ARTICLE AD

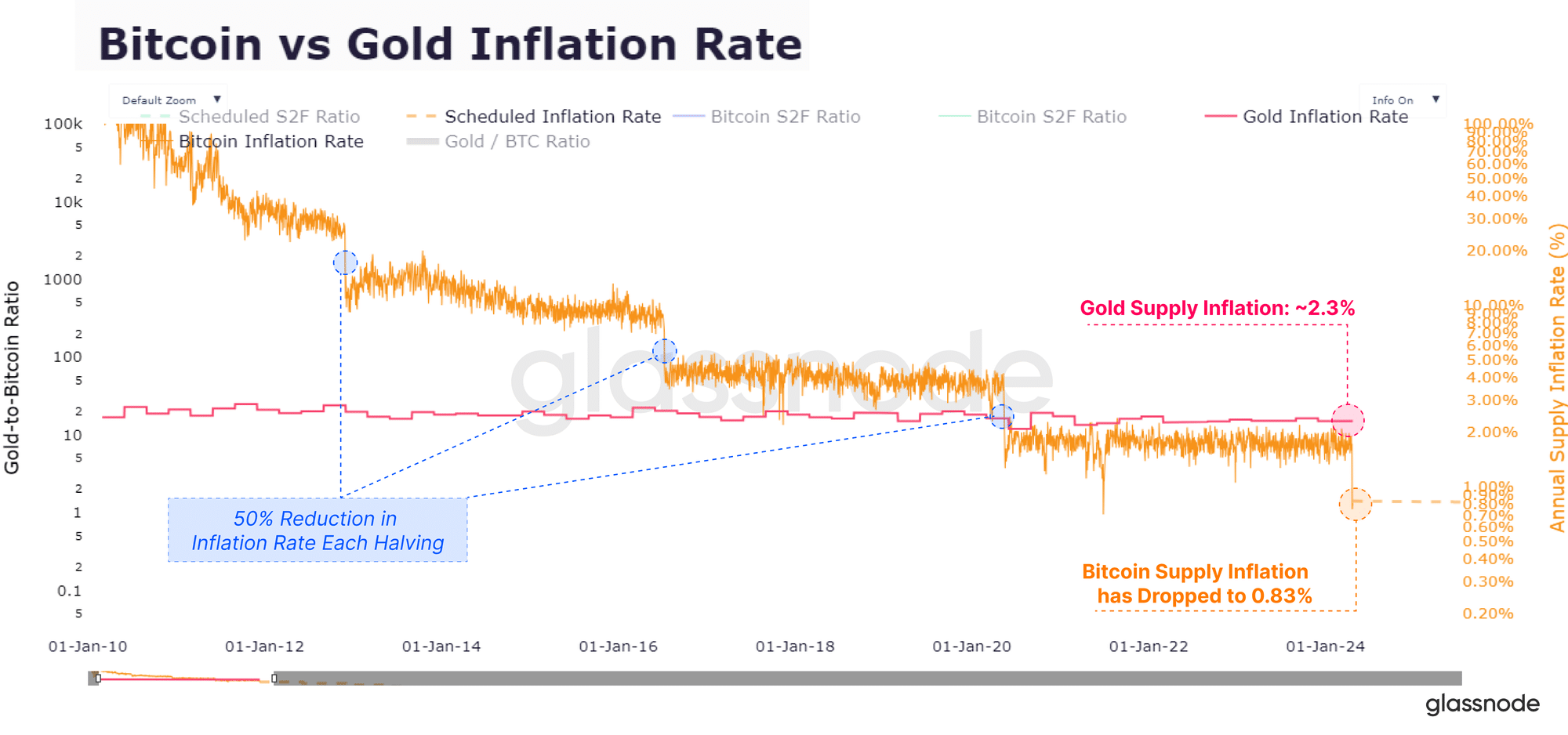

Bitcoin’s fourth halving event has drawn significant attention to its comparison with gold regarding scarcity, as highlighted by Glassnode analysts.

According to Glassnode, this event marked a historic moment where Bitcoin’s (BTC) issuance rate fell below that of gold for the first time, emphasizing a pivotal shift in the narrative surrounding the two assets.

As reported, the halving event on Saturday reduced block subsidies, with the issuance dropping from 6.25 BTC to 3.125 BTC per block. This translates to an issuance of approximately 450 bitcoin per day, further underlining the event’s impact on Bitcoin’s supply dynamics.

Yassine Elmandjra from ARK Investment Management echoed similar sentiments, noting that Bitcoin’s issuance rate post-halving is now lower than gold’s long-term supply growth.

Elmandjra’s analysis, as shared in the ARK Disrupt newsletter, emphasized the significant decrease in Bitcoin’s supply growth following the halving event, reinforcing its comparison with gold. Glassnode analysts further supported Elmandjra’s observation regarding the reduction in Bitcoin’s supply growth.

Bitcoin versus Gold issuance rate from Glassnode

Bitcoin versus Gold issuance rate from Glassnode

They suggested that while the halving events continue to affect Bitcoin’s available traded supply, the impact may diminish across cycles due to the asset’s expanding size and ecosystem.

Assessments such as these provide valuable insights into the evolving dynamics between Bitcoin and gold, shedding light on Bitcoin’s increasing scarcity compared to the traditional precious metal.

Today, Bitcoin’s price is down 2.5% and just plunged below $65,000 at the time of writing.

24-hour chart of BTC from TradingView

24-hour chart of BTC from TradingView

7 months ago

27

7 months ago

27