ARTICLE AD

Table of Contents

Ride The Wave of Innovation with ScapesMania Ripple CEO Discusses SEC Hurdles and ETF Ambitions Ripple (XRP) Technical Analysis Ripple (XRP) Price Prediction Final WordsThe cryptocurrency market has recently been navigating through a slightly bearish phase. In the last 24 hours, there's been a discernible shift, marked by the first net outflow from Bitcoin ETFs since January 25 and further compounded by unfavorable funding rates for bulls. Despite this trend, Bitcoin has admirably managed to maintain its position, holding ground at around $51,000. This resilience, however, contrasts with the performance of Ripple (XRP), which has mirrored the broader market's downturn.

On February 22, XRP fell to $0.54, and its decline continued in today's session, losing over 1.7%, as net outflows from BTC ETFs dampened buyer demand across the crypto spectrum. Interestingly, there haven't been any significant updates from the ongoing SEC vs Ripple case that might influence investor decisions. Yet, behind the scenes, both parties are preparing for the coming submission of remedy-related briefs, with deadlines set for March 13 and April 12, which could potentially reshape Ripple's (XRP) trajectory.

Amidst this somewhat uncertain climate for XRP and the broader crypto market, there's a growing buzz around ScapesMania (MANIA). Although its presale stage has concluded, the crypto community is eagerly anticipating the impending Token Generation Event and its listing on a DEX,expected to significantly broaden the project's reach, attracting a more diverse group of crypto investors.

The ScapesMania public sale wrapped up, becoming the talk of the crypto community. The project managed to secure over $6,125,000 at an unprecedented rate and there’s a strong probability that the token's value might increase exponentially in the future.

The spotlight has shifted to the Token Generation Event (TGE) coming up on February 25 – March 09. The pool of tokens is smaller than it was before, the conditions are better than the market average, so the chance to maximize your potential returns is quickly diminishing. Letting it slip now would be a huge waste, especially since your chance to join is only a click away.

Your Last Chance to Boost Potential Returns Post Listing

The team behind ScapesMania, with years of expertise, has crafted a robust post-listing marketing strategy. Buyback, burn, staking, and all the perks for holders keep attracting new adopters while also ensuring a high level of community engagement. Through DAO governance, backers will be able to influence and benefit from a growing industry.

Moreover, the token's utility is impressive. It's not another meme coin whose success relies heavily on trends and hype. ScapesMania ($MANIA) is a well-balanced, meticulously designed project that acts as a gaming ecosystem. As a player in the multi-billion casual gaming industry, it leverages the market's growth potential. Post-debut, holders can anticipate greater liquidity and easier trading. A solid token management plan will further increase longer-term growth potential.

The community's excitement about the project is evident so far: the follower count has reached 60K+. Also, the growing interest from crypto whales with deposits of $20,000+ might expedite ScapesMania's transition from niche to mainstream.

ScapesMania's smart contract has received approval from prominent security-ranking firms, ensuring peace of mind for holders. Additionally, the PancakeSwap listing is on the horizon, with CEX listings still in the works.

ScapesMania is also notable for a great cliff vesting structure to prevent token dumping, making sure that supply and demand are well-matched for potential growth.

Make sure you don't pass up the opportunity to leverage all discounts and potentially beat the market with the TGE fast approaching. Be quick if you want to be the first one in line for all the post-listing opportunities, which might be quite lucrative.

>>> TGE ALERT – Keep Up With Latest News <<<

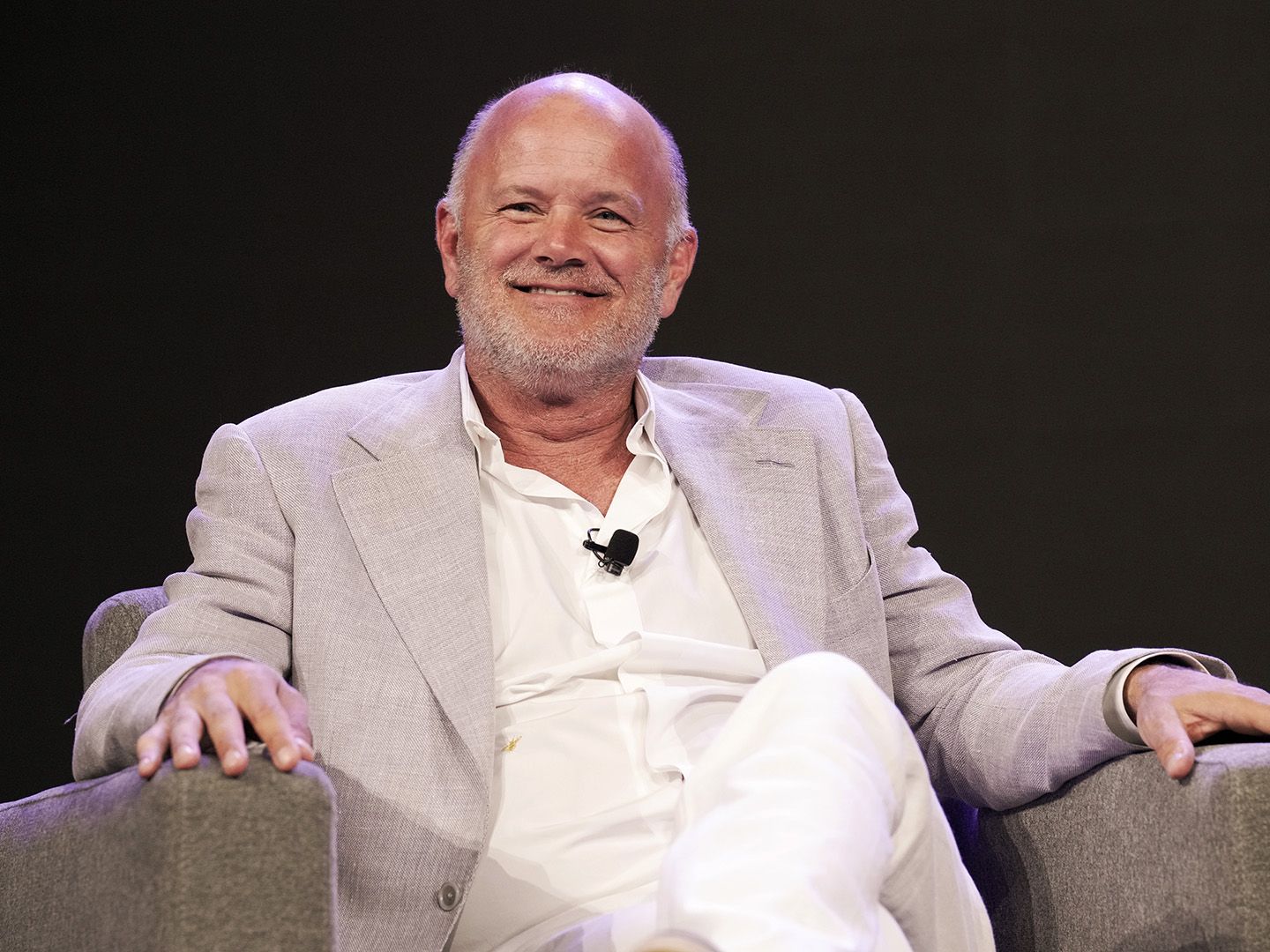

This week, Ripple CEO Brad Garlinghouse spoke with Bloomberg, covering a range of topics from the SEC vs. Ripple case to crypto-spot ETFs. He noted that while other countries had made progress in crafting clear crypto regulations, the SEC had largely resorted to what he described as "regulation through enforcement".

Garlinghouse suggested that the SEC's string of losses, including their defeat in the Grayscale case and the skeptical tone of the judge in the Coinbase case, will either continue until they recognize their ineffective approach or until Congress steps in, especially with potential legislation around stablecoins. Although he noted the difficulty of passing new laws in an election year.

Regarding the much-discussed topic of an XRP-spot ETF, Garlinghouse expressed his belief that the market will see the launch of such ETFs, though the timing remains uncertain. Arguing that ETFs enhance market safety and robustness, he stressed that the SEC had to be compelled by court orders to approve Bitcoin ETFs. When asked about Ripple's discussions with major issuers like BlackRock for launching an XRP-spot ETF, Garlinghouse chose not to comment directly but acknowledged the overall benefits for the XRP community.

Recently, Ripple (XRP) has been trading in a defined range, hovering between its first support level at $0.5209 and the first resistance level at $0.5864.

Source: TradingView

From a technical analysis standpoint, XRP's Exponential Moving Averages (EMAs) for 10, 50, and 200 days are clustered close to each other and the current price, with values at $0.5419, $0.5476, and $0.5424 respectively, indicating a lack of a strong trend in either direction in the short to medium term.

The Relative Strength Index (RSI) stands at 38.5, suggesting that XRP is neither overbought nor oversold, but edging closer towards the oversold territory. The Stochastic %K is at a low 15.88, reinforcing the potential for a bullish reversal.

However, the Average Directional Index (ADX) at 23.75 indicates a weak trend strength, and the Commodity Channel Index (CCI) at -108.84 points towards a short-term bearish sentiment.

The MACD Level at -0.0059 is barely negative, hinting at a possible change in momentum.

Ripple (XRP) Price Prediction

In a bullish scenario, if buying pressure increases and Ripple (XRP) breaks above $0.5864, it could pave the way for a move towards the second resistance level at $0.6158, and potentially challenge the third resistance at $0.6813.

On the flip side, in a bearish outlook, if XRP fails to maintain its footing and breaks below $0.5209, it could lead to a test of the second support level at $0.4847, and in a more extended downturn, the third support level at $0.4191 could be in play.

Given the close proximity of the EMAs and the current indecisive indicators, traders might need to keep a close eye on any shifts in market sentiment or fundamental news that could tip the balance for Ripple (XRP).

Affected by the ongoing SEC lawsuit, Ripple (XRP) is currently navigating a period of uncertainty, mirroring broader market trends. XRP's position within a narrow trading corridor between its key support and resistance levels indicates a period of consolidation, with potential shifts in investor sentiment on the horizon. The outcome of the SEC case and developments in the crypto regulatory landscape are likely to be significant factors that will determine Ripple's (XRP) future direction. Investors and traders are thus advised to stay attuned to these developments as they could play a crucial role in shaping XRP's trajectory in the near term.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

1 year ago

59

1 year ago

59