ARTICLE AD

While the pace of outflows has slowed compared to earlier this year, the overall trend remains negative.

Key Takeaways

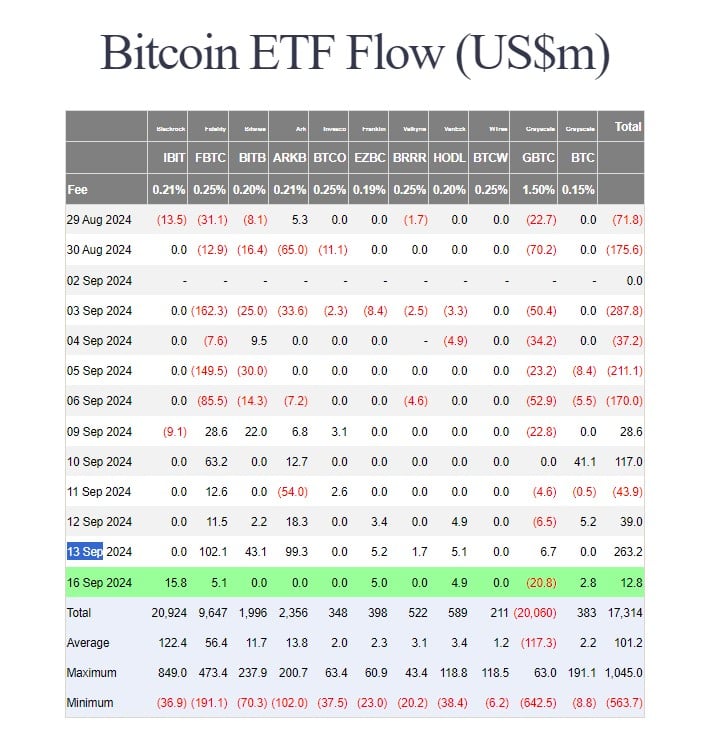

GBTC's total net outflows have surpassed $20 billion since its ETF conversion. BlackRock's iShares Bitcoin Trust saw a resurgence in inflows, collecting $15.8 million. <?xml encoding="UTF-8"?>Grayscale Investments’ Bitcoin Trust (GBTC) continues to face investor redemptions, with another $20.8 million withdrawn on Monday, according to data tracked by Farside Investors. This brings the total net outflows since its exchange-traded fund (ETF) conversion in January to over $20 billion.

Source: Farside Investors

Source: Farside InvestorsThe pace of outflows has slowed compared to earlier this year. Data reveals that the first $10 billion was withdrawn within two months of its ETF conversion, while the subsequent $10 billion took over six months.

However, GBTC remains under pressure as investors continue to exit positions. The fund’s Bitcoin holdings have decreased to approximately 222,170, valued at around $12.8 billion, data shows.

Despite GBTC’s losses, the US spot Bitcoin ETF market as a whole remains positive. On Monday, these ETFs collectively attracted $12.8 million in net capital.

BlackRock’s iShares Bitcoin Trust (IBIT) saw a resurgence of inflows after a period of stagnation, taking in $15.8 million. Other prominent Bitcoin ETFs managed by Fidelity, Franklin Templeton, and VanEck reported inflows of around $5 million each.

Grayscale’s low-cost Bitcoin ETF also managed to attract some inflows, ending the day with $2.8 million. The rest reported zero flows.

Disclaimer

2 months ago

18

2 months ago

18