ARTICLE AD

More and more employers are adding financial products to their employee benefits and perks, and many startups have jumped into this sector to help.

Fintech company Kashable is the latest to also grab some venture capital attention for its approach to offering credit and financial wellness products as an employer-sponsored voluntary benefit.

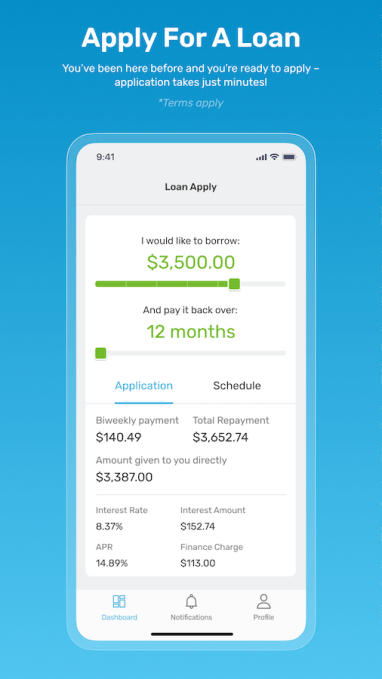

Kashable’s lending app. Image Credits: Kashable

The company raised $25.6 million in Series B funding. Revolution Ventures and Moneta Ventures co-led the round and were joined by EJF Capital and Krillion Ventures. In total, the company raised $45 million in equity capital and over $175 million in debt capital.

Financial wellness is one of the areas many of the startups get into. For example, Payroll Integrations, Minu, HoneyBee, Addition Wealth and Origin — to name a few — raised VC in the past three years for their own approaches to adding financial wellness to employee benefits.

However, Einat Steklov and Rishi Kumar, both co-founders and co-CEOs of Kashable, say their company differs in that they not only provide access to free financial education tools but also make employment-based loans.

“When we first started our journey in 2013, financial wellness was just an emerging concept,” Kumar told TechCrunch. “We spent a lot of time educating the employer community about the need for this type of financing.”

However, during the global pandemic, when millions of people lost their jobs, it thrust a spotlight on how many Americans didn’t have one paycheck’s worth of disruption in savings, Kumar said.

In an effort to help employers offer meaningful benefits and employees an alternative to borrowing from their 401(k)s or other retirement plans, Kashable provides average loans of $4,000.

It integrates with a company’s payroll systems and then uses that data to power its fully automated underwriting ability to extend affordable credit to that company’s employees. Its algorithm takes into account group and individual employment data, income stability and other factors. The loans are automatically repaid through payroll deductions.

In addition, Kashable offers financial education resources, including credit monitoring, individual financial coaching and budgeting tools. All of that is free and employers are in control of what their employees can access.

“People who have borrowed from Kashable saw an improvement in their credit score, and they can see how, on a monthly basis, their actions actually translate to credit,” Steklov said in an interview. “Two-thirds of people see an improvement in a credit score of 40 or 50 points on average. This is significant. It can move people from the subprime category into a near prime category. That makes a difference from being able to borrow or take out a mortgage on a house.”

Since Kashable’s inception in 2013, the company has provided 300,000 loans through over 250 employers, including Cigna, Reid Health, Huntington Ingalls, Alight Solutions and Chobani. The company’s revenue grew 50% annually for the past few years, the co-founders say. It has also done $300 million a year in loan volume.

Meanwhile, Steklov and Kumar intend to use the new capital on expansion, to extend further credit, additional financial wellness services and on hiring. They plan to grow the R&D team to further develop its suite of financial products and its underwriting model.

David Golden, managing partner at Revolution Ventures, and Meirav Har Noy, co-founder and managing partner at Moneta Ventures, will join Kashable’s board of directors as part of the investment.

“This is an area I find inherently interesting because there’s so much innovation in how we provide credit for the underbanked,” Golden said in an interview. “It’s a huge problem in the United States. It’s an area that has been widely embraced by the venture community but not very successful. Kashable has a different customer acquisition model through employers and a different underwriting model. They can see real-time employment history and get access to bi-weekly payrolls. I hadn’t seen that anywhere else in the United States.”

1 year ago

90

1 year ago

90