ARTICLE AD

The fund’s returns are based on staking rewards paid quarterly and are only available for investors with over $1 million in AUM.

Asset manager Grayscale announced on Mar. 29 the “Grayscale Dynamic Income Fund” (GDIF), its new staking-focused fund for qualified investors. According to the firm’s X post, the fund “seeks to optimize income in the form of staking rewards associated with proof-of-stake digital assets.”

The GDIF official page explains how Grayscale allocates investors’ funds to different proof-of-stake tokens, stakes them, and cashes the rewards weekly. The earnings are distributed to investors quarterly, as does the rebalancing of the fund’s portfolio.

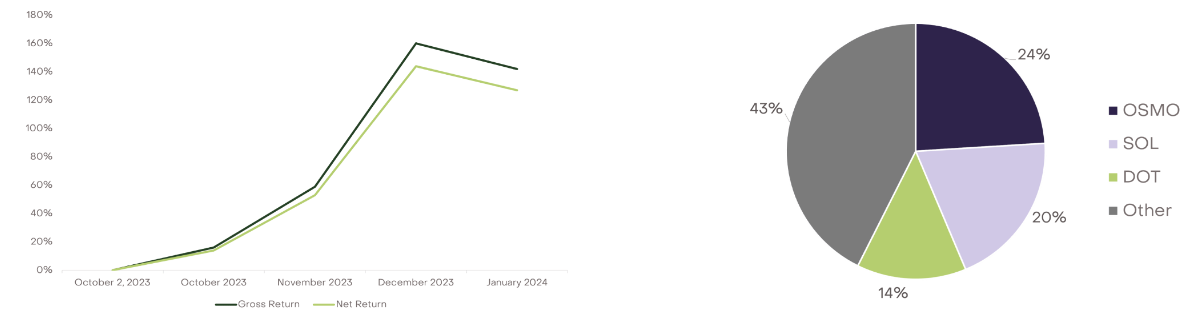

OSMO, the native token of Cosmos-based appchain Osmosis, represents 24% of the GDIF portfolio and its staking offers an average yield at a 12.7% annual percentage rate (APR). Solana (SOL) and Polkadot (DOT) are also two significant assets in the funds’ composition, with 20% and 14% shares respectively.

GDIF returns and portfolio composition. Image: Grayscale

GDIF returns and portfolio composition. Image: GrayscaleMoreover, Grayscale states that the fund showed a net return of over 140% from October 2023 to January, which means fees and expenses were already deducted. However, the fund is restricted to investors with assets under management of $1,1 million or a net worth of $2,2 million.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

9 months ago

58

9 months ago

58