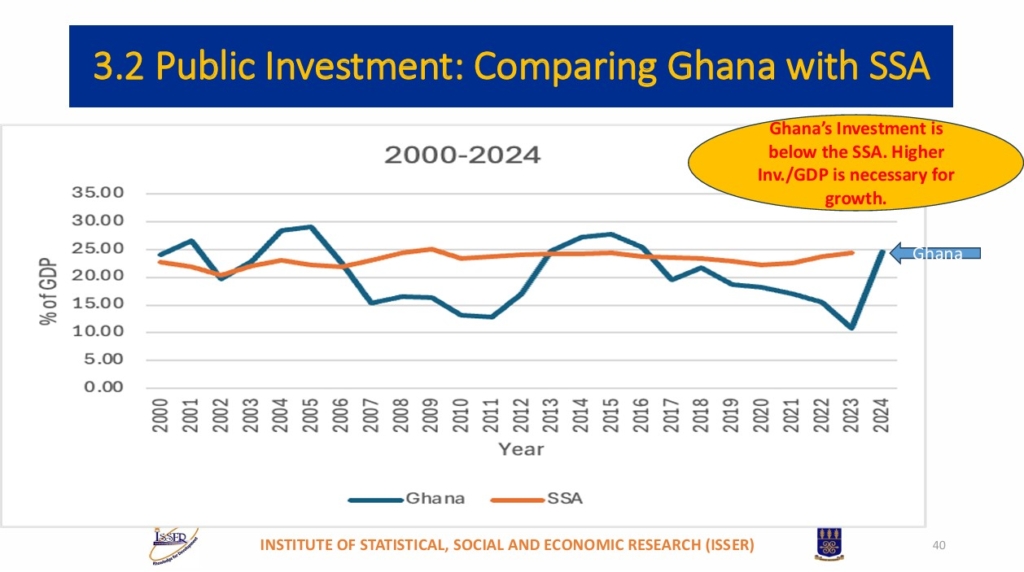

Despite this heavy borrowing, the country has not seen a proportional increase in investment, raising concerns about whether loans have been used productively or merely to finance recurrent expenditures.

At his Inaugural Lecture on March 13, 2025 at the Ghana Academy of Arts and Sciences, Professor Peter Quartey, Director of the Institute of Statistical, Social and Economic Research (ISSER), examined the link between debt, investment, and economic growth in Ghana.

He argued that while borrowing is a necessary tool for development, its effectiveness depends on strategic investment decisions.

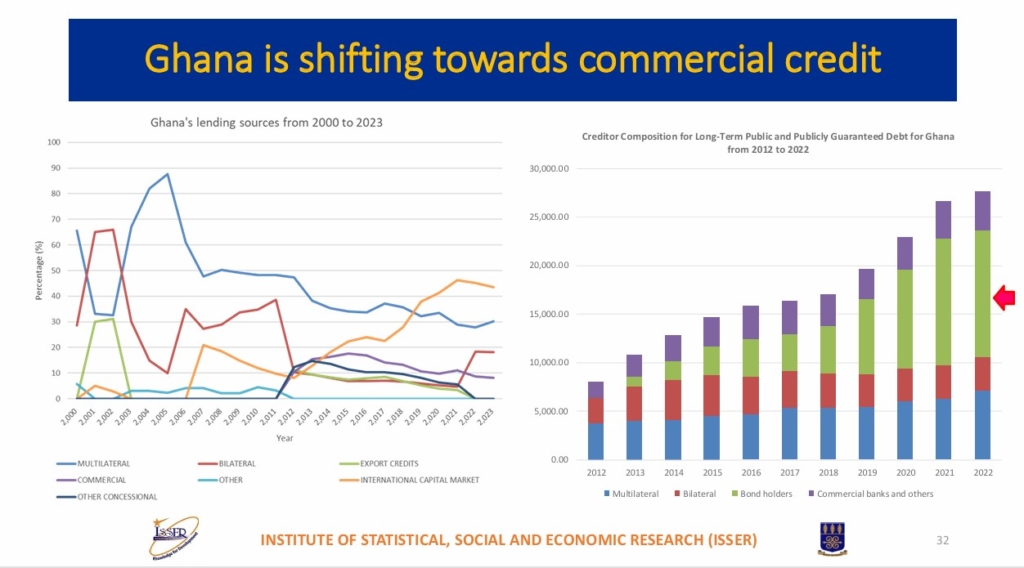

Over the years, Ghana has shifted from multilateral lending to high-interest bonds on the international capital markets.

This transition, according to Professor Quartey, has made debt servicing more expensive and constrained the country’s ability to invest in productive sectors.

Capital spending in Ghana has dwindled from 6.9% of GDP in 2010 to just 2.4% in 2023, indicating that much of the borrowed funds have not been directed toward infrastructure or other forms of investment for economic expansion.

Case studies he presented during the lecture highlighted the importance of investment efficiency. One example compared a financially reckless technology entrepreneur to Ronald Read, a frugal janitor-turned-investor who amassed millions through disciplined savings.

Professor Quartey used these examples to stress that financial success is not solely about acquiring resources but about managing them effectively.

He pointed out that in Ghana, several high-profile projects financed through loans, such as the Sinohydro and Afreximbank-funded initiatives, have faced significant delays.

He said the Pwalugu Multi-Purpose Dam project, expected to enhance electricity generation and irrigation, has yet to commence six years after funding was disbursed.

Such inefficiencies, he warned, undermined the potential benefits of debt-driven investments.

Professor Quartey recommended stronger fiscal discipline, a legislated debt ceiling of 60% of GDP, and enhanced domestic revenue mobilisation to reduce reliance on borrowing.

He also called for improved procurement practices to ensure better value for money and to curb wasteful spending.

With Ghana’s debt now exceeding GHȼ721 billion, he pointed out that it will be difficult to defend the position that the country has strategically invested for sustainable growth or that borrowing has indeed served as a catalyst for the nation’s development.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

1 day ago

14

1 day ago

14