ARTICLE AD

The Ethereum price performance has been a major source of concern for investors over the past few weeks, persisting in a downward trend. What makes the token’s struggles even more worrying is that it has not shown any signs of relief despite the recent launch of spot ETH ETFs (exchange-traded funds) in the United States.

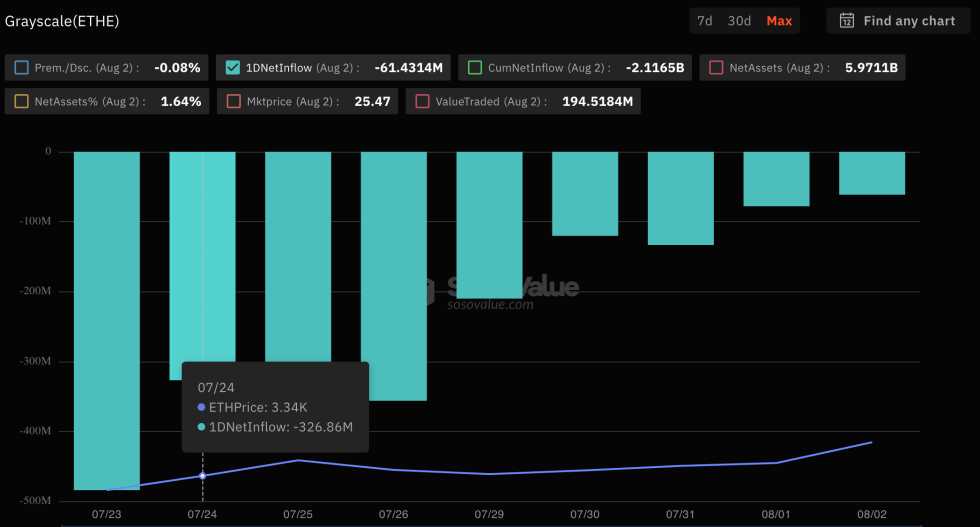

However, it appears that the underwhelming performance of the ETH ETFs — so far — might even be contributing to the Ethereum price troubles in recent weeks. Specifically, Grayscale has been seeing a significant flow of capital out of its Ether fund, the Grayscale Ethereum Trust (ETHE).

Grayscale Ethereum Trust Hits $2.1 Billion In Outflows

Following the first full week of trading, the US spot Ethereum ETF market saw a significant outflow of funds from the crypto products. According to data from SoSoValue, a total of $169.35 million flowed out of the ETH exchange-traded funds in the past week.

While this value still represents a significant amount of outflow from the spot Ethereum funds, it is more than 50% lower than the outflow witnessed in the debut week. In the debut week, the ETH ETF market saw a net outflow of more than $341 million.

The primary fund responsible for this level of capital outflow is the Grayscale Ethereum Trust, which has seen a withdrawal of over $2.1 billion in the past two weeks. ETHE witnessed a net outflow of over $1.5 billion in the week it launched.

On Friday, August 2, the Grayscale Ethereum Trust saw a total outflow of $61.43 million, according to data from SoSoValue. This latest fund movement brings the total net asset value of ETHE to just a little under $6 billion.

Similarly to when the spot Bitcoin ETFs launched, holders of Grayscale’s ETHE seem to be redeeming their shares from the fund, having been unable to do so for years. And as seen with BTC, the massive outflows seem to be putting a decent amount of downward pressure on the Ethereum price.

Ethereum Price Overview

As of this writing, the Ethereum price stands at around $2,907, reflecting a 2.2% decline in value in the past 24 hours. According to data from CoinGecko, the cryptocurrency is down by more than 10% in the last seven days.

This last seven-day performance underscores the ETH token’s struggles in the past few weeks. Data from CoinGecko shows that the Ethereum price has fallen by nearly 8% in the past month.

Nevertheless, Ether maintains its position as the second-largest cryptocurrency in the sector, with a market cap of over $347 billion.

Featured image from iStock, chart from TradingView

3 months ago

25

3 months ago

25