ARTICLE AD

Bitcoin faces $621M outflow as investors react to FOMC's hawkish signals.

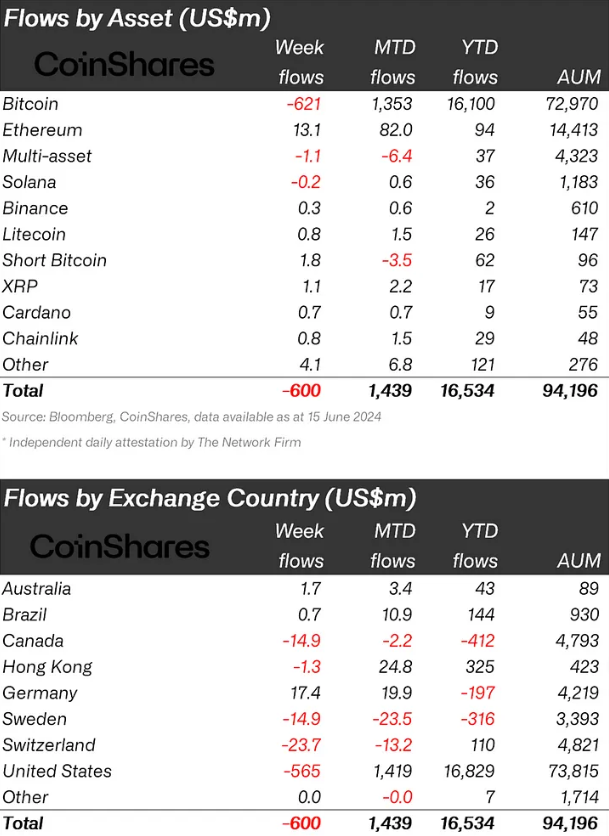

Crypto products saw $600 million in weekly outflows, marking the largest withdrawal since March, prompted by a “more hawkish-than-expected” Federal Open Market Committee (FOMC) meeting last week, according to CoinShares.

The recent outflows, coupled with a price sell-off, caused total assets under management (AUM) to drop from over $100 billion to $94 billion within a week. Notably, it also breaks the five-week streak of crypto products’ inflows.

Bitcoin (BTC) bore the brunt of the bearish mood, with outflows totaling $621 million. Conversely, the market’s cautious stance led to $1.8 million being channeled into short Bitcoin positions. Meanwhile, a variety of altcoins attracted inflows, with Ethereum (ETH), Lido (LDO), and XRP receiving $13 million, $2 million, and $1 million, respectively.

Image: CoinShares

Image: CoinSharesAdditionally, the outflow was not evenly distributed across regions. The US accounted for the majority, with outflows of $565 million. However, the sentiment was widespread, with Canada, Switzerland, and Sweden experiencing outflows of $15 million, $24 million, and $15 million, respectively. Germany, Brazil, and Australia contrasted the trend with inflows of $17 million, $0.7 million, and $1.7 million, respectively.

Trading volumes dipped to $11 billion for the week, falling short of the $22 billion weekly average for the year, yet still substantially higher than the $2 billion weekly average last year. Despite the downturn, digital asset exchange-traded products (ETPs) continue to account for a consistent 31% of global trading volumes on reputable exchanges.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

3 months ago

26

3 months ago

26