ARTICLE AD

Global crypto assets flows turned positive after two weeks of outflows. Solana’s weekly inflows improved as Ethereum recorded more outflows.

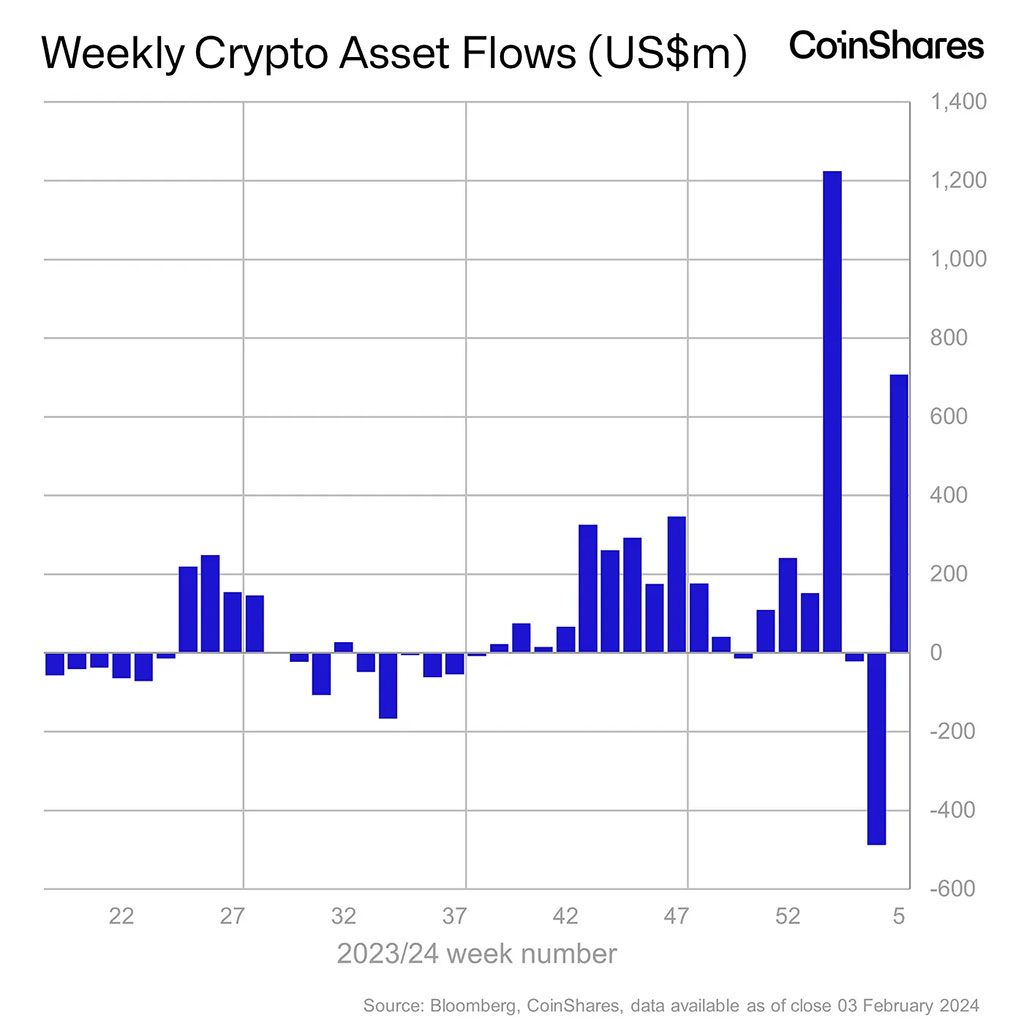

Global crypto assets posted $708 million in inflows last week, marking the first net positive inflows in the past three weeks, according to Coinshares’ weekly fund flow report.

The inflows saw the total assets under management increase to $53 billion. Since the introduction of US spot BTC ETFs, the total inflows from the ETFs hit $7.7 billion. Total outflows from other issuers shot to $6 billion, but the momentum has reduced significantly.

GBTC was responsible for most of the outflows, totaling $5.97 billion. But Coinshares analysts opined that the offloading has waned.

Photo: CoinShares

Spot BTC ETF Trading Volumes Tanked Last Week

Besides, the overall trading volumes for the new ETFs dropped to $8.2 billion last week compared to the preceding week’s $10.6 billion. Despite the drop, the previous week’s figure was a third of BTC trading volumes across trusted exchanges. Interestingly, the slow momentum didn’t deter BlackRock’s iShares Bitcoin Fund (IBIT) from outpacing GBTC’s on the daily trading volumes.

On the altcoins front, Solana led in inflows, eclipsing Ethereum and a clear signal of the chain’s recent positive traction. Solana saw $13 million in inflows last week. In contrast, Ethereum recorded $6.4 million in outflows, followed by Avalanche with $1.3 million.

It’s worth noting the outflows from Ethereum happened after the US Securities and Exchange Commission (SEC) delayed the decision on various spot ETH ETF applications.

Regional Dynamics in Crypto Weekly Funds Flows

On the regional front, the US was the most bullish on the crypto scene, recording $721 million in inflows. The new US BTC ETFs alone recorded $1.7 billion in inflows last week, Coinshares data showed.

Switzerland followed the US closely, recording $21 million in weekly inflows. Other bullish countries were Germany and Brazil. However, Canada recorded $31 million in outflows, followed by Sweden at $8.2 million.

On the price performance front, the key highlighted crypto on the report (BTC, ETH, and SOL) recorded a slight bounce on the weekly timeframe. For BTC, prices were up +3.3% on the 7-day change, according to Coinmarketcap. It was trading at $43.3k at press time.

Ethereum also demonstrated a similar weekly price performance to BTC. It bounced slightly, posting 3.5% gains based on the press time value of $2.3k.

On the other hand, SOL traded at $97.9 at the time of writing and translated to a 1.9% gain on the weekly chart, as per CoinmarketCap. It meant that despite Solana recording more inflows than Ethereum last week, the latter outperformed it slightly on the weekly price performance.

1 year ago

52

1 year ago

52