ARTICLE AD

Hashdex's ETF application could pave the way for a diversified crypto investment product in the US.

Asset manager Hashdex filled in a joint spot exchange-traded fund (ETF) indexed to Bitcoin (BTC) and Ethereum (ETH) weighted by market cap, as reported by Bloomberg ETF analyst James Seyffart. The decision comes three weeks after Nasdaq withdrew Hashdex’s proposed Ethereum ETF, as reported by Crypto Briefing. The final deadline for SEC approval should be set for the first week of March 2025.

Update: A dual Ethereum and #Bitcoin ETF filing from @hashdex just dropped. Will be market cap weighted. Shouldn't be a surprise to anyone — makes a lot of sense.

Final deadline for SEC approval should be sometime around the first week of March 2025 pic.twitter.com/5wB7ucvbgM

— James Seyffart (@JSeyff) June 18, 2024

Notably, Seyffart highlights that the application includes “language to allow the addition of other digital assets,” if and when they are approved by the US regulator. The analyst shares his belief that Hashdex might try to offer a hybrid ETF in the US, such as the HASH11 product offered in Brazil.

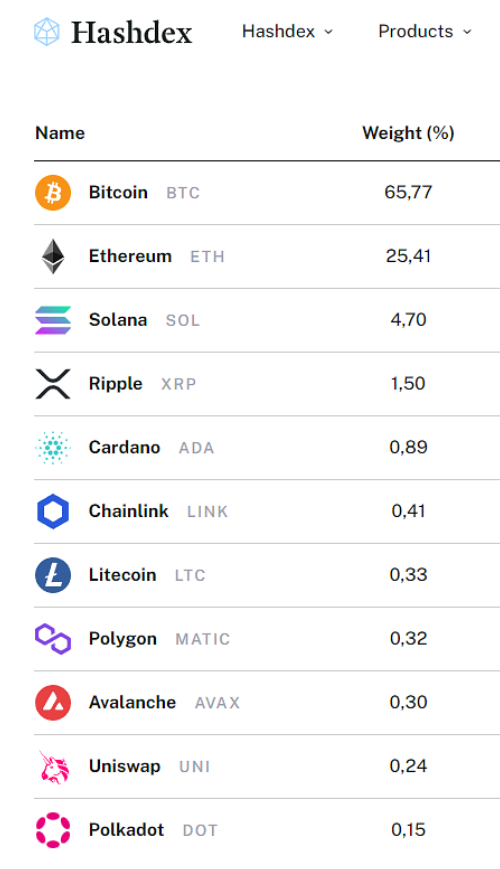

The HASH11 follows the Nasdaq Crypto Index (NCI), which consists of 11 different crypto with different weights.

NCI composition. Image: Hashdex/James Seyffart

NCI composition. Image: Hashdex/James Seyffart“So bringing something like this to the US makes complete sense as a future goal,” said Seyffart. According to data aggregator bold.report, the HASH11 presents over $511 million in assets under management (AUM) and nearly 7,700 BTC.

However, it is still too early to say how open the SEC is to approving spot ETFs indexed to other tokens. In a recent participation on CNBC’s Squawk on the Street, SEC Chairman Gary Gensler told host Jim Cramer that the crypto market still lacks disclosure.

“Let me say something more broadly about crypto markets: right now, without pre-judging anyone, these tokens, whether the ones Jim listed or other tokens, have not given you the disclosures that not only do you need to make your investment decisions, but also are required by the law,” said Gensler.

Therefore, although Hashdex opens up its filing for potential stance changes on the SEC, they might not come so soon.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

50

7 months ago

50