ARTICLE AD

The firm partners with BTG Pactual for new ETF, expanding Brazil's crypto offerings.

Key Takeaways

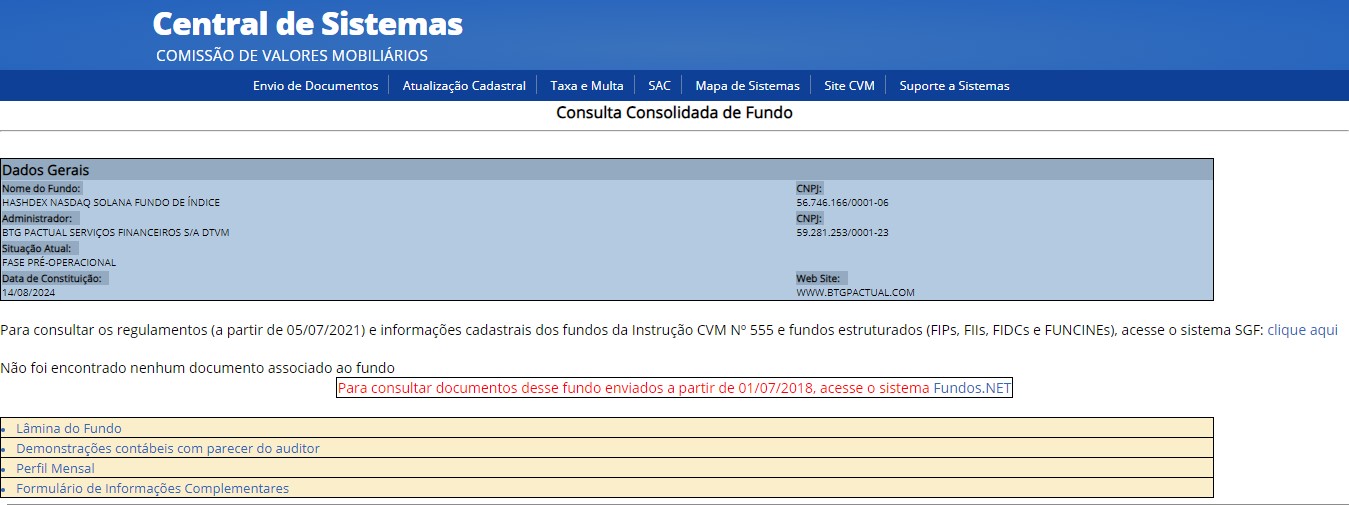

Brazil's securities regulator has approved a Solana-based ETF managed by Hashdex and BTG Pactual. Hashdex previously launched ETFs linked to Bitcoin, Ethereum, and the Nasdaq Crypto Index. <?xml encoding="UTF-8"?>Hashdex, a known player in the crypto asset management space, will launch an exchange-traded fund (ETF) that provides investors with exposure to Solana (SOL), as shown in the database of Brazil’s Securities and Exchange Commission (CVM), which has approved the product.

The ETF, called the “Hashdex Nasdaq Solana Index Fund,” is still in its pre-operational phase, the CVM database shows. That means the fund is in the process of finalizing its setup before being fully operational and open to investors.

The ETF will be managed by Hashdex in collaboration with BTG Pactual, a major local investment bank.

Hashdex, with assets over $962 million, has been active in the crypto ETF market since its founding in 2018. In 2021, Hashdex launched the world’s first crypto index ETF, the Nasdaq Crypto Index (NCI). The firm is also behind Brazil’s first ETF based on a crypto index.

In addition to products tied to the Nasdaq Crypto Index, Hashdex has expanded its offerings to include crypto assets like Bitcoin and Ethereum. The firm recently filed for a pioneering dual Bitcoin and Ethereum ETF with the US Securities and Exchange Commission (SEC).

The approval follows the acceptance of the country’s first Solana ETF by QR Asset on August 8. While Brazil shows growing interest in diversified crypto investments, the US is more hesitant despite recent progress with spot Bitcoin and Ethereum ETFs.

In June, VanEck and 21Shares filed for spot Solana ETFs in the US, aiming to list on the Cboe BZX Exchange despite Solana’s classification as a security by the SEC.

However, sources familiar with the situation recently told The Block that the SEC had rejected Cboe’s 19b-4 filings for Solana ETFs of VanEck and 21Shares. That was likely the reason behind the removal of these filings from the Cboe.

Disclaimer

3 months ago

34

3 months ago

34