ARTICLE AD

Despite previous red flags, the project managed to gather a significant amount of funds through its token pre-sale.

Investors created a Telegram called “ZKasino Legal Task Force” aiming to prosecute gambling blockchain infrastructure ZKasino co-founders after they swapped nearly $33 million in Ether (ETH) for their native token. After the swap, the co-founders went dark and their groups started banning users that suggested the possibility of an exit scam being executed, according to Rekt News.

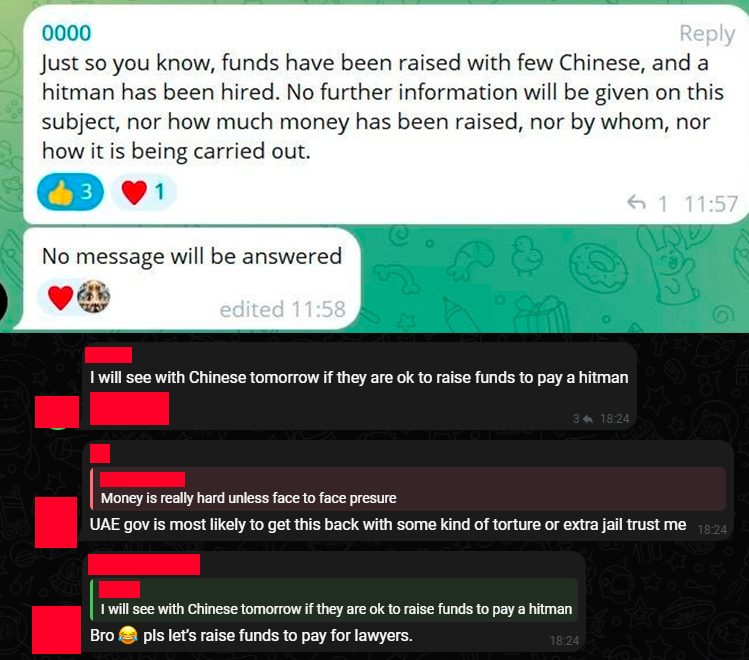

However, the tension escalated quickly, with a few members venting about the possibility of hiring hitmen to go after the project’s co-founders.

Messages from ZKasino investors

Messages from ZKasino investorsThe controversy started on March 23, when ZigZag Exchange founder Kedar Iyer made a post on X stating that ZKasino’s co-founder known as Monke used ZigZag’s funds to start ZKasino. As it was said in the same publication, Monke and two other co-founders were part of ZigZag’s team and signers from its treasury multi-signature wallet and allegedly stole funds to start their new venture.

Decentralized blockchain-native fundraising group BlackDragon added more information on an April 23 post, revealing they wanted to invest in ZKasino. However, the due diligence team at BlackDragon stated that the investment didn’t go through, as ZKasino team members didn’t react well about revealing themselves.

Regarding recent drama with @ZKasino_io who scammed their investors for $35M – we wanted to invest some months ago, but skipped due to ZKasino team going nuts while we were doing basic due dilligence to protect our members and investors.

Check the screenshots below between our… pic.twitter.com/q20HqOInvs

— BlackDragon (@BlackDragon_io) April 23, 2024

In another post, the BlackDragon team explained that they tried to warn fellow venture capital funds and communities, but they still invested significant amounts in ZKasino.

The user who identifies himself as Cygaar also went to X to highlight that ZKasino’s native blockchain infrastructure doesn’t apply any zero-knowledge technology, contrary to what its team advertised. Instead, they deployed a blockchain based on Arbitrum Nitro’s structure which, according to Cygaar, takes two minutes to build.

Moreover, the current situation of ZKAS, ZKasino’s native token, is still uncertain. Investors who bought ZKAS during the pre-sale are yet to receive their tokens.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

40

7 months ago

40