ARTICLE AD

The Acting Commissioner General of the Ghana Revenue Authority (GRA) has disclosed to Joybusiness that it will begin measures to eliminate the electronic levy and betting tax from the tax compliance scheme immediately the President gives the go ahead.

According to Anthony Kwasi Sarpong, the GRA is willing to abide by the laws as an implementing agency to remove the tax handles as passed by Parliament.

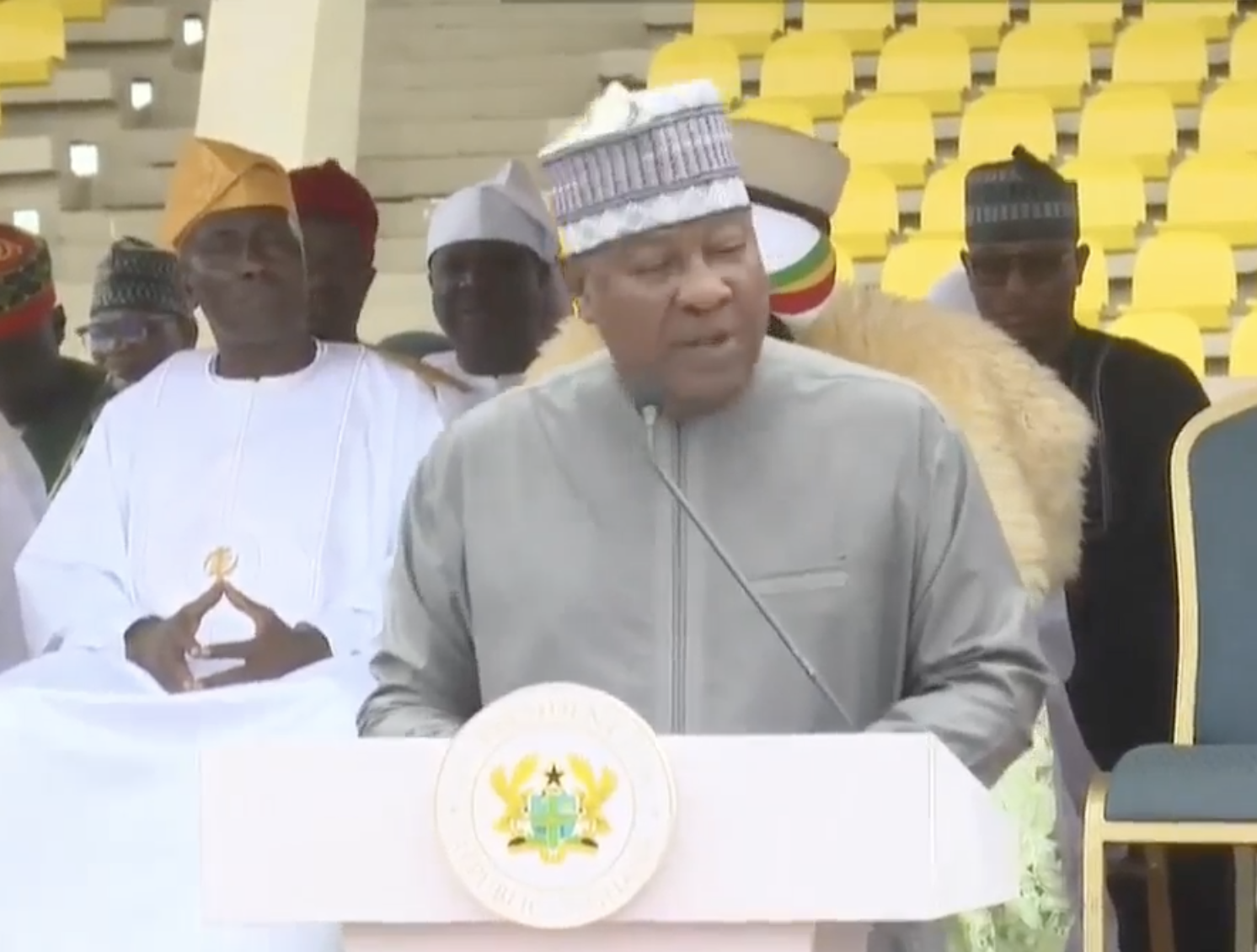

The Commissioner General was speaking to Joybusiness after introducing the new Commissioner of Customs, Brigadier General Glover Ashong Annan to officials of the Tema sector Command.

"We're implementing the institution and once the law has been passed, we're going to take it off and for the benefit of Ghanaians, our president has indicated that he will do it and through the Minister, he has done it.

"E-levy has been abolished, betting tax has been abolished and passed together with all other taxes presented by the Minister on behalf of the President in parliament.

"So we're going to work to ensure that these taxes that have been passed and abolished will be taken out immediately from our compliance scheme so that Ghanaians can enjoy their earnings," he told Joy Business.

At a short ceremony to welcome the new Commissioner of Customs, the Outgoing Commissioner, Brigadier General Ziblim Ayorongo, urged the officials to give maximum support to the Commissioner to deliver on the mandate given by the President.

The New Commissioner, Brigadier General Glover Ashong Annan, pledged to continue the good policies implemented by the Outgoing Commissioner to meet the revenue target.

The delegation also visited the Tema Oil Refinery Command at the Tema Industrial Area before departing back to Accra.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

3 days ago

2

3 days ago

2