ARTICLE AD

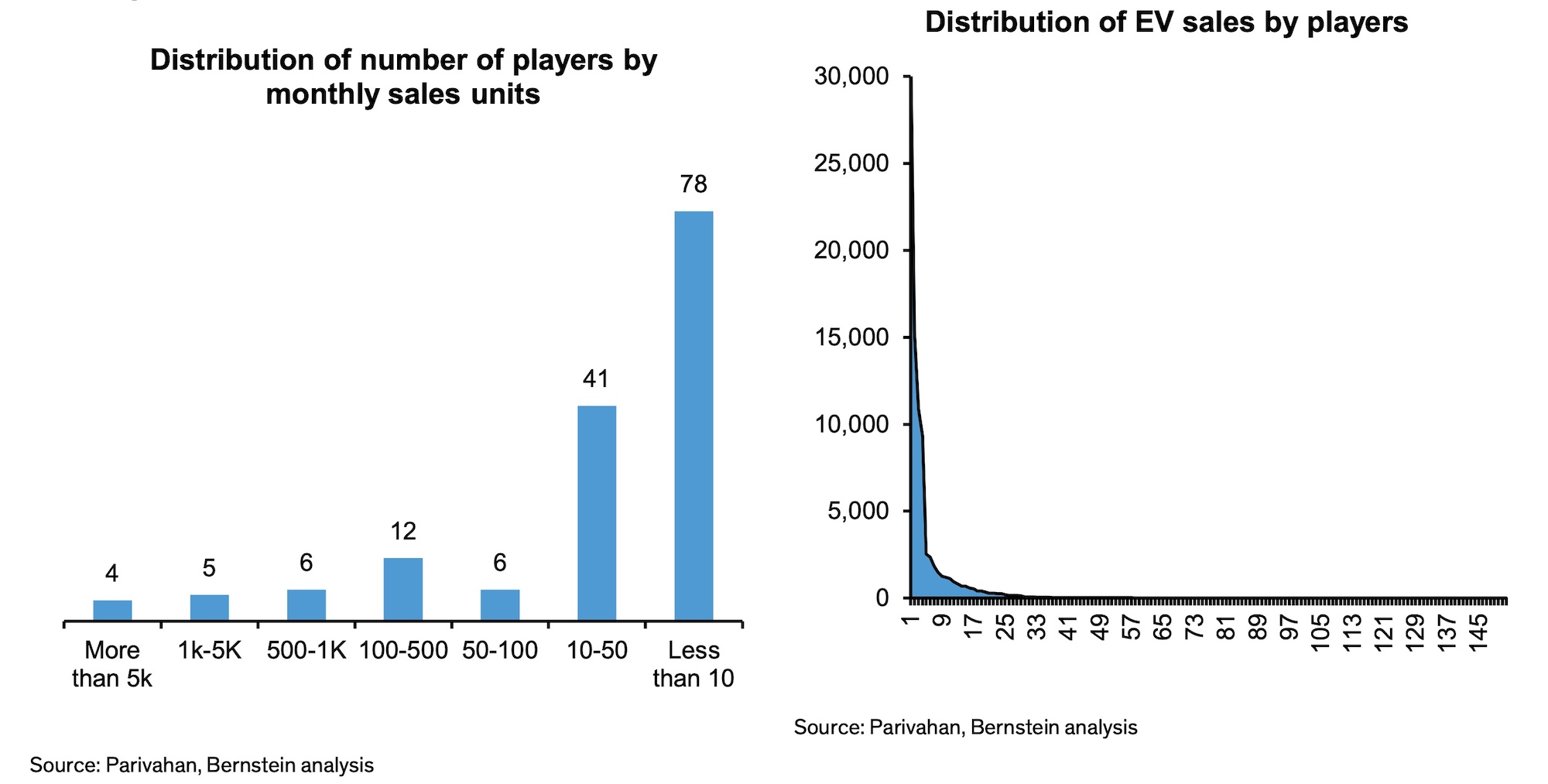

The number of startups in India’s electric two-wheeler market has surged to over 150 from 54 in 2021, driven by government incentives to promote clean vehicles and cut oil imports, according to a new analysis.

The influx has intensified competition in a segment expected to grow 15-20 times to annual sales of 15-20 million units over the next decade, Bernstein said in a report late Tuesday.

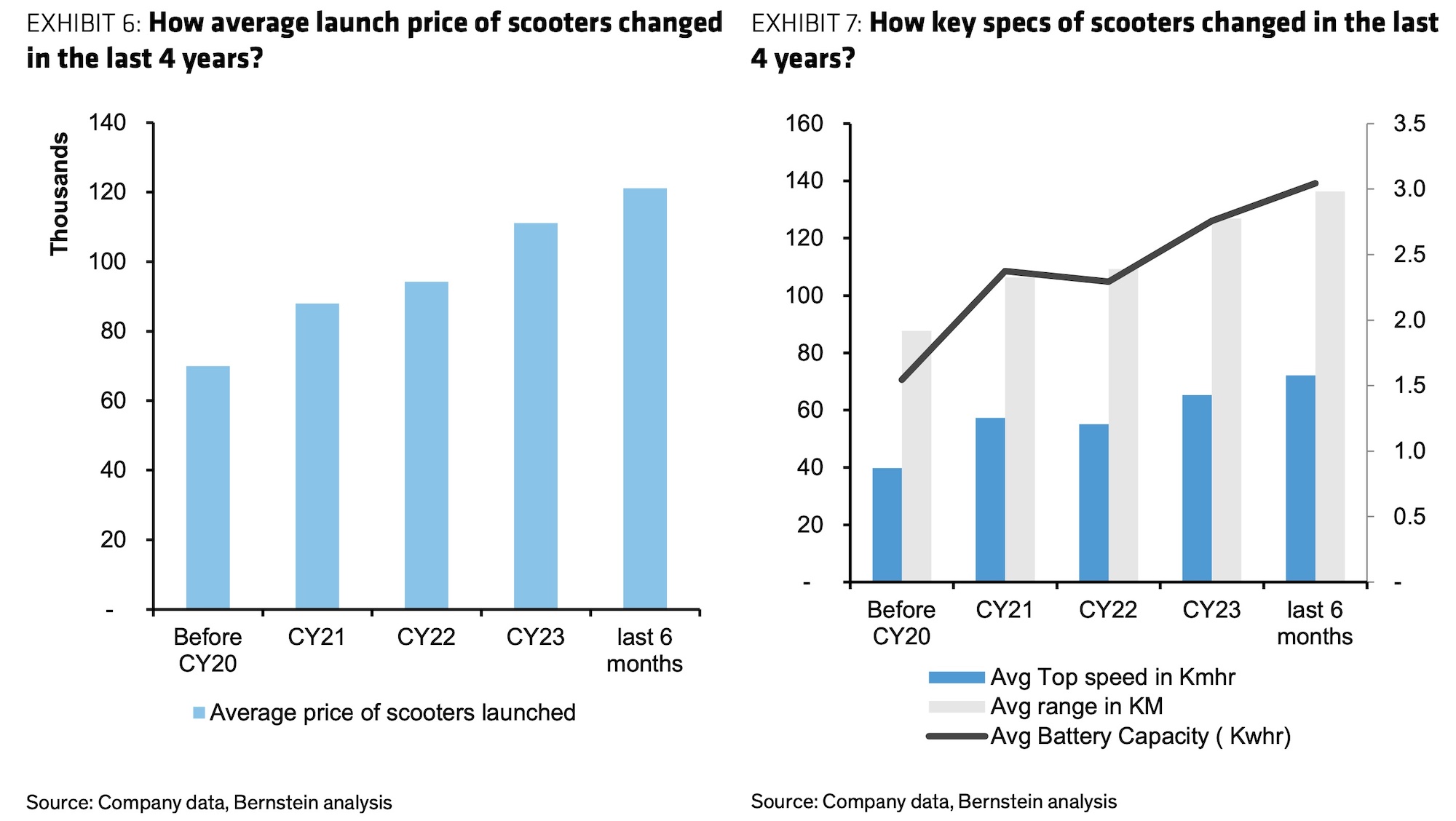

“Most are competing in the mainstream, and 85% of the 65 models launched last year were such products: high-speed as against speed and range-constrained products, which used to be a feature of the startups,” Bernstein analysts wrote. “The average battery capacity for new launches increased from 2.3kWhr in 2022 to 3kWhr.”

India aims to achieve 30% electric vehicle penetration by 2030 and net zero carbon emissions by 2070. The government has offered incentives under its FAME II scheme, which provides subsidies to buyers and was recently extended to 2024.

Despite a reduction in FAME II subsidies in mid-2023, the number of electric two-wheeler companies rose from 124 in June 2023 to 152 by January 2024, with much of the increase coming from “importers” sourcing components or entire vehicles from abroad, Bernstein noted.

“Most of these are just assembled kits from China,” said Kunal Khattar, founder of mobility-focused venture firm AdvantEdge. “Getting an EV product out the door is not expensive. It’s the brand building and distribution that folks underestimate.”

Image credits: Bernstein

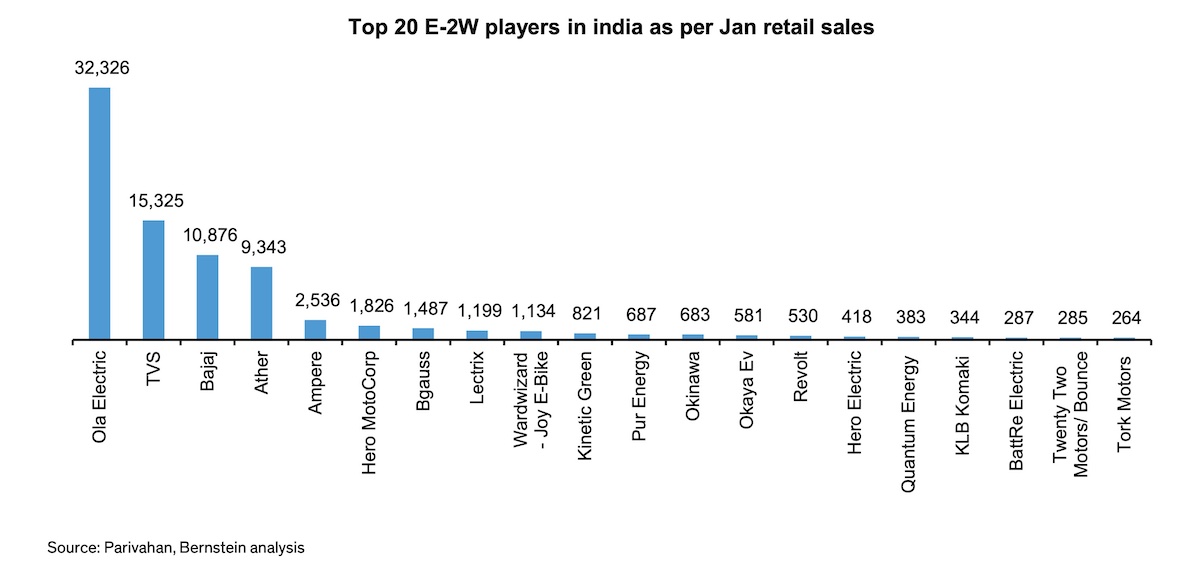

Startups currently hold seven of the top 10 spots, including the market leader (Ola Electric; which is also planning to go public soon) with a 39% share as of January 2024. Some 85% of sales volumes are concentrated among the top five players, however.

Bernstein’s analysis found low barriers to entry, with electric two-wheelers built using outsourced models and readily available components. Only about half of the 35 founders they analyzed had engineering backgrounds.

Image credits: Bernstein

The government is now shifting towards production-linked incentives (PLI) favoring domestic manufacturing. Most established automotive companies have been granted PLI while only a few startups qualified, potentially providing a cost advantage for major incumbents, Bernstein said.

The report sees room for at least five startups to emerge as relevant players alongside established companies, but cautions that intense competition could keep industry profit margins and returns subdued in the medium term.

Image credits: Bernstein

9 months ago

60

9 months ago

60