ARTICLE AD

Bitcoin is stable when writing, falling below $60,000 after the encouraging expansion in the second half of last week. The path of least resistance in the short-term is northward since, despite weakness, prices are inside the bullish engulfing bar of September 13.

Is The Bitcoin Bottom In?

As prices retrace, on-chain data points to strength and the possibility of the world’s most valuable coin printing out a bottom. Taking to X, one analyst, citing on-chain data from CryptoQuant, notes that the Mayer Multiple, a tool used for gauging market sentiment, is falling.

Specifically, the analyst observes that the Mayer Multiple reading is down from 1.82 to 0.9. While down, it ought to fall some more. According to the trader, if sentiment dips, and the reading decreases to 0.7, it could signal a market bottom. From price action, this bottom ranges between $46,000 and $50,000.

Mayer Multiple falling | Source: @AxelAdlerJr via X

Mayer Multiple falling | Source: @AxelAdlerJr via X

All the same, it should be noted that the Mayer Multiple, though useful, is a lagging indicator. It is calculated by dividing the spot BTC price by the 200-day moving average. If the reading is below 1, it points to a possible undervaluation, as is the case.

Technically, the Bitcoin uptrend remains based on the formation in the daily chart. Even though the coin is trending below $60,000, prices are still inside the September 13 bull bar. From an effort-versus-result perspective, this is a net positive for buyers now that the drop is even with lighter trading volume.

Buyers still have a chance if BTC holds above the $56,500 level. There will be better opportunities should Bitcoin push higher, closing above last week’s highs of around $61,000.

Hints From The Futures Market

Besides the Mayer Multiple and hopes of a price bottom, the analyst is bullish, expecting the coin to find support. In the Bitcoin futures market, there are hints of strength.

The Futures Sentiment Index for Bitcoin is now turning up, looking at CryptoQuant data. Historically, prices tend to follow whenever the index begins turning higher, rising in tandem.

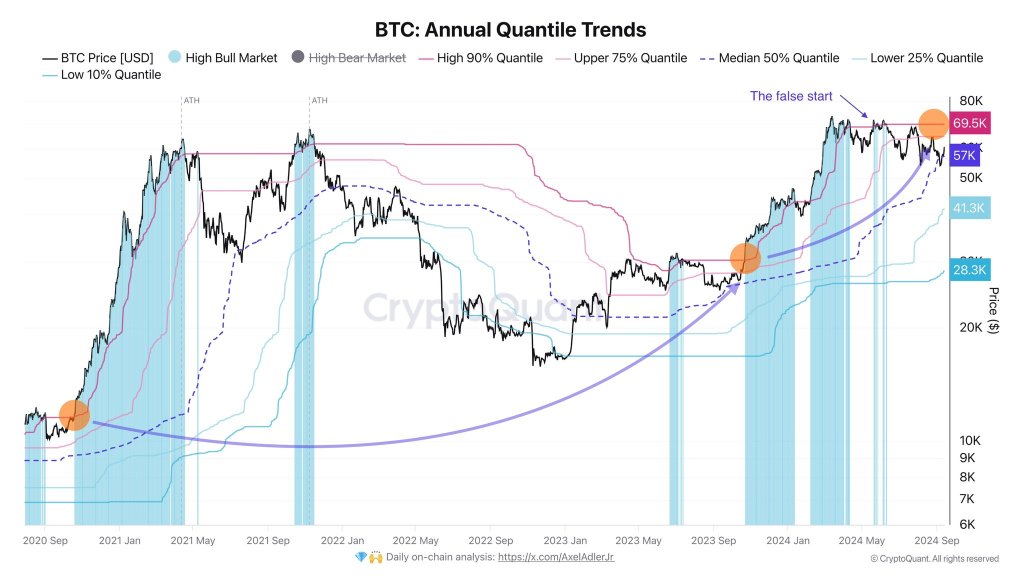

Bitcoin bulls must break $69,500 | Source: @AxelAdlerJr via X

Bitcoin bulls must break $69,500 | Source: @AxelAdlerJr via X

Bullish as this development is, Bitcoin bulls must push prices higher, ideally breaking above the immediate local resistance levels. According to the analyst, a decent, high-volume close above $69,500 could trigger a market fear of missing out (FOMO), further lifting the coin to new horizons.

Feature image from Canva, chart from TradingView

2 months ago

21

2 months ago

21